United States Retail Banking Market Size, Share, and COVID-19 Impact Analysis, By Type (Public Sector Banks, Private Sector Banks, Foreign Banks, Community Development Banks, and Non-banking Financial Companies), By Service (Saving and Checking Account, Transactional Account, Personal Loan, Home Loan, Mortgages, Debit and Credit Cards, ATM Cards, and Certificates of Deposits), and United States Retail Banking Market Insights Forecasts 2023 - 2033.

Industry: Banking & FinancialUnited States Retail Banking Market Insights Forecasts to 2033

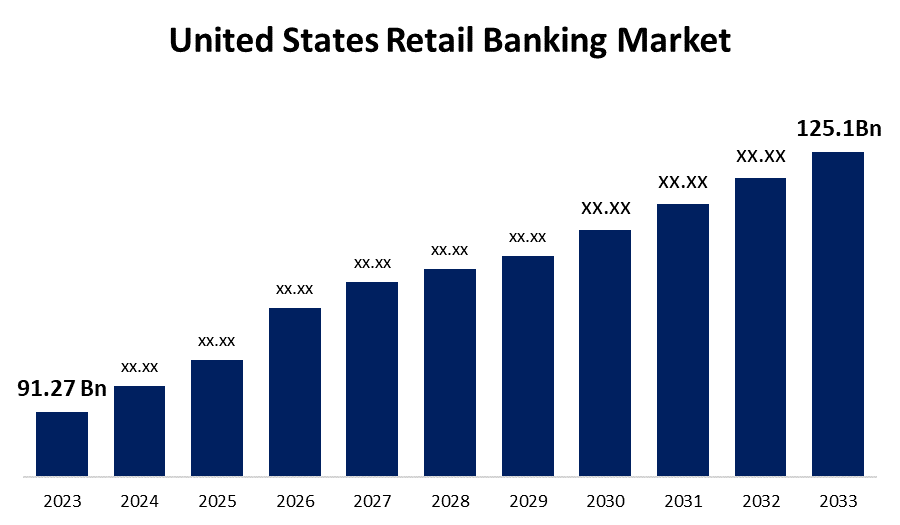

- The United States Retail Banking Market Size was valued at USD 91.27 Billion in 2023

- The Market Size is Growing at a CAGR of 3.20% from 2023 to 2033.

- The United States Retail Banking Market Size is Expected to Reach USD 125.1 Billion by 2033.

Get more details on this report -

The United States Retail Banking Market size is expected to reach USD 125.1 Billion by 2033, at a CAGR of 3.20% during the forecast period 2023 to 2033.

Market Overview

The cornerstone of personal or consumer banking, sometimes referred to as retail banking, is individual financial management. It involves offering essential financial services to the general population directly as opposed to through businesses or other organizations. This includes a broad range of services like credit and payment solutions, loan and mortgage security, everyday transaction management, investment options, financial planning, and digital banking experiences. Furthermore, by fostering financial inclusion, encouraging entrepreneurship, facilitating trade and commerce, and strengthening real estate markets, retail banking contributes significantly to a variety of industries. It continues to be an essential part of our financial ecosystem, changing and adapting to satisfy people's ever-changing needs as well as those of the broader economy. Retail banking is becoming more and more popular among certain demographic groups as a result of growing public trust and understanding of it. In the retail banking market, there is also a considerable demand for a range of financial services such as loans, mortgages, and investments due to the increase in disposable income. People are moving to cities in quest of better work opportunities and economic advancement, which increases demand for digital financial services and mobile banking. The need for specialized services like wealth management and retirement planning is fueled by improved healthcare and declining birth rates.

Report Coverage

This research report categorizes the market for the United States retail banking market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States retail banking market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States retail banking market.

United States Retail Banking Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 91.27 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 3.20% |

| 2033 Value Projection: | USD 125.1 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Service |

| Companies covered:: | Bank of America Corp., U.S. Bancorp, and, Citigroup Inc., Wells Fargo and Co., PNC Financial Services, JP Morgan Chase and Co., Trust Financial, Fifth Third Bank, Capital One, and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The primary driver of market expansion is the ongoing digital transformation. Retail banks can now provide smooth, user-friendly online and mobile banking experiences due to digital transformation. Features like real-time transaction tracking, 24/7 account access, and user-friendly interfaces provide customers with more convenience and accessibility, which increases customer loyalty and draws in new business. To draw in new customers, banks are constantly investing in digital technologies. Digital innovations can also be used to ensure regulatory compliance and put strong cybersecurity safeguards in place. Customers feel more confident when using enhanced security features, like biometric authentication and encryption technology, which also address concerns about cyber threats and provide a safe environment for digital banking. As a result, these variables will keep funding digital technologies, which will promote market growth throughout the projection.

Restraining Factors

Increase in significant loan losses as a result of people failing to repay bank-issued loans, which could impede the market's overall expansion. Furthermore, the retail banking market is facing numerous difficulties as a result of the strict rules placed on the banking industry.

Market Segment

The United States Retail Banking Market share is classified into type and service.

- The private sector banks segment is expected to hold the largest market share through the forecast period.

Based on type, the United States retail banking market is segmented into public sector banks, private sector banks, foreign banks, community development banks, and non-banking financial companies. Among these, the private sector banks segment is expected to hold the largest market share through the forecast period. The market's expansion can be attributed to the conditions in the industry changing with flexibility and agility. Numerous banks and other financial institutions that aggressively compete for market share make up the private sector. Private banks can offer cutting-edge goods and services to draw clients since they frequently have more resources to invest in infrastructure, marketing, and technology. Because of the fierce competition in the private sector, banks can maintain their market dominance by constantly enhancing their products, services, and total value proposition.

- The savings and checking account segment is expected to hold the largest market share through the forecast period.

Based on service, the United States retail banking market is segmented into savings and checking accounts, transactional accounts, personal loans, home loans, mortgages, debit and credit cards, ATM cards, and certificates of deposits. Among these, the savings and checking account segment is expected to hold the largest market share through the forecast period. The foundation of personal banking is the savings and checking account section. In addition to managing their money and handling the necessary transactions for their daily objectives, banking offers a safe place for deposits. Checking accounts, which are essentially bank accounts, are used to pay for daily expenses. These accounts are easy to access and have no restrictions on withdrawals. Regular deposits into a savings account can help customers build wealth and save money.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States retail banking market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bank of America Corp.

- U.S. Bancorp, and

- Citigroup Inc.

- Wells Fargo and Co.

- PNC Financial Services

- JP Morgan Chase and Co.

- Trust Financial

- Fifth Third Bank

- Capital One

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2023, Amazon and JPMorgan Chase worked together on Embedded Banking. JPMorgan Chase will offer financial services through the Amazon app, including credit cards, checking accounts, and bill payments. This suggests that customers can simply handle their money without having to leave the cozy Amazon setting.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States Retail Banking Market based on the below-mentioned segments:

United States Retail Banking Market, By Type

- Public Sector Banks

- Private Sector Banks

- Foreign Banks

- Community Development Banks

- Non-banking Financial Companies

United States Retail Banking Market, By Service

- Saving and Checking Account

- Transactional Account

- Personal Loan

- Home Loan

- Mortgages

- Debit and Credit Cards

- ATM Cards

- Certificates of Deposits

Need help to buy this report?