United States Probiotics Market Size, Share, and COVID-19 Impact Analysis, By Products (Probiotic Food & Beverages, Probiotic Dietary Supplements, Animal Feed, and Others), By Ingredients (Bacteria and Yeast), By Distribution Channels (Supermarket/Hypermarket, Pharmacies & Drug Stores, Convenience Stores, Online Channels, and Others), By End User (Human and Animal), and United States Probiotics Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Probiotics Market Insights Forecasts to 2033

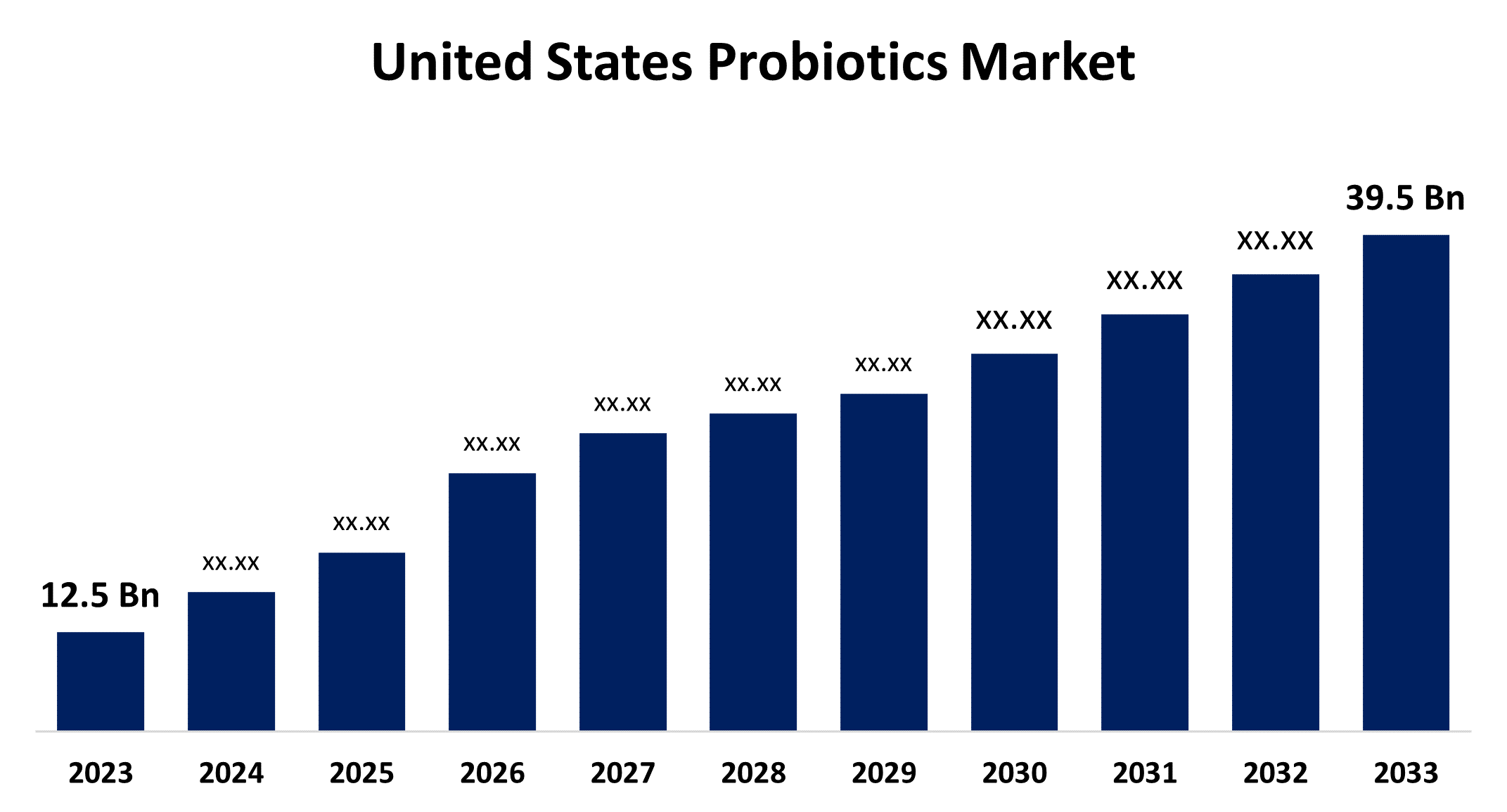

- The United States Probiotics Market Size was valued at USD 12.5 Billion in 2023.

- The Market Size is Growing at a CAGR of 12.19% from 2023 to 2033

- The U.S Probiotics Market Size is Expected to reach USD 39.5 Billion by 2033

Get more details on this report -

The United States Probiotics Market is anticipated to exceed USD 39.5 Billion by 2033, growing at a CAGR of 12.19% from 2023 to 2033. The growing concern regarding health and awareness about the benefits of probiotic-fortified products is driving the growth of the probiotics market in the United States.

