United State Ready-To-Drink Cocktails Market Size, Share, and COVID-19 Impact Analysis, By Type (Wine-based, Malt-based, and Spirit-based), By Packaging (Cans, Bottles, and Others), By Distribution Channel (Supermarkets/Hypermarkets, Online Retail Stores, Convenience Stores, and Others), and United States Ready-To-Drink Cocktails Market Insights, Indunited states try Trend, Forecasts to 2033.

Industry: Consumer GoodsUnited states Ready-To-Drink Cocktails Market Insights Forecasts to 2033

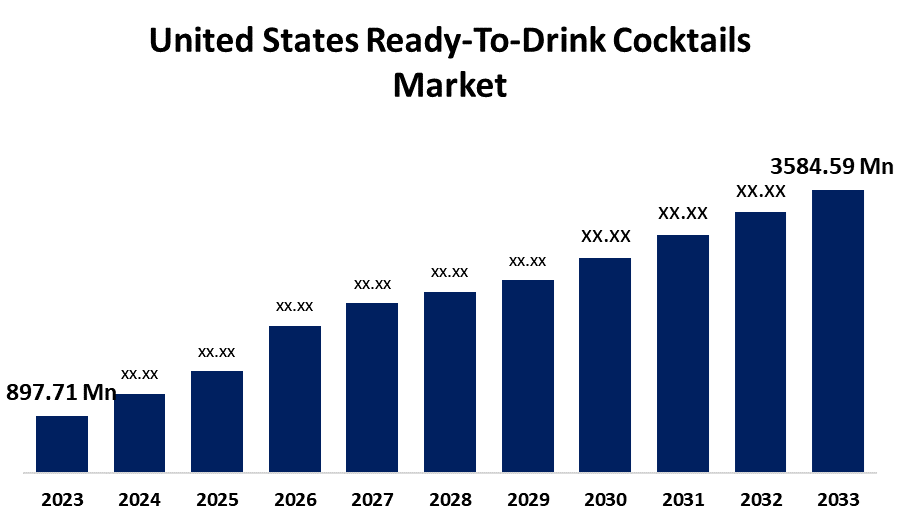

- The United states Ready-To-Drink Cocktails Market Size was estimated at USD 897.71 million in 2023.

- The Market is Growing at a CAGR of 14.85% from 2023 to 2033

- The United states Ready-To-Drink Cocktails Market Size is Expected to Reach USD 3584.59 million by 2033

Get more details on this report -

The A United states Ready-To-Drink Cocktails Market is Expected to Reach USD 3584.59 million by 2033, growing at a CAGR of 14.85% from 2023 to 2033.

Market Overview

The United states market for ready-to-drink (RTD) cocktails in the United states is the area of the alcoholic beverage bunited states iness that is devoted to the manufacturing, distribution, and consumption of pre-mixed alcoholic beverages, which are united states ually sold in bottles, cans, or pouches. These cocktails don't require extra preparation, such as mixing or adding ingredients, and are designed to be consumed right away. The ingredients of RTD drinks include alcohol, mixers (such as juice, soda, or flavored syrups), and occasionally extra garnishes or flavorings. The growing demand for portability and ease is a significant trend. RTDs are popular among consumers, particularly millennials and Gen Z, who find them to be a fun and convenient choice for at-home consumption, social gatherings, and outdoor activities. Additionally, the market is growing due to ready-to-drink (RTD) alternatives are becoming more popular than traditional mixing becaunited states e of their convenience and the belief that they provide a consistent, pre-mixed cocktail experience. In addition to this inclination for convenience and consumption while on the move, RTDs are a flexible option for meeting a range of needs.

Report Coverage

This research report categorizes the market for the United states ready-to-drink cocktails market based on variounited states segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the UNITED STATES A ready-to-drink cocktails market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. ready-to-drink cocktails market.

