United States Public Safety LTE Market Size, Share, and COVID-19 Impact Analysis, By Services (Infrastructure, Services), By Deployment Model (Private LTE, Commercial LTE, Hybrid LTE, Others), By Applications (Law Enforcement and Border Control, Firefighting Services, Emergency Medical Services, Disaster Management), By End User (Public Safety Agencies, Industrial, Transport, Utilities), and United States Public Safety LTE Market Insights Forecasts 2023 – 2033

Industry: Aerospace & DefenseUnited States Public Safety LTE Market Insights Forecasts to 2033

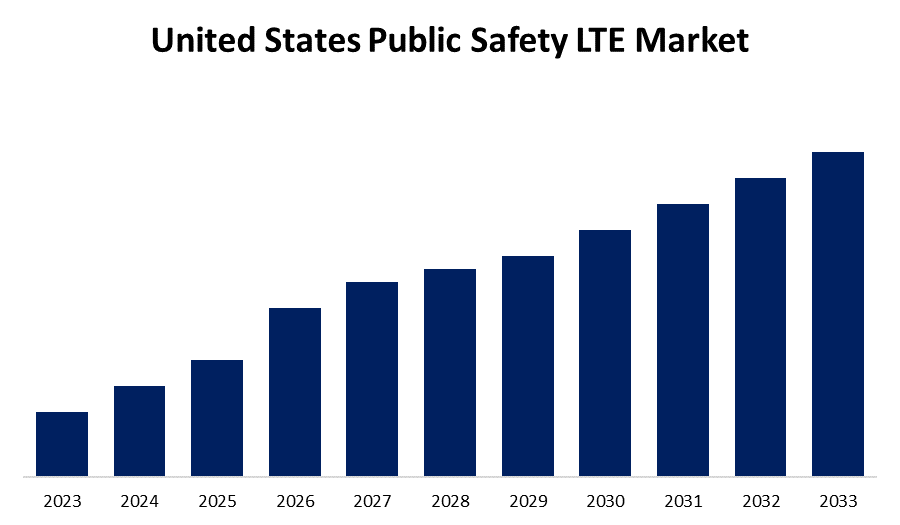

- The Market Size is Growing at a CAGR of XX% from 2023 to 2033.

- The United States Public Safety LTE Market Size is Expected to Hold a Significant Share by 2033.

Get more details on this report -

The United States Public Safety LTE Market size is expected to hold a significant share by 2033, at a CAGR of XX% during the forecast period 2023 to 2033.

Market Overview

Public safety is one of the primary responsibilities of any government, with the overarching goal of protecting citizens from threats such as crime and natural disasters. The availability of a converged communication network dedicated to public safety, such as public safety-LTE (PS-LTE), will assist organizations in accomplishing this. LTE benefits public safety by providing high reliability, cost-effectiveness, real-time capability, and flexibility, as well as enabling remote management and zero-touch deployment and configuration. There are three deployment models for the Public Safety LTE Market: commercial LTE, private LTE, and hybrid LTE. The emphasis on interoperability and unified communication among different public safety agencies is a major driver of the public safety LTE Market. Historically, different agencies used separate and incompatible communication systems, which made coordination difficult during an emergency. LTE technology promotes interoperability, allowing for seamless communication and data sharing among police, fire, emergency medical services, and other agencies. The ability to collaborate on a standardized communication platform improves overall situational awareness and response effectiveness, accelerating the adoption of public safety LTE.

Report Coverage

This research report categorizes the market for the United States public safety LTE market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States public safety LTE market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States public safety LTE market.

United States Public Safety LTE Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | XX% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Services, By Deployment Model, By Applications, By End User |

| Companies covered:: | Motorola Solutions, Inc., AT&T Inc., Verizon Communications Inc., Harris Corporation, FirstNet, Sierra Wireless, Inc., Sonim Technologies, Inc., Ericsson Inc., General Dynamics Corporation, Raytheon Technologies Corporation, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

The rapid evolution of technology has increased the demand for advanced communication and data services in the United States, particularly in the realm of public safety. The United States public safety LTE market has been boosted forward by the urgent need for cutting-edge communication technologies to meet the evolving demands of modern public safety operations. Furthermore, one of the major drivers of the United States public safety LTE market is the growing emphasis on interoperability and unified communication among various agencies. Another key driver of the United States public safety LTE market is the proliferation of enhanced public safety applications and the incorporation of the Internet of Things (IoT) into emergency response systems. LTE networks provide a solid foundation for deploying a diverse set of applications to support public safety operations. These applications include real-time video surveillance, location-based services, biometric identification, and sensor networks. As the demand for innovative public safety applications and IoT integration grows, the United States public safety LTE market is experiencing a surge in adoption, driven by a desire to leverage advanced technologies for more efficient and effective emergency response.

