United States Real World Evidence Solutions Market Size, Share, and COVID-19 Impact Analysis, By Type (Clinical Setting Data, Claims Data, Pharmacy Data, Patient-Powered Data, and Others), By End-User (Pharmaceutical and Medical Device Companies, Healthcare Payers, Healthcare Providers, and Others), and US Real World Evidence Solutions Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Real World Evidence Solutions Market Insights Forecasts to 2033

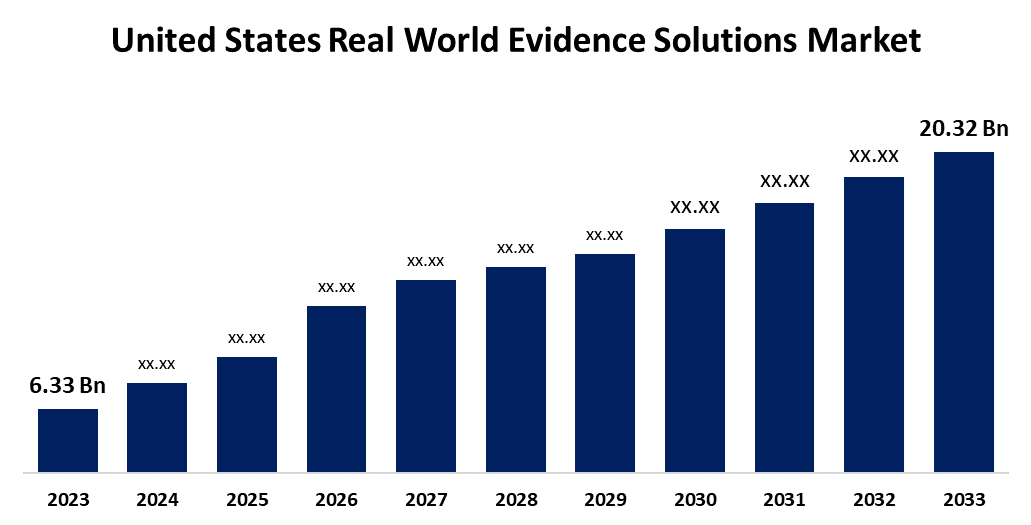

- The U.S. Real World Evidence Solutions Market Size was valued at USD 6.33 Billion in 2023.

- The Market is Growing at a CAGR of 12.37% from 2023 to 2033

- The U.S. Real World Evidence Solutions Market Size is Expected to Reach USD 20.32 Billion by 2033

Get more details on this report -

The U.S. Real World Evidence Solutions Market Size is Anticipated to Exceed USD 20.32 Billion by 2033, Growing at a CAGR of 12.37% from 2023 to 2033.

Market Overview

As per the U.S. FDA definition, real-world evidence (RWE) is clinical evidence that could be derived from the analysis of real-world data (RWD) about the potential benefits and usage of medical products. Recent years have witnessed significant attention to the insights provided by real-world evidence especially as they become closely associated with the decision-making across the product life cycle. Increased use of these solutions by end-users is expected to translate into an increase in studies based on real-world evidence in the short term. These solutions have gained surging interest from biopharmaceutical companies that increasingly draw on these solutions to strengthen clinical knowledge and gain product approval with effective reimbursement more rapidly. In September 2022, Verantos made the public announcement of the release of the Verantos evidence platform. The system has facilitated pharmaceutical companies to build real-world evidence solutions with highly defined standards that the U.S. FDA approves.

Report Coverage

This research report categorizes the market for the US real world evidence solutions market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States real world evidence solutions market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. real world evidence solutions market.

United States Real World Evidence Solutions Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 6.33 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 12.37% |

| 2033 Value Projection: | USD 20.32 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 217 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Type, By End-User and COVID-19 Impact Analysis. |

| Companies covered:: | IQVIA Inc., IBM, Cognizant, Syneos Health, Oracle, Optum Inc. (United Health Group), Flatiron Health (F. Hoffmann-La Roche), Thermo Fisher Scientific Inc., Parexel International Corporation, SAS Institute Inc., Perkin Elmer Inc., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Pharmaceutical companies are gaining momentum in using real-world evidence solutions to strengthen their clinical understanding of products during the development phase. For instance, in September 2022, Verantos launched the Evidence Platform. The system is designed to facilitate the generation of real-world evidence solutions by pharmaceutical companies with high standards which the FDA approves. Increased requirements for the RWE solutions by payers and providers, greater acceptance in regulatory terms, and more experience in digital and analytics led the way toward biopharmaceutical companies benefiting from real-world evidence solutions on a broader scale. This is the same reason why the market is growing.

Restraining Factors

One such factor is security and quality concerns related to patient data that can restrict market growth somewhat. Risks of leakage of private information related to health. The major risk faced by the leakage of private medical information relates to financial theft or identity theft.

Market Segmentation

The US real world evidence solutions market share is classified into type and end-user.

- The clinical setting data segment is expected to hold a significant market share through the forecast period.

The United States real world evidence solutions market is segmented by type into clinical setting data, claims data, pharmacy data, patient-powered data, and others. Among these, the clinical setting data segment is expected to hold a significant market share through the forecast period. The most important factors driving the dominance in the segment are the increasing healthcare cost-cutting demand and the adoption of electronic health records. The presence of numerous contract research and manufacturing organizations in the country also adds to the growth of the segment.

- The pharmaceutical and medical device companies segment is expected to dominate the US market during the projected period.

Based on the end-user, the United States real world evidence solutions market is divided into pharmaceutical and medical device companies, healthcare payers, healthcare providers, and others. Among these, the pharmaceutical and medical device companies segment is expected to dominate the US real world evidence solutions market during the projected period. The increasing demand for assessing the real-world performance of drugs and the cause to prevent costly drug recalls are primarily driving its growth. Additionally, market players are focusing on mergers and acquisitions to offer real-world data solutions across the country, which will drive segmental growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States real world evidence solutions market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- IQVIA Inc.

- IBM

- Cognizant

- Syneos Health

- Oracle

- Optum Inc. (United Health Group)

- Flatiron Health (F. Hoffmann-La Roche)

- Thermo Fisher Scientific Inc.

- Parexel International Corporation

- SAS Institute Inc.

- Perkin Elmer Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2023, Flatiron Health expanded the RWE offering into scientific, analytical, and consulting services.

- In March 2023, MediMergent announced it is being used in national-level clinical trials.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States real world evidence solutions market based on the below-mentioned segments:

United States Real World Evidence Solutions Market, By Type

- Clinical Setting Data

- Claims Data

- Pharmacy Data

- Patient Powered Data

- Others

United States Real World Evidence Solutions Market, By End-User

- Pharmaceutical and Medical Device Companies

- Healthcare Payers

- Healthcare Providers

- Others

Need help to buy this report?