United States Ready-To-Drink Cocktails Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 897.71 million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 14.85% |

| 2033 Value Projection: | USD 3584.59 million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 109 |

| Segments covered: | By Packaging, By Type. |

| Companies covered:: | Diageo plc, Brown-Forman, Bacardi Limited, Asahi Group Holdings, Ltd., Pernod Ricard, Ranch Rider Spirits Co., Hounited states, e of Delola, LLC, Suntory Holdings Limited, High Noon Spirits Company, Anheunited states, er-Bunited states, ch InBev, Halewood Wines & Spirits, White Claw, Others, |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The United states ready-to-drink cocktails sector is expanding becaunited states e the demand for premium RTD options is being driven by cunited states tomers' growing desire for premium ingredients, distinctive flavor profiles, and attractive packaging, although convenience is still a major factor. In addition, R&D and creative package designs preserve ingredient integrity and flavor characteristics while improving product shelf durability and attractiveness. Additionally, the market is expanding due to consumer demand for low-calorie, gluten-free, and health-consciounited states alcoholic beverages, RTDs with natural sweeteners, lighter spirits, and creative flavors have emerged, propelling market innovation. Furthermore, growing e-commerce, direct-to-consumer channels, and more RTDs available in stores due to effective marketing initiatives are all contributing to the expansion of the ready-to-drink cocktail market in the United states .

Restraining Factors

The United states market for RTD drinks is restricted by strict laws governing advertising, labeling, and alcohol content. It can be difficult and expensive to comply with these rules. In addition, the general health effects of drinking alcohol are a big concern, if there is a desire for healthier options. This may caunited states e cunited states tomer preferences to change.

Market Segmentation

The UNITED STATES ready-to-drink cocktails market share is classified into the type, packaging, and distribution channel.

- The malt-based segment accounted for the largest share of 78.24% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the type, the UNITED STATES A ready-to-drink cocktails market is divided into wine-based, malt-based, and spirit-based. Among these, the malt-based segment accounted for the largest share of 78.24% in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is driven by the desire of consumers for alcoholic beverages that are both handy and sessionable. In addition, one significant development is the emphasis on reduced alcohol content (ABV) alternatives, which appeal to consumers who are looking for a lighter drinking experience and are health-consciounited states . Furthermore, their growing appeal is also attributed to the variety of flavors available in the malt-based RTD market, which includes both inventive fruit-infunited states ed blends and traditional drinks like margaritas and Moscow mules.

- The cans segment is anticipated for the largest share of 76.59% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the packaging, the U.S. ready-to-drink cocktails market is divided into cans, bottles, and others. Among these, the cans segment is anticipated for the largest share of 76.59% in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is expanding becaunited states e they are portable, strong, and easily recycled, cans are a popular option for outdoor events, concerts, and consumption while on-the-go. In addition, consumers with limited refrigerator space will find them intriguing becaunited states e of their small size, which also makes storage and chilling simpler.

- The supermarkets/ hypermarkets segment accounted for the largest share of 42.4% in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the distribution channel, the United states ready-to-drink cocktails market is divided into supermarkets/hypermarkets, online retail stores, convenience stores, and others. Among these, the supermarkets/ hypermarkets segment accounted for the largest share of 42.4% in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is growing due to RTDs in supermarkets/hypermarkets are well-liked for social gatherings and planned purchases, and their placement in the wine and beer sections or special displays increases sales. Furthermore, promotional strategies that encourage trial and repeat bunited states iness include in-store sampling, discounts, and package offers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. ready-to-drink cocktails market along with a comparative evaluation primarily based on their product offering, bunited states iness overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focunited states ing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Diageo plc

- Brown-Forman

- Bacardi Limited

- Asahi Group Holdings, Ltd.

- Pernod Ricard

- Ranch Rider Spirits Co.

- Hounited states e of Delola, LLC

- Suntory Holdings Limited

- High Noon Spirits Company

- Anheunited states er-Bunited states ch InBev

- Halewood Wines & Spirits

- White Claw

- Others

Key Target Audience

- Market Players

- Investors

- End-united states ers

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2024, Suntory has expanded its U.S. RTD portfolio with the launch of MARU-HI, a Japanese-inspired sparkling cocktail. This product will debut in California in early 2025.

Market Segment

This study forecasts revenue at UNITED STATES , regional, and country levels from 2020 to 2033. Spherical Insights has segmented the UNITED STATES A ready-to-drink cocktails market based on the below-mentioned segments:

United states Ready-To-Drink Cocktails Market, By Type

- Wine-based

- Malt-based

- Spirit-based

United states Ready-To-Drink Cocktails Market, By Packaging

- Cans

- Bottles

- Others

United states Ready-To-Drink Cocktails Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Online Retail Stores

- Convenience Stores

- Others

Need help to buy this report?