United States Refrigerated Trucking Market Size, Share, and COVID-19 Impact Analysis, By Service (FTL, Non-Dedicated FTL, Dedicated FTL, and LTL), By Temperature Compartment (Single Temperature and Multiple Temperature), By Vehicle Type (Trailers and Vans), By End-User (Food & Beverage, Meat, Poultry & Seafood, Dairy & Beverages, Bakery Confectionary, & Others, Pharmaceuticals, and Others), and United States Refrigerated Trucking Market Insights, Industry Trend, Forecasts to 2033

Industry: Automotive & TransportationUnited States Refrigerated Trucking Market Insights Forecasts to 2033

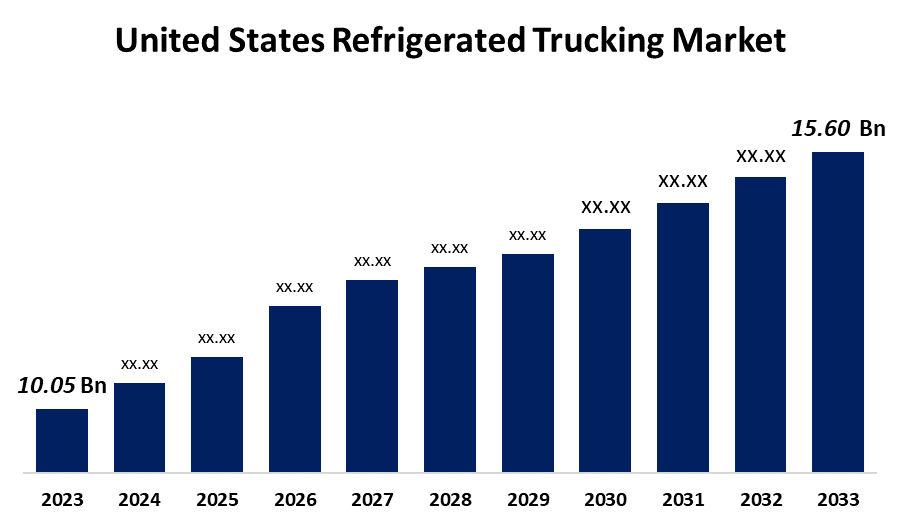

- The U.S. Refrigerated Trucking Market Size was valued at USD 10.05 Billion in 2023.

- The Market is growing at a CAGR of 4.5% from 2023 to 2033

- The U.S. Refrigerated Trucking Market Size is expected to reach USD 15.60 Billion by 2033

Get more details on this report -

The United States Refrigerated Trucking Market is anticipated to exceed USD 15.60 Billion by 2033, growing at a CAGR of 4.5% from 2023 to 2033. The growing demand for frozen perishable commodities and demand for healthcare & pharmaceutical industries are driving the growth of the refrigerated trucking market in the US.

Market Overview

A Refrigerated truck is a van or truck that is designed to carry perishable freight at low temperatures. The rise in development of novel approaches for managing temperature sensitive biological goods and a large number of registered patents by the US Patent and Trademark Office surge the need for temperature-controlled conditions owing to the technological advancements in these industries. Over USD 46.4 billion was spent on new brand medications in the US in 2021, a 140% increase over 2020 levels. A greater reliance on the refrigerated transportation sector has resulted from the expansion of agricultural products and increased trade. There are about 89 million acres of arable land in the United States, where farms are usually 445 acres in size. The market opportunities for temperature-controlled transportation services are created by the rising production of various medicinal items that are sensitive to temperature, as it is required to keep these products within a specific temperature range to maintain efficiency.

Report Coverage

This research report categorizes the market for the US refrigerated trucking market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States refrigerated trucking market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US refrigerated trucking market.

United States Refrigerated Trucking Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 10.05 Billion |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 4.5% |

| 2033 Value Projection: | USD 15.60 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 235 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Service, By Temperature Compartment, By Vehicle Type, By End-User and COVID-19 Impact Analysis |

| Companies covered:: | C.R. England Inc., Prime Inc., J. B. Hunt Transport Inc., KLLM Transport Services, Swift Transportation Company, Stevens Transport Inc., Marten Transport Ltd, ATS, Emerald Transporation Solutions, XPRESS CARGO, FFE Transportation Services Inc., FST Logistics, Hirschbach Motor Lines, Navajo Express, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing investment in specialized refrigerated trucks and storage facilities with advanced temperature control technology to effectively transport and store frozen perishable products is driving the market. The increasing demand for frozen foods owing to changing consumer preferences and lifestyle trends is propelling the market. Further, the healthcare and pharmaceutical industries are surging the need for refrigerated transport services for temperature sensitive medical supplies, vaccines, biologics, and pharmaceutical products.

