United States Property Management Market Size, Share, and COVID-19 Impact Analysis, By Component (Software, Services), By Deployment (Cloud, On-premises), By Application (Residential, Commercial), By End-User (Property Managers, Housing Associations, Real Estate Agents, Others), and US Property Management Market Insights Forecasts to 2032

Industry: Information & TechnologyUnited States Property Management Market Insights Forecasts to 2032

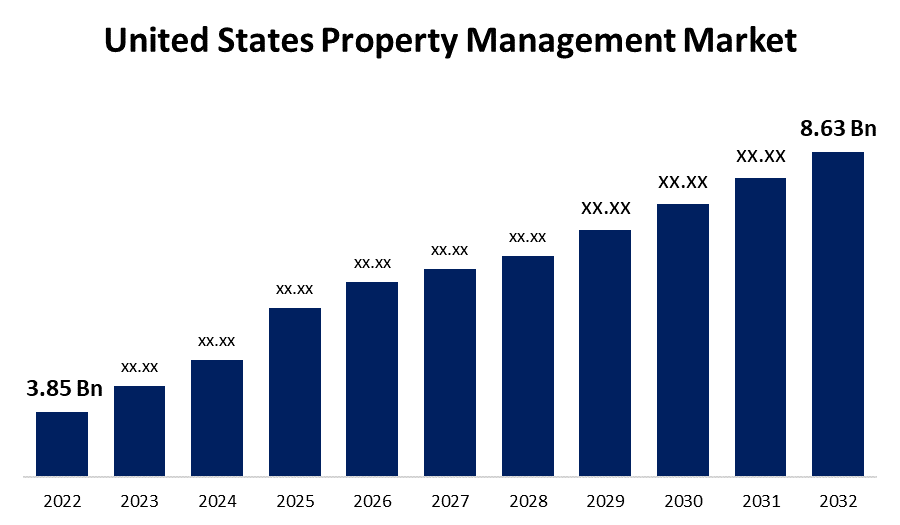

- The United States Property Management Market Size was valued at USD 3.85 Billion in 2022.

- The Market Size is Growing at a CAGR of 8.4% from 2022 to 2032.

- The United States Property Management Market Size is expected to reach 8.63 Billion by 2032.

Get more details on this report -

The United States Property Management Market Size is expected to reach USD 8.63 Billion by 2032, at a CAGR of 8.4% during the forecast period 2022 to 2032.

Market Overview

The property management solution monitors and manages the commercial and residential building operations. Property managers can use the solutions to automate tasks like vacancy alerts, customer interaction, marketing, payment-related processes, revenue management, lease management, and more. Furthermore, the incorporation of advanced technologies such as virtual reality, artificial intelligence, the Internet of Things, machine learning, and others is expected to drive market growth. A rise in new apartment construction in major U.S. cities fuels demand for efficient real-estate management solutions, and the SaaS model emerges as a strategic imperative for property management firms seeking to remain competitive and agile in the volatile real estate market. Furthermore, the evolving trend of workplace mobility provides a significant growth opportunity for property management professionals in the United States. Real-estate managers can access critical property data, collaborate seamlessly, and address tasks efficiently from anywhere owing to technological advancements and mobile devices. Real-time communication features in PMS allow for faster issue resolution and higher tenant satisfaction.

Report Coverage

This research report categorizes the market for the United States property management market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States property management market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States property management market.

United States Property Management Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 3.85 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 8.4% |

| 2032 Value Projection: | USD 8.63 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Component, By Deployment, By Application and By End-User |

| Companies covered:: | RealPage, Inc., Infor, Inc., MRI Software, LLC, CoreLogic, Inc., ApartmentData.com, Yardi Systems, Inc., ResMan, LLC, AppFolio Inc., Entrata Inc., Buildium, LLC, Others, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Rental property, both commercial and residential, is rapidly growing in the real estate industry. The availability of accessible, affordable, and high-quality properties in major metropolitan areas is propelling the country's renter growth. Furthermore, employment opportunities, immigration and domestic migration, an increase in international students, rising residential home prices, a shift toward urbanization or lifestyle changes, and other factors are likely to boost rental property demand. As a result, the country is experiencing a significant increase in the demand for rental properties. Managing all of the tasks creates a lot of paperwork for the property managers. As a result, property managers are implementing software to conduct all tasks seamlessly.

