United States Refrigerated Transport Market Size, Share, and COVID-19 Impact Analysis, By Technology (Air-blown Evaporators, Eutectic, Hybrid, and Fully Electrified), By Mode of Transport (Road, Air, Sea, and Railway), By Application (Food & Beverages, Pharmaceuticals, and Others), and US Refrigerated Transport Market Insights, Industry Trend, Forecasts to 2033

Industry: Automotive & TransportationUnited States Refrigerated Transport Market Insights Forecasts to 2033

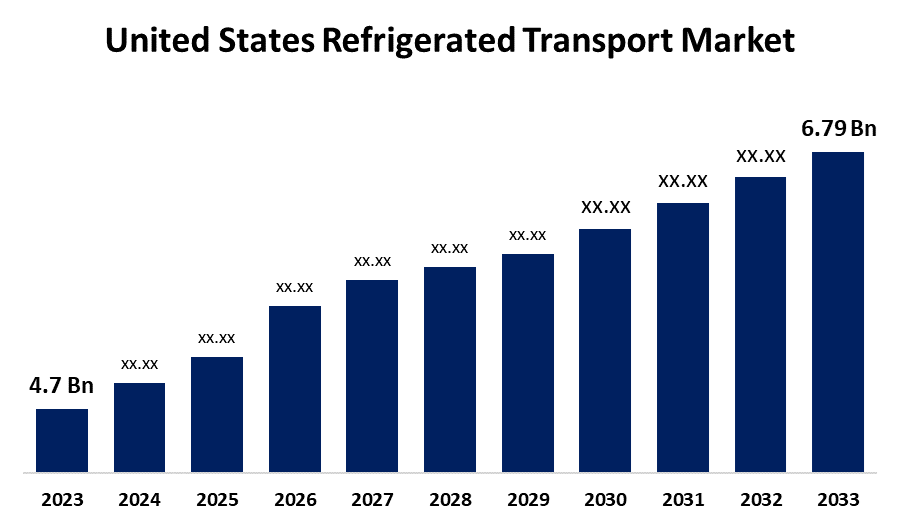

- The US Refrigerated Transport Market Size was valued at USD 4.7 Billion in 2023.

- The Market is growing at a CAGR of 3.75% from 2023 to 2033

- The U.S. Refrigerated Transport Market Size is expected to reach USD 6.79 Billion by 2033

Get more details on this report -

The United States Refrigerated Transport Market is anticipated to exceed USD 6.79 Billion by 2033, growing at a CAGR of 3.75% from 2023 to 2033.

Market Overview

Refrigerated transport refers to the temperature-controlled and air-conditioned transportation of perishable food products including confectionery, fruits and vegetables, dairy products, seafood, fish, and meat. The temperature-controlled system is intelligently designed so that food is stored longer. The US is one of the largest refrigerated transport markets worldwide. The market is mainly driven by the growing import and export of products such as fruits, vegetables, seafood, meat, and fresh flowers. Refrigerated transport minimizes food spoilage due to physical, biochemical, and physiological changes while maintaining product quality. Technological developments such as cryogenics and increasing demand for frozen foods have increased the demand for refrigerated transport systems in the country. Furthermore, refrigerated transport service providers are focusing on improving their supply chain efficiency and cold storage facilities. Leading companies are using new technologies such as Radio Frequency Identification (RFID), Bluetooth drone delivery, and driverless vehicles to increase the efficiency of logistics services. Progresses in refrigeration innovation have also contributed to the development of the refrigerated transport showcase. With the advancement of modern and made strides in refrigeration frameworks, it has ended up conceivable to keep up the temperature and stickiness levels required for the secure transportation of perishable merchandise. Additionally, innovative headways have too driven the advancement of more energy-efficient refrigeration frameworks, which not as it were diminish working costs but moreover essentially decrease the carbon impression of the transportation industry.

Report Coverage

This research report categorizes the market for the US refrigerated transport market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US refrigerated transport market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. refrigerated transport market.

