United States Rhinoplasty Market Size, Share, and COVID-19 Impact Analysis, By Treatment Type (Augmentation, Reduction, Post-Traumatic, Reconstructive, Revision, Filler, and Others), By Technique (Open Rhinoplasty and Closed Rhinoplasty), and United States Rhinoplasty Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Rhinoplasty Market Insights Forecasts to 2033

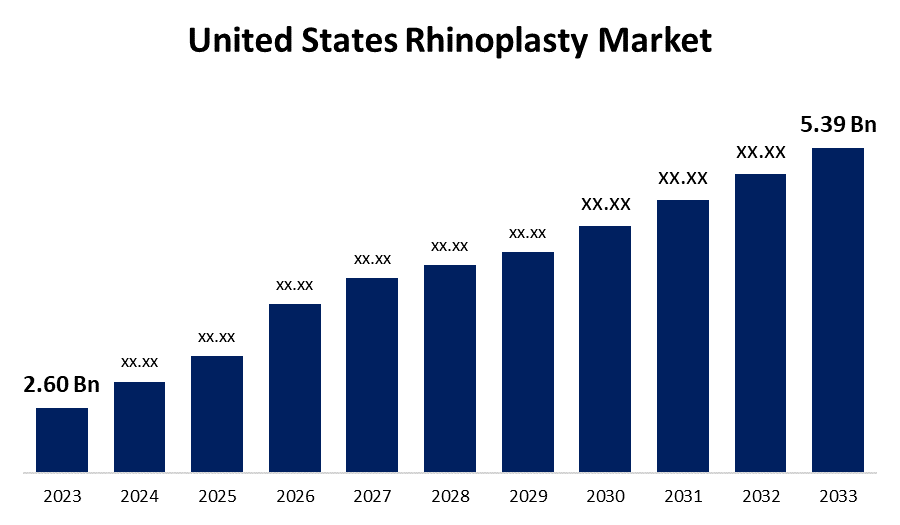

- The U.S. Rhinoplasty Market Size was valued at USD 2.60 Billion in 2023.

- The Market is growing at a CAGR of 7.56% from 2023 to 2033

- The U.S. Rhinoplasty Market Size is Expected to Reach USD 5.39 Billion by 2033

Get more details on this report -

The United States Rhinoplasty Market is Anticipated to Exceed USD 5.39 Billion by 2033, growing at a CAGR of 7.56% from 2023 to 2033. The growing demand for cosmetic procedures and technological advancements in surgical procedures are driving the growth of the rhinoplasty market in the US.

Market Overview

Rhinoplasty is the surgical procedure that offers a potential remedy to enhance nasal function and reduce symptoms like snoring and breathing problems. It improves the aesthetic appearance and structural integrity of the nose, correcting deformities from injury or congenita conditions, and providing balanced facial profile. The most prevalent plastic surgery operation in the United States is still rhinoplasty, with 3,50,000 nose-reshaping procedures carried out each year, according to the National Library of Medicine. Any new product for a rhinoplasty operation must adhere to certain laws, which are essential for the establishment of new products. Celebrities' increasing use of cosmetic procedures and rising public awareness of these procedures are expected to drive the growth. Introducing cutting-edge surgical tools and using minimally invasive techniques have significantly shortened recovery times and post-operative pain, improving patient satisfaction overall.

Report Coverage

This research report categorizes the market for the US rhinoplasty market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States Rhinoplasty market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US rhinoplasty market.

United States Rhinoplasty Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.60 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.56% |

| 2033 Value Projection: | USD 5.39 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Treatment Type, By Technique |

| Companies covered:: | Grover Aesthetics, Stryker, GC Aesthetics, Sunset Cosmetic Surgery, Surgiform Technologies LLC, Implantech, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The growing number of people seeking aesthetic modifications through surgical interventions and the introduction of technologically advanced treatment procedures like 3D computer-assisted technologies are driving the market. Modern technology and enhanced surgical methods are primarily driving growth of the rhinoplasty market. Because of the application of computer-aided design and three-dimensional imaging, the process has become much more accurate and precise, which makes it safer and more effective.

Restraining Factors

The increased cost associated with the surgical procedures may hamper market growth. Further, the lack of skilled professionals is also responsible for restraining the market.

Market Segmentation

The United States Rhinoplasty Market share is classified into treatment type and technique.

- The augmentation segment dominated the US rhinoplasty market during the forecast period.

The United States rhinoplasty market is segmented by treatment type into augmentation, reduction, post-traumatic, reconstructive, revision, filler, and others. Among these, the augmentation segment dominated the US rhinoplasty market during the forecast period. Augmentation rhinoplasty is a highly beneficial procedure choice for people who are uncomfortable with the idea of using artificial implants and offers many benefits. The rising number of patients seeking better facial aesthetics and nose reshaping with the upgradation of cosmetics is driving market growth.

- The open rhinoplasty segment accounted for the largest market share through the forecast period.

Based on the technique, the U.S. rhinoplasty market is divided into open rhinoplasty and closed rhinoplasty. Among these, the open rhinoplasty segment accounted for the largest market share through the forecast period. Open rhinoplasty could perform intricate and lengthy nose surgery. Open rhinoplasty is a cosmetic procedure intended to enhance a person's nose's functioning as well as appearance. The capacity of the surgical method to offer improved sight and accurate surgical adjustments for the best possible outcomes is driving the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. rhinoplasty market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Grover Aesthetics

- Stryker

- GC Aesthetics

- Sunset Cosmetic Surgery

- Surgiform Technologies LLC

- Implantech

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2023, Acclarent, Inc., a subsidiary of Johnson & Johnson, introduced Balloon Sinuplasty Systems, RELIEVE SPINPLUS.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Rhinoplasty Market based on the below-mentioned segments:

US Rhinoplasty Market, By Treatment Type

- Augmentation

- Reduction

- Post-Traumatic

- Reconstructive

- Revision

- Filler

- Others

US Rhinoplasty Market, By Technique

- Open Rhinoplasty

- Closed Rhinoplasty

Need help to buy this report?