United States Remote Therapeutic Monitoring Market Size, Share, and COVID-19 Impact Analysis, By Deployment Mode (Cloud & Web-based, On-premise, and Others), By Monitoring Type (Therapeutic Data and Non-Physiological Data), By End-use (Home Healthcare, Patients & Caregivers, Healthcare Providers, and Payers), and U.S. Remote Therapeutic Monitoring Market Insights, Industry Trend, Forecasts to 2033.

Industry: HealthcareUnited States Remote Therapeutic Monitoring Market Insights Forecasts to 2033

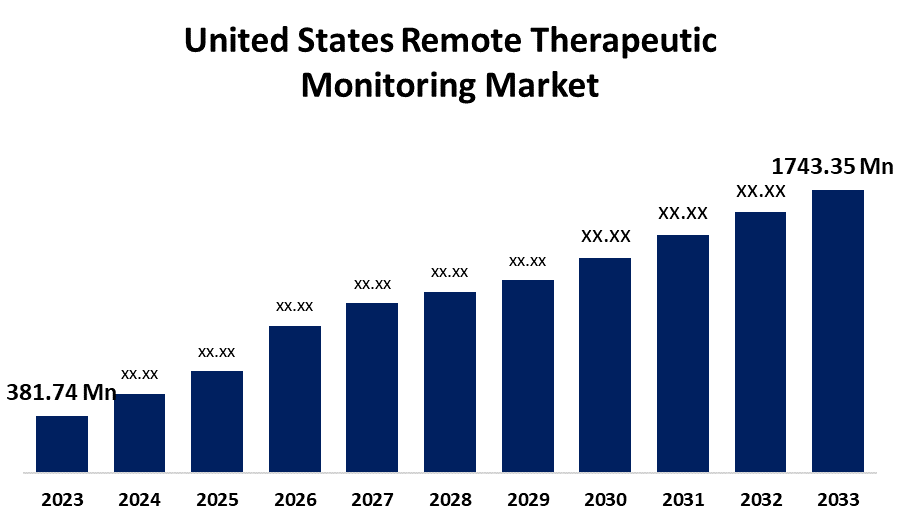

- The United States Remote Therapeutic Monitoring Market Size was Estimated at USD 381.74 Million in 2023.

- The Market Size is Growing at a CAGR of 16.40% from 2023 to 2033

- The USA Remote Therapeutic Monitoring Market Size is Expected to Reach USD 1743.35 Million by 2033

Get more details on this report -

The US Remote Therapeutic Monitoring Market Size is Expected to reach USD 1743.35 Million by 2033, Growing at a CAGR of 16.40% from 2023 to 2033

Market Overview

The market for remote therapeutic monitoring (RTM) in the United States is the area of healthcare technology devoted to using tools and technologies for remote monitoring to monitor and manage a patient's treatment progress in real time. RTM is the process of gathering health data outside of conventional clinical settings, usually via wearable technology, mobile applications, or digital health devices, to track the efficacy of ongoing medicines or treatments. The market is expanding due to several factors, including the increasing prevalence of musculoskeletal disorders, technological advancements in wearables and mobile health devices, and the growing preference for telemedicine and telehealth solutions. Additionally, platforms that use artificial intelligence (AI) to support remote therapeutic monitoring (RTM) provide more precise, effective, and individualized tracking of patients' therapeutic progress by utilizing machine learning, advanced data analytics, and real-time feedback. Furthermore, the US government initiatives aid the market growth, for instance, a US initiative known as Therapeutic Monitoring (RTM) was introduced in 2022 and enables clinical personnel to examine electronic patient-generated data in between visits, facilitating prompt clinical attention.

Report Coverage

This research report categorizes the market for the U.S. remote therapeutic monitoring market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US remote therapeutic monitoring market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA remote therapeutic monitoring market.