Restraining Factors

One of the major obstacles facing the United States public safety LTE market is the high cost of deploying and maintaining advanced LTE networks. Another important obstacle for the United States public safety LTE market is the allocation and management of the radio frequency spectrum. Integrating LTE technology into existing legacy systems is a significant hurdle for public safety agencies in the United States.

Market Segment

- In 2023, the infrastructure segment accounted for the largest revenue share over the forecast period.

Based on the services, the United States public safety LTE market is segmented into infrastructure and services. Among these, the infrastructure segment has the largest revenue share over the forecast period. It includes the necessary physical components for establishing and maintaining LTE networks dedicated to public safety agencies. This encompasses base stations, antennas, network equipment, and spectrum allocation. The strong demand for infrastructure is driven by the need to build and expand LTE networks capable of providing high-speed data and reliable communication to first responders. As governments and public safety organizations prioritize modernizing their communication infrastructure, the infrastructure segment is steadily growing. Investment in resilient, high-performance LTE infrastructure remains a key driver in ensuring that public safety agencies respond to emergencies in an effective and timely manner.

- In 2023, the private LTE segment is witnessing significant growth over the forecast period.

Based on the deployment model, the United States public safety LTE market is segmented into private LTE, commercial LTE, hybrid LTE and others. Among these, the private LTE segment is witnessing significant growth over the forecast period. The demand for dedicated and secure communication networks is a major driver of the Private LTE segment in the United States public safety LTE market. Public safety agencies require a communication infrastructure that provides dependable connectivity, low latency, and priority access during emergencies. Private LTE networks allow agencies to establish their dedicated spectrum, reducing interference and improving communication channel security. By deploying private LTE networks, public safety agencies can gain more control over their communication infrastructure, allowing for the implementation of robust encryption, authentication, and access control mechanisms.

- In 2023, the law enforcement and border control segment accounted for the largest revenue share over the forecast period.

Based on application, the United States public safety LTE market is segmented into law enforcement and border control, firefighting services, emergency medical services, disaster management. Among these, the law enforcement and border control segment have the largest revenue share over the forecast period. One of the primary drivers of the Law Enforcement and border control segment in the public safety LTE market is the growing emphasis on situational awareness and video surveillance. LTE networks enable law enforcement agencies to deploy high-resolution video cameras, drones, and other surveillance devices along borders. These devices transmit real-time video, allowing officers to monitor and respond to potential security threats quickly. The ability to send high-quality video over LTE networks improves the efficiency of border control operations. It enables law enforcement agencies to detect illegal border crossings, monitor remote areas, and respond to incidents more accurately. This trend reflects a growing reliance on advanced technologies to improve border security and ensure the safety of both officers and the public.

- In 2023, the public safety agencies segment is witnessing significant growth over the forecast period.

Based on end user, the United States public safety LTE market is segmented into public safety agencies, industrial, transport and utilities. Among these, the public safety agencies segment is witnessing significant growth over the forecast period. It consists of government entities and organizations responsible for public safety and emergency response, such as police departments, fire departments, emergency medical services, and disaster management agencies. These organizations rely on advanced communication networks to coordinate responses, share critical information, and ensure public safety during emergencies and routine operations. LTE technology is tailored to these agencies' specific needs, ensuring secure, high-speed communication and data transmission.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States public safety LTE market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Motorola Solutions, Inc.

- AT&T Inc.

- Verizon Communications Inc.

- Harris Corporation

- FirstNet

- Sierra Wireless, Inc.

- Sonim Technologies, Inc.

- Ericsson Inc.

- General Dynamics Corporation

- Raytheon Technologies Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States public safety LTE market based on the below-mentioned segments:

United States Public Safety LTE Market, By Services

- Infrastructure

- Services

United States Public Safety LTE Market, By Deployment Model

- Private LTE

- Commercial LTE

- Hybrid LTE

- Others

United States Public Safety LTE Market, By Application

- Law Enforcement and Border Control

- Firefighting Services

- Emergency Medical Services

- Disaster Management

United States Public Safety LTE Market, By End User

- Public Safety Agencies

- Industrial

- Transport

- Utilities

Need help to buy this report?