United States Range Cooker Market Size, Share, and COVID-19 Impact Analysis, By Size (20 Inch, 24 Inch, 30 Inch, and Above 30 Inch), By Application (Commercial and Residential), By Distribution Channel (Online and Offline), and U.S. Range Cooker Market Insights, Industry Trend, Forecasts to 2033.

Industry: Consumer GoodsUnited States Range Cooker Market Insights Forecasts to 2033

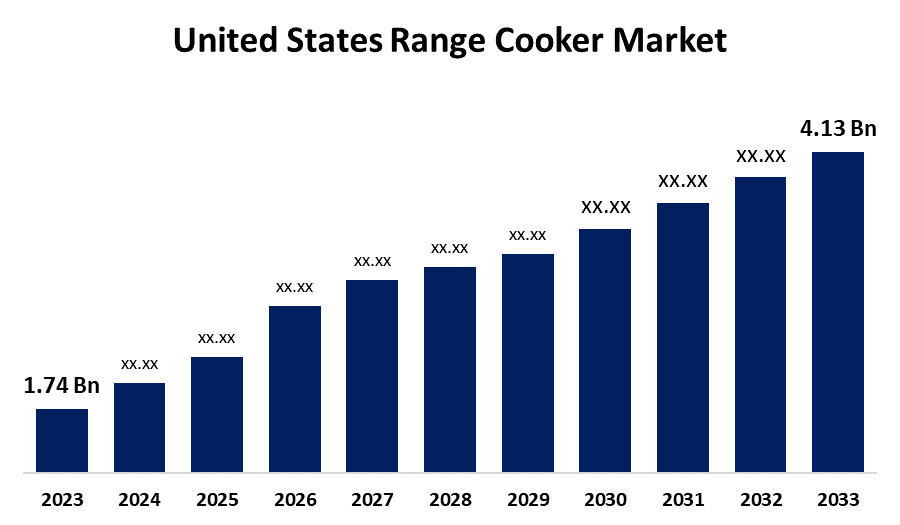

- The United States Range Cooker Market Size Was Estimated at USD 1.74 Billion in 2023.

- The Market Size is Growing at a CAGR of 9.03% from 2023 to 2033

- The USA Range Cooker Market Size is Expected to Reach USD 4.13 Billion by 2033

Get more details on this report -

The United States Range Cooker Market Size is Expected to reach USD 4.13 Billion By 2033, Growing at a CAGR of 9.03% from 2023 to 2033.

Market Overview

The industry that produces and markets multipurpose cooking appliances, which integrate a cooktop and one or more ovens into a single unit, is known as the United States range cooker market. A range cooker is a standalone kitchen appliance that includes a burner and oven. It is available in various sizes and styles for both home and commercial use, with more advanced models featuring built-in storage and monochromatic or pastel color schemes. These appliances cater to both residential and business needs, offering dual-fuel, gas, and electric options to meet diverse cooking requirements. In the United States, demand for modular kitchens is on the rise in both residential and commercial sectors, driven by their growing popularity and increased living standards. Moreover, the trend of home renovations aimed at creating and installing modular kitchens has led to a rapid adoption of these products in the U.S. Additionally, while promoting home cooking and raising awareness through TV shows, magazines, and social media, online platforms offer affordable options and discounts.

Report Coverage

This research report categorizes the market for the U.S. range cooker market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US range cooker market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA range cooker market.

United States Range Cooker Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.74 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.03% |

| 2033 Value Projection: | USD 4.13 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Size, By Application, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Amana, GE Appliances, SAMSUNG, VIKING RANGE, LLC, THERMADOR, Dacor, Inc., Whirlpool, Premier Marketing, Monogram, LG Electronics, Frigidaire, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The US range cooker market is experiencing steady growth due to the increasing trend of eating out; more and more restaurants, hotels, resorts, food stations, and other commercial eateries are opening up all across the nation. Restaurant owners are compelled to invest in modern, integrated cooking equipment because patrons expect delicious meals fast. These enterprises need high-capacity and efficient cooking equipment so they can serve large people fast while focusing on the quality of the food they serve. Range cookers are thought to be ideal for these commercial applications. As a result, it is anticipated that product usage in restaurants and cafes would rise during the next several years.

Restraining Factors

The market for range cooker in the United States is hampered because of their size, space requirements, and floor installation, Range cookers might interfere with kitchen hygiene and slow the expansion of the range cooker market in the US.

Market Segmentation

The U.S. range cooker market share is divided into size, application, and distribution channel.

- The 30 inch segment accounted for the largest market share of 27.42% in 2023 and is estimated to grow at a significant CAGR during the projected period.

Based on the size, the U.S. range cooker market is classified into 20 inch, 24 inch, 30 inch, and above 30 inch. Among these, the 30 inch segment accounted for the largest market share of 27.42% in 2023 and is estimated to grow at a significant CAGR during the projected period. This segment is expanding because 30-inch range cookers have more settings, functionalities, and cooking options than standard cookers; they are far more adaptable. To grill and roast meals simultaneously, many even use a second grill. 30-inch range cookers and other white goods have been produced by GE Appliances, a Boston-based corporation with a committed workforce, cutting-edge technology, and global reach and capabilities.

- The residential segment accounted for the highest market share of 75.11% in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the application, the U.S. range cooker market is divided into commercial and residential. Among these, the residential segment accounted for the highest market share of 75.11% in 2023 and is expected to grow at a significant CAGR during the projected timeframe. Residential customers can choose from a wide variety of products offered by manufacturers. These can be classified as dual fuel, which combines two sources, typically gas and electricity, or all-electric or all-gas. The most recent designs also incorporate steam ovens. With up to three ovens and a separate grill cavity, the range's remarkable cooking capacity is its most well-liked feature and a major factor in its uptake in homes.

- The offline segment is anticipated the largest market share in 2023 and is estimated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the U.S. range cooker market is divided into online and offline. Among these, the offline segment is anticipated the largest market share in 2023 and is estimated to grow at a significant CAGR during the forecast period. The offline segment is anticipated to continue to hold its leading position during the projection period due to the supply of comprehensive instructions regarding product features and installation services by experts. Additionally, major construction businesses, hotels, and restaurants favor working directly with product makers. The market is dominated by this segment since B2B sales require appropriate communication to better grasp the smallest nuances. Retail establishments sell the vast majority of range cookers and associated accessories.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. range cooker market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amana

- GE Appliances

- SAMSUNG

- VIKING RANGE, LLC

- THERMADOR

- Dacor, Inc.

- Whirlpool

- Premier Marketing

- Monogram

- LG Electronics

- Frigidaire

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2025, Stoves introduced the upgraded Richmond and Richmond Deluxe range cookers, which have a capacity of up to 196 liters and an inventive Quad-Oven design with four fully functional ovens. Additionally, the new models have AirFry technology for quicker and healthier cooking. The cookers, which come in 90 cm, 100 cm, and 110 cm sizes and include dual fuel, electric, and induction options, provide enhanced dependability and cutting-edge cooking features.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. range cooker market based on the below-mentioned segments

U.S. Range Cooker Market, By Size

- 20 Inch

- 24 Inch

- 30 Inch

- Above 30 Inch

U.S. Range Cooker Market, By Application

- Commercial

- Residential

U.S. Range Cooker Market, By Distribution Channel

- Online

- Offline

Need help to buy this report?