United States Refrigerated Transport Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.7 Billion |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 3.75% |

| 2033 Value Projection: | USD 6.79 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Technology, By Mode of Transport, By Application and COVID-19 Impact Analysis |

| Companies covered:: | C. R. England Inc., J. B. Hunt Transport Services, Inc., Schneider National, Inc., Swift Transportation Co., C.H. Robinson Worldwide, Inc., Wabash National Corporation, Great Dane LLC, and other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

A key driver of the U.S. refrigerated transport market is the growing demand for fresh and perishable goods across various industries, including food and beverages, pharmaceuticals, and healthcare. As consumers seek fresh, locally sourced, and organic produce, the need for efficient and reliable refrigerated transport solutions to maintain the quality and integrity of these goods throughout the supply chain has increased. Additionally, the growth of e-commerce and online grocery delivery has further increased the demand for refrigerated transportation services, as companies strive to meet consumer expectations for fast and convenient delivery of perishable items such as fruits, vegetables, dairy products, and frozen foods. As a result, refrigerated transport providers are experiencing increasing demand for their services, increasing revenue, and investing in fleet expansion, infrastructure development, and technology upgrades to meet the evolving needs of their customers.

Restraining Factors

The primary restraining factor is the high operating costs associated with refrigerated transport, fuel costs, maintenance costs, and compliance with regulatory requirements.

Market Segmentation

The United States refrigerated transport market share is classified into technology, mode of transport, and application.

- The air-blown evaporators segment is expected to hold the largest market share through the forecast period.

The U.S. refrigerated transport market is segmented by technology into air-blown evaporators, eutectic, hybrid, and fully electrified. Among them, the air-blown evaporators segment is expected to hold the largest market share through the forecast period. Growth in demand for frozen foods including meat, seafood and dairy products is a significant driving factor for this segment. As the demand for these frozen products increases, so does the need for an efficient and reliable refrigeration system. Air-blown evaporators are an important component of refrigerated transport systems, playing an important role in maintaining the desired temperature in the cargo space.

- The road segment dominates the market with the largest market share over the predicted period.

The US refrigerated transport market is segmented by mode of transport into road, air, sea, and railway. Among them, the road segment dominates the market with the largest market share over the predicted period. The growing preference for online shopping and the demand for fast and reliable delivery of goods, including perishables, has increased the need for flexible and responsive transport networks. The road segment, with its door-to-door delivery capabilities, becomes an important link in meeting the time-sensitive requirements of e-commerce platforms, ensuring that temperature-sensitive products reach consumers on time while maintaining proper quality.

- The food & beverages segment dominates the market with the largest market share over the predicted period.

The U.S. refrigerated transport market is segmented by application into food & beverages, pharmaceuticals, and others. Among them, the food & beverages segment dominates the market with the largest market share over the predicted period. The growth of the e-commerce industry is an important driver of this segment. With the rise of online grocery shopping, food and beverage manufacturers are placing more emphasis on delivering their products to consumers' doorsteps. This has increased the demand for refrigerated transport services to ensure safe and timely delivery of goods, thereby driving the growth of the refrigerated transport market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States refrigerated transport market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- C. R. England Inc.

- J. B. Hunt Transport Services, Inc.

- Schneider National, Inc.

- Swift Transportation Co.

- C.H. Robinson Worldwide, Inc.

- Wabash National Corporation

- Great Dane LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2023, Kodiak Robotics built a truckload carrier and Collaborated with C.R. England. Together, they are launching a pilot program aimed at autonomously transporting Tyson Foods products in refrigerated trailers from Dallas to San Antonio, Texas. To ensure safety during the initial phase of the pilot, human safety drivers will be present in the truck. Additionally, C.R. England has become part of Kodiak's Partner Deployment Program, an initiative designed to help carriers establish autonomous freight operations and seamlessly integrate Kodiak Driver, an autonomous system developed by Kodiak, into their existing fleets.

Market Segment

This study forecasts revenue at US regional, and country levels from 2020 to 2033. Spherical Insights has segmented the US Refrigerated Transport Market based on the below-mentioned segments:

United States Refrigerated Transport Market, By Technology

- Air-blown Evaporators

- Eutectic

- Hybrid

- Fully Electrified

United States Refrigerated Transport Market, By Mode of Transport

- Road

- Air

- Sea

- Railway

United States Refrigerated Transport Market, By Application

- Food & Beverages

- Pharmaceuticals

- Others

Need help to buy this report?