United States Rotor Blade Market Size, Share, and COVID-19 Impact Analysis, By Location of Deployment (Onshore and Offshore), By Blade Material (Carbon Fiber, Glass Fiber, and Others), and the United States Rotor Blade Market Insights, Industry Trend, Forecasts to 2033.

Industry: Energy & PowerUnited States Rotor Blade Market Insights Forecasts to 2033

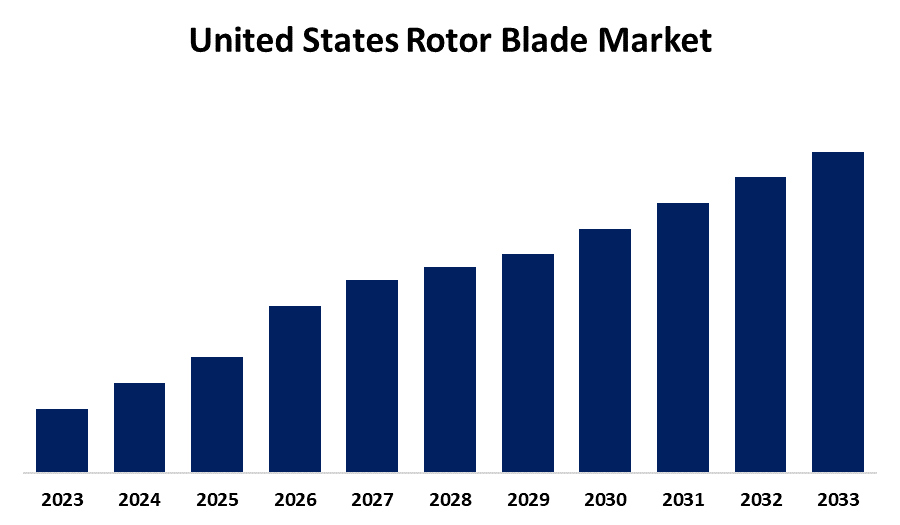

- The United States Rotor Blade Market Size is expected to Grow at a CAGR of around XX% from 2023 to 2033

- The U.S. Rotor Blade Market Size is expected to reach a significant share by 2033.

Get more details on this report -

The USA Rotor Blade Market size is expected to grow XX% CAGR from 2023 to 2033, and is expected to reach a significant share by 2033. The U.S. rotor blade market is expanding rapidly, driven by rising renewable energy demand, technological advancements, and supportive policies, with onshore wind and glass fiber blades leading market adoption and growth.

Market Overview

The United States wind turbine rotor blade market encompasses the design, manufacturing, and distribution of rotor blades used in wind energy generation. Rotor blades are critical components of wind turbines, capturing wind energy to produce electricity. The U.S. wind market has expanded substantially, supported by a complex supply chain with over 500 manufacturing facilities specializing in components such as blades, towers, and generators. Moreover, the U.S. rotor blade market's