United States Protein Ingredients Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Plant Proteins, Legumes, Roots, Ancient Grains, Nuts & Seeds, Animal/Dairy Proteins, Microbe-Based Protein, and Insect Protein), By Application (Food & Beverages, Infant Formulations, Clinical Nutrition, Animal Feed, and Others), and United States Protein Ingredients Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsUnited States Protein Ingredients Market Insights Forecasts to 2033

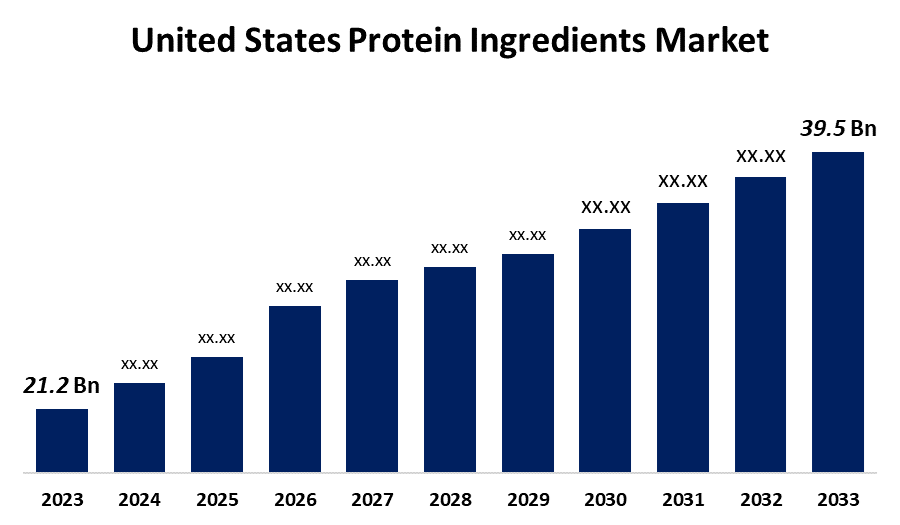

- The U.S. Protein Ingredients Market Size was valued at USD 21.2 Billion in 2023.

- The Market is Growing at a CAGR of 6.42% from 2023 to 2033

- The U.S. Protein Ingredients Market Size is expected to reach USD 39.5 Billion by 2033

Get more details on this report -

The United States Protein Ingredients Market is anticipated to exceed USD 39.5 Billion by 2033, growing at a CAGR of 6.42% from 2023 to 2033. The growing demand for protein-enriched functional foods, health consciousness, and rising environmental sustainability concerns are driving the growth of the protein ingredients market in the US.

Market Overview

Proteins are the greatest source for keeping the body in shape; people consume them to keep their protein level in check. The essential amino acids needed for cell repair cannot be produced by the human body. They reduce age-related muscle loss, increase physical strength, reduce the incidence of chronic illnesses, and assist in controlling weight. Sufficient protein intake also aids in stress reduction, immune system enhancement, appetite suppression, and body fat reduction. The utilization of microbes and insects as protein sources is growing in popularity because of their high nutritional content, minimal environmental impact, and affordability when compared to conventional cattle production. The trend of utilization of protein ingredients in breakfast cereals and the increasing emphasis on highly functional protein for high-protein based products are leveraging the market growth.

Report Coverage

This research report categorizes the market for the US protein ingredients market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States Protein Ingredients market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US protein ingredients market.

United States Protein Ingredients Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 21.2 Billion |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 6.42% |

| 2033 Value Projection: | USD 39.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Cargill, Incorporated, Darling Ingredients, Roquette Frères, ADM, Ingredion, Hilmar Ingredients, Myco Technology, Inc., International Flavors & Fragrances Inc., Axiom Foods, Inc., Farbest Brands, Diversified Ingredients, and Others Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing trend of health and wellness leads to increasing emphasis on adding protein components to dietary supplements and functional food products are driving the market. The extensive research into the elimination of distinctive flavourings linked to plant-based protein sources is enhancing market growth. The growing trend of people consuming wholesome food products. The changes in consumer behaviour and the rising popularity of vegan foods are propelling the market growth.

Restraining Factors

The health effects associated with high protein consumption are hampering the market growth for protein ingredients. Further, the lack of awareness about the non-soy plant proteins is restraining the market.

Market Segmentation

The United States Protein Ingredients Market share is classified into product type and application.

- The animal/dairy proteins segment is expected to hold the largest market share during the forecast period.

The United States protein ingredients market is segmented by product type into plant proteins, legumes, roots, ancient grains, nuts & seeds, animal/dairy proteins, microbe-based protein, and insect protein. Among these, the animal/dairy proteins segment is expected to hold the largest market share during the forecast period. Animal protein is regarded as a complete protein source as it contains every important amino acid needed for the human body and is therefore a popular option for customers trying to maintain a healthy lifestyle. The increasing demand for high-quality proteins is responsible for driving the market due to its various health benefits.

- The food & beverages segment dominates the US protein ingredients market with the largest market share in 2023.

Based on the application, the U.S. protein ingredients market is divided into food & beverages, infant formulations, clinical nutrition, animal feed, and others. Among these, the food & beverages segment dominates the US protein ingredients market with the largest market share in 2023. Because of their higher protein content and longer shelf life, whey protein powders and bars are growing in popularity among fitness enthusiasts and athletes. Further, the increasing popularity of whey proteins in candy, nutritional supplements, powders, and packaged foods is fueling the market expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. protein ingredients market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill, Incorporated

- Darling Ingredients

- Roquette Frères

- ADM

- Ingredion

- Hilmar Ingredients

- Myco Technology, Inc.

- International Flavors & Fragrances Inc.

- Axiom Foods, Inc.

- Farbest Brands

- Diversified Ingredients

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2023, Ingredients giant ADM “re-scoped” its protein modernization investment project in Decatur, Illinois, amid sluggish demand for meat alternatives.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Protein Ingredients Market based on the below-mentioned segments:

US Protein Ingredients Market, By Product Type

- Plant Proteins

- Legumes

- Roots

- Ancient Grains

- Nuts & Seeds

- Animal/Dairy Proteins

- Microbe-Based Protein

- Insect Protein

US Protein Ingredients Market, By Application

- Food & Beverages

- Infant Formulations

- Clinical Nutrition

- Animal Feed

- Others

Need help to buy this report?