United States Remote Therapeutic Monitoring Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 381.74 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 16.40% |

| 2033 Value Projection: | USD 1743.35 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 113 |

| Segments covered: | By Deployment Mode, By Monitoring Type, By End-use and COVID-19 Impact Analysis |

| Companies covered:: | Zimmer Biomet, Medsien, Inc., Adhere+ Corporation, HealthViewX, OneStep, IncludeHealth Inc, Force, Propeller Health (Resmed), Limber Health, Inc., HealthArc, Hero Health, Inc., and Others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The market for remote therapeutic monitoring (RTM) has expanded due in large part to the development of sophisticated wearable technology, sensors, and connected health solutions. In addition, RTM saves health care providers and insurance organizations a lot of money by lowering the need for emergency care, readmissions to the hospital, and frequent in-person visits. Furthermore, the growing incidence of musculoskeletal illness and other chronic conditions drives the market expansion. Additionally, the presence of these businesses results in affordable remote treatment monitoring rates throughout the area. Manufacturers and suppliers provide goods with a range of features and specifications at all price points because of the existence of these businesses on a regional and global scale.

Restraining Factors

The USA remote therapeutic monitoring market faces challenges due to the remote monitoring technologies, which might be prohibitively expensive, particularly in insufficient and rural locations. In addition, there may be difficulties with rapidly evolving government rules regarding the supply of over-the-counter medications and remote monitoring technologies. Additionally, widespread adoption may be hampered by problems with infrastructure, digital literacy, and reimbursement.

Market Segmentation

The U.S. remote therapeutic monitoring market share is classified into deployment mode, monitoring type, and end-use.

- The cloud & web-based segment accounted for the largest share of 68.72% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the deployment mode, the U.S. remote therapeutic monitoring market is divided into cloud & web-based, on-premise, and others. Among these, the cloud & web-based segment accounted for the largest share of 68.72% in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is growing due to real-time data collection and analysis, which are made possible by cloud & web-based deployments, which give patients and healthcare professionals virtual access to monitoring systems. This makes it possible for connected equipment to intervene instantly, improving patient safety and treatment quality.

- The therapeutic data segment accounted for the highest share of 63.95% in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the monitoring type, the U.S. remote therapeutic monitoring market is divided into therapeutic data and non-physiological data. Among these, the therapeutic data segment accounted for the highest share of 63.95% in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is expanding due to collecting therapeutic data allows for real-time progress tracking, which improves patient engagement. By promptly modifying treatment plans in response to actual performance, healthcare professionals may guarantee that interventions are customized to meet the needs of each patient.

- The healthcare providers segment accounted for the largest share of 38.59% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the end-use, the U.S. remote therapeutic monitoring market is divided into home healthcare, patients & caregivers, healthcare providers, and payers. Among these, the healthcare providers segment accounted for the largest share of 38.59% in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is attributed to RTM tools allow healthcare providers to continuously monitor patients' health conditions, improving patient care. This helps manage long-term conditions like diabetes, high blood pressure, and heart disease.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. remote therapeutic monitoring market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Zimmer Biomet

- Medsien, Inc.

- Adhere+ Corporation

- HealthViewX

- OneStep

- IncludeHealth Inc

- Force

- Propeller Health (Resmed)

- Limber Health, Inc.

- HealthArc

- Hero Health, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2025, Sara Health and Fyzical Therapy Balance Centers collaborated to improve patient care via remote treatment monitoring. Using cutting-edge technology, the program aims to improve outcomes for people with mobility and balance problems.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. remote therapeutic monitoring market based on the below-mentioned segments:

U.S. Remote Therapeutic Monitoring Market, By Deployment Mode

- Cloud & Web-based

- On-premise

- Others

U.S. Remote Therapeutic Monitoring Market, By Monitoring Type

- Therapeutic Data

- Non-Physiological Data

U.S. Remote Therapeutic Monitoring Market, By End-use

- Home Healthcare

- Patients & Caregivers

- Healthcare Providers

- Payers

Need help to buy this report?