United States Residential Lighting Fixtures Market Size, Share, and COVID-19 Impact Analysis, By Product (Ceiling, Pendant & Chandeliers, Wall Mounted, Others), By Source (Incandescent, Fluorescent, LED & OLED), and United States Residential Lighting Fixtures Market Insights Forecasts to 2033

Industry: Consumer GoodsUnited States Residential Lighting Fixtures Market Insights Forecasts to 2033

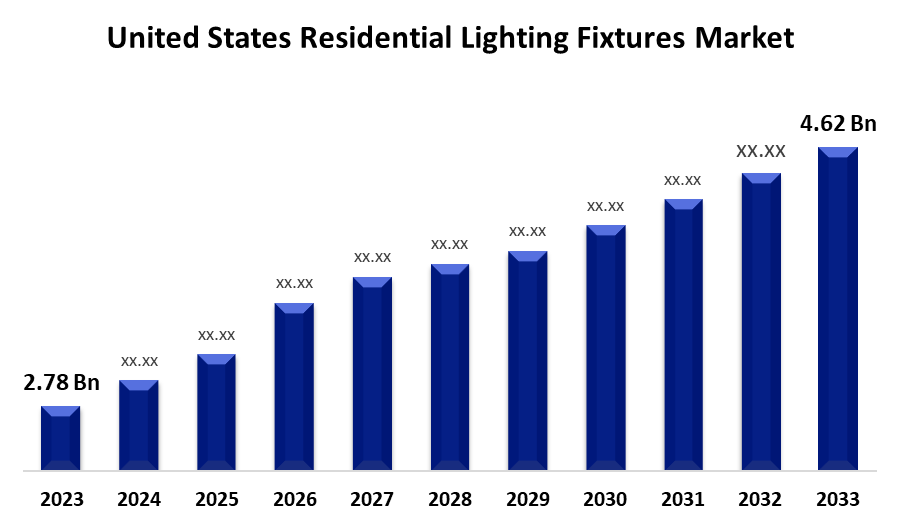

- The United States Residential Lighting Fixtures Market Size was valued at USD 2.78 Billion in 2023

- The Market Size is Growing at a CAGR of 5.2% from 2023 to 2033

- The United States Residential Lighting Fixtures Market Size is Expected to Reach USD 4.62 Billion by 2033

Get more details on this report -

The United States Residential Lighting Fixtures Market Size is expected to reach USD 4.62 Billion by 2033, at a CAGR of 5.2% during the forecast period 2023 to 2033.

Market Overview

LED lights use approximately 80% less energy than conventional lights such as florescent and incandescent lights, and LED bulbs do not contain toxic materials, so these factors are compelling consumers to switch from conventional to LED lights. The movement to phase out traditional lighting in countries such as China, Brazil, and Europe will have an impact on the adoption of LED lights. Furthermore, smart and connected LED lights will be the next big thing in smart home projects. This industry has transitioned from analog to digital systems, which allow users to control and monitor light efficiency.

In the coming years, the market is expected to be driven by rising demand for energy-efficient products in the residential and commercial sectors. The government's support for a low-energy consumption plan is also increasing demand for lighting fixtures. Consumer preference for upgraded domestic lighting, as well as the rapid development of the real estate sector, are expected to drive demand for lighting fixtures. The growing number of affluent communities is also driving up demand for yard lamps. Furthermore, the commercial sector is increasing its use of lighting fixtures, particularly LED light modules. Lighting fixtures are expected to be in high demand due to their attractive appearance and ability to enhance the overall aura of a location.

Report Coverage

This research report categorizes the market for United States residential lighting fixtures market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States residential lighting fixtures market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States residential lighting fixtures market.