Restraining Factors

The high energy costs are a growing concern for cold chain providers is hampering the market growth for refrigerated truckings. Since the need for chilled vehicles in cold chains has expanded, rising fuel costs and effective fuel consumption management are some of the other main concerns for cold chain suppliers.

Market Segmentation

The United States Refrigerated Trucking Market share is classified into service, temperature compartment, vehicle type, and end-user.

- The FTL segment accounted for the largest revenue share of the US refrigerated trucking market in 2023.

The United States refrigerated trucking market is segmented by service into FTL, non-dedicated FTL, dedicated FTL, and LTL. Among these, the FTL segment accounted for the largest revenue share of the US refrigerated trucking market in 2023. FTL services are critical to the timely and effective delivery of goods for the food and beverage, pharmaceutical, and agricultural industries. The need to move perishable commodities in large-volumes upsurges market demand.

- The multiple temperature segment is anticipated to grow at the fastest CAGR during the forecast period.

Based on the temperature compartment, the U.S. refrigerated trucking market is divided into single temperature and multiple temperature. Among these, the multiple temperature segment is anticipated to grow at the fastest CAGR during the forecast period. The adaptability of handling a wide range of perishable items with different temperature requirements upsurges the market demand. The need to transport perishable food products and frozen food products is driving the market.

- The trailers segment dominates the US refrigerated trucking market in 2023.

Based on the vehicle type, the U.S. refrigerated trucking market is divided into trailers and vans. Among these, the trailers segment dominates the US refrigerated trucking market in 2023. The refrigerated trucking industry in the United States depends heavily on trailers to transport perishable goods across long distances in large quantities. Further, the agricultural, food processing, and pharmaceutical industries are driving the market.

- The pharmaceuticals segment is anticipated to grow at the fastest CAGR during the forecast period.

Based on the end-user, the U.S. refrigerated trucking market is divided into food & beverage, meat, poultry & seafood, dairy & beverages, bakery confectionary, & others, pharmaceuticals, and others. Among these, the pharmaceuticals segment is anticipated to grow at the fastest CAGR during the forecast period. Pharmaceuticals industries are dependent on refrigerated trucking services for biologics, vaccines, temperature-sensitive pharmaceuticals, and other healthcare supplies. The development of precision medicine and biotechnology developments is contributing to driving the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. refrigerated trucking market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- C.R. England Inc.

- Prime Inc.

- J. B. Hunt Transport Inc.

- KLLM Transport Services

- Swift Transportation Company

- Stevens Transport Inc.

- Marten Transport Ltd

- ATS

- Emerald Transporation Solutions

- XPRESS CARGO

- FFE Transportation Services Inc.

- FST Logistics

- Hirschbach Motor Lines

- Navajo Express

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2022, Stevens Trucking Co. reached an eight-year agreement with startup Locomation to use its autonomous relay convoys, also known as truck platoons to operate up to 500 trucks on specific interstate lane segments in the next five years. Financial terms were undisclosed.

- In July 2022, KLLM Transport Services (KLLM), one of the leading temperature-controlled, truckload carriers in North America, has acquired refrigerated transporter Quest Global Inc., located in Cartersville, GA.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Refrigerated Trucking Market based on the below-mentioned segments:

US Refrigerated Trucking Market, By Service

- FTL

- Non-Dedicated FTL

- Dedicated FTL

- LTL

US Refrigerated Trucking Market, By Temperature Compartment

- Single Temperature

- Multiple Temperature

US Refrigerated Trucking Market, By Vehicle Type

- Trailers

- Vans

US Refrigerated Trucking Market, By End-User

- Food & Beverage

- Meat, Poultry & Seafood

- Dairy & Beverages

- Bakery, Confectionary, & Others

- Pharmaceuticals

- Others

Need help to buy this report?