Restraining Factors

The software collects essential and personal information of both clients and owners. The software tracks and saves the client's behavior, historical data, and preferences. Data breaches can occur via any digital connection if the software is not properly secured. The real estate industry and the agency are becoming more vulnerable to security threats as more personal and confidential data is handled and stored through software. The property management market share in the United States is likely to remain stable as a result of a lack of awareness about security solutions and the increasing risk of a data breach.

Market Segment

- In 2022, the software segment is expected to hold the largest share of the United States property management market during the forecast period.

Based on the component, the United States property management market is classified into software and services. Among these, the software segment is expected to hold the largest share of the United States property management market during the forecast period. Among the software provided by the key players are SAP residential and commercial real estate management software, software licenses, ERP, and financial services. Its ability to manage multiple property operational tasks is driving its market demand over the forecast period. The software performs functions such as revenue management, accounting, leasing, community association management, document and maintenance management.

- In 2022, the cloud segment accounted for the largest revenue share over the forecast period.

Based on the deployment, the United States property management market is segmented into cloud and on-premises. Among these, the cloud segment has the largest revenue share over the forecast period. The advanced security and cost-effective solution are likely to increase demand for cloud-based software for controlling property activities. The majority of organizations are currently moving away from on-premises deployment and toward cloud platforms.

- In 2022, the residential segment accounted for the largest revenue share over the forecast period.

Based on the application, the United States property management market is segmented into residential and commercial. Among these, the residential segment has the largest revenue share over the forecast period. In addition, multifamily suites, risk management & monitoring, senior living suites, and other residential application solutions for residential management are available. The demand for software to manage residential properties such as single and multi-story apartments and houses is driving U.S. property management market growth during the forecast period.

- In 2022, the property managers segment accounted for the largest revenue share over the forecast period.

Based on the end user, the United States property management market is segmented into property managers, housing associations, real estate agents, and others. Among these, the property managers segment has the largest revenue share over the forecast period. The software helps the managers in showcase virtual property, automate housing work, analyze tenant historical data and behavior, and gain real-time insights and support in maintaining property premises, tools, and other hardware among others. Also, it helps the property managers in managing tasks such as assisting clients, understanding customer preferences, answering client queries, and arranging virtual shows among others.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States property management market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- RealPage, Inc.

- Infor, Inc.

- MRI Software, LLC

- CoreLogic, Inc.

- ApartmentData.com

- Yardi Systems, Inc.

- ResMan, LLC

- AppFolio Inc.

- Entrata Inc.

- Buildium, LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2022, Greystar and Origin Investments began construction on their USD 83.1 million joint venture community in Colorado Springs. Elan Rio Grande, located at 602 S. Wahsatch Ave., is a Class A apartment complex with 207 units. This is Greystar-Origin's third project in Colorado Springs, and it is being built alongside another property in the partnership's portfolio.

- In April 2021, Entrata Inc. announced its new residential service in Amazon's Alexa. Through this integration, property managers will be able to provide innovative and voice-enabled experiences to their customers, in addition to other management services for their properties.

- In July 2021, Yardi Systems, Inc. announced the release of Yardi Corom, a new product suite for commercial tenants. The new product provides a unified platform for lease management, as well as occupancy tracking and desk hoteling for flexible workplaces. The Yardi Corom also assists with transaction management, facility maintenance, and capital projects.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the United States property management market based on the below-mentioned segments:

United States Property Management Market, By Component

- Software

- Services

United States Property Management Market, By Deployment

- Cloud

- On-premises

United States Property Management Market, By Application

- Residential

- Commercial

United States Property Management Market, By End User

- Property Managers

- Housing Associations

- Real Estate Agents

- Others

Need help to buy this report?