United States Residential Lighting Fixtures Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.78 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.2% |

| 2033 Value Projection: | USD 4.62 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Source |

| Companies covered:: | Koninklijke Philips N.V., Hubbell Incorporated, Acuity Brands, Inc, NICHIA CORPORATION, Everlight Electronics Co., Ltd., Kichler Lighting LLC, NBG Home, Visa Lighting, Hinkley Inc., Minka Group (Ferguson), SavoyHouse.com, Maxim Lighting, Artika, Globe Electric Company Inc, Designers Fountain, Golden Lighting, Visual Comfort & Co. (Generation Lighting), Hudson Valley Lighting Group (HVLG), Elite Lighting, Livex Lighting and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Consumer lifestyles in the United States are rapidly changing. Growing disposable incomes and increasing urbanization are the two factors expected to drive market expansion over the predicted period. One of the major factors expected to drive the United States residential lighting fixtures market during the forecast period is an increase in smart city initiatives. Smart lighting has evolved into one of the most sophisticated smart city applications in recent years. Smart lighting solutions are being implemented by an increasing number of businesses. When combined with LEDs, such smart lighting systems save more than 30% of energy. Furthermore, increased government spending on smart cities, as well as the introduction of the smart cities concept, have resulted in an increase in demand for the construction of smart buildings. As a result of the increased demand for smart buildings, the demand for energy-saving infrastructure such as LED lighting fixtures is expected to rise, resulting in the U.S. expansion of the lighting fixtures market.

Restraining Factors

The United States residential lighting fixtures market growth is expected to be hampered by complex purchasing decisions in the lighting fixtures industry during the forecast period. Lighting fixture purchases are not made solely by end users, but rather by a team of professionals that includes architects, lighting designers, and electrical engineers. The involvement of various professionals has complicated the purchasing process, which is limiting the growth of the lighting fixtures market. As a result, these factors are expected to hamper the market growth over the forecast period.

Market Segment

- In 2023, the ceiling segment accounted for the largest revenue share over the forecast period.

Based on the product, the United States residential lighting fixtures market is segmented into ceiling, pendant & chandeliers, wall mounted, and others. Among these, the ceiling segment has the largest revenue share over the forecast period, these fixtures are suspended from the ceiling and have a glass or plastic shade that conceals the light bulb. The lights' applications vary, but they are mostly used as track or recessed lights. Track ceiling lights are suspended or mounted on the ceiling. Track lighting is made up of a linear housing with several heads that can be positioned anywhere along the track and whose direction can also be adjusted. Track lighting is frequently used for task lighting or accent lighting.

- In 2022, the LED & OLED segment accounted for the largest revenue share over the forecast period.

Based on the source, the United States residential lighting fixtures market is segmented into incandescent, fluorescent, and LED & OLED. Among these, the LED & OLED segment has the largest revenue share over the forecast period. LED lighting is now widely used in both residential and commercial applications, and it is available in a variety of household and industrial products. The rapid advancement of LED technology results in more inventive products and increased manufacturing efficiency, resulting in lower pricing. According to the Office of Energy Efficiency and Renewable Energy, widespread LED lighting adoption has the greatest potential impact on energy savings in the United States.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States residential lighting fixtures market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Koninklijke Philips N.V.

- Hubbell Incorporated

- Acuity Brands, Inc

- NICHIA CORPORATION

- Everlight Electronics Co., Ltd.

- Kichler Lighting LLC

- NBG Home

- Visa Lighting

- Hinkley Inc.

- Minka Group (Ferguson)

- SavoyHouse.com

- Maxim Lighting

- Artika

- Globe Electric Company Inc

- Designers Fountain

- Golden Lighting

- Visual Comfort & Co. (Generation Lighting)

- Hudson Valley Lighting Group (HVLG)

- Elite Lighting

- Livex Lighting

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States residential lighting fixtures market based on the below-mentioned segments:

United States Residential Lighting Fixtures Market, By Product

- Ceiling

- Pendant & Chandeliers

- Wall Mounted

- Others

United States Residential Lighting Fixtures Market, By Source

- Incandescent

- Fluorescent

- LED & OLED

Need help to buy this report?