Market Overview

Probiotics are live microorganisms that are intended to have health benefits when consumed or applied to the body. They can be found in yogurt and other fermented foods, dietary supplements, and beauty products. Probiotics may contain a variety of microorganisms including the most common bacteria that belong to groups called Lactobacillus and Bifidobacterium. The 2012 National Health Interview Survey (NHIS) showed that about 4 million (1.6 percent) U.S. adults had used probiotics in the past 30 days. Probiotics were the third most commonly used dietary supplement other than vitamins and minerals. The use of probiotics by adults quadrupled between 2007 and 2012. The 2012 NHIS also showed that 300,000 children aged 4 to 17 (0.5 percent) had used probiotics in the 30 days. Probiotic formulations are designed to address specific digestive needs. The protein-rich Greek yogurt called strained yoghurt popular in the US used as a lower-calorie substitute for sour cream. The key players in the market are launching a wide range of dairy-free probiotic yogurts sourced from almond milk, soy milk, oat milk, and others. Furthermore, the concept of “personalized probiotics” has emerged, where probiotic interventions are tailored to individual gut microbiome characteristics. Different gut microbiome profiles are associated with ethnicity, age, diet, lifestyle, and stool consistency.

Report Coverage

This research report categorizes the market for the US probiotics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the probiotics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US probiotics market.

United States Probiotics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 12.5 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 12.19% |

| 2033 Value Projection: | USD 39.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Products, By Ingredients, By Distribution Channels |

| Companies covered:: | Danone, Yakult Honsha Co., PepsiCo, Now foods, Lifeway Foods Inc., Kerry Group plc., Nestle, Probi, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising concern about the health consciousness and inclination of consumers towards nutritive foods is anticipated to drive the market demand. Further, the increasing awareness about the benefits of probiotics for health and wellness is anticipated to propel the market demand. Further, the increasing geriatric population, technological advancements, and medical facilities are also responsible for driving the US probiotic market.

Restraining Factors

The high R&D cost for the development of new probiotic strains and the high prices of the products are majorly responsible for restraining the market for probiotics.

Market Segmentation

The United States Probiotics Market share is classified into products, ingredients, distribution channels, and end user.

- The food & beverages segment is expected to hold the largest share of the United States probiotics market during the forecast period.

Based on the products, the United States probiotics market is divided into probiotic food & beverages, probiotic dietary supplements, animal feed, and others. Among these, the food & beverages segment is expected to hold the largest share of the United States probiotics market during the forecast period. Probiotics-fortified products like yogurts, kefir, kombucha, and fortified beverages are used in daily routine. The increasing trend of preventative healthcare, maintaining health, and proactive well-being among people are enhancing the market demand.

- The bacteria segment accounted for a significant revenue share of the US probiotics market during the forecast period.

The United States probiotics market is segmented by ingredients into bacteria and yeast. Among these, the bacteria segment accounted for a significant revenue share of the US probiotics market during the forecast period. Bacterial probiotics comprise species derived from strains of Bacillus and Escherichia coli, lactic acid bacteria (LAB) (genus Lactobacillus, Leuconostoc, and Streptococcus), and the genus Bifidobacterium. These strains offer a broader spectrum as compared to yeast. The established and cost-effective manufacturing of bacterial probiotics is effective (affordable) and accessible which is ultimately responsible for driving the market for the bacteria probiotics segment.

- The supermarket/hypermarket segment holds the largest market share through the forecast period.

The United States probiotics market is segmented by distribution channel into supermarket/hypermarket, pharmacies and drug stores, convenience stores, online channels, and others. Among these, the supermarket/hypermarket segment holds the largest market share through the forecast period. The purchasing of probiotic products from supermarket/hypermarket is the most convenient option for consumers owing to easy access. Thus, the comprehensive shopping experience by consumers surges the probiotics market demand in the supermarket/hypermarket segment.

- The human segment dominates the market with the largest market share over the forecast period.

The United States probiotics market is segmented by end user into human and animal. Among these, the human segment dominates the market with the largest market share over the forecast period. Human health needs include digestive support, immune enhancement, and mental well-being. Product innovations like chewable tablets and personalized formulations for the human segment are contributing to drive the market demand in the human segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US probiotics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Danone

- Yakult Honsha Co.

- PepsiCo

- Now foods

- Lifeway Foods Inc.

- Kerry Group plc.

- Nestle

- Probi

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Probiotics Market based on the below-mentioned segments:

United States Probiotics Market, By Products

- Probiotic Food & Beverages

- Probiotic Dietary Supplements

- Animal Feed

- Others

United States Probiotics Market, By Ingredients

- Bacteria

- Yeast

United States Probiotics Market, By Distribution Channels

- Supermarket/Hypermarket

- Pharmacies & Drug Stores

- Convenience Stores

- Online Channels

- Others

United States Probiotics Market, By End User

- Human

- Animal

Need help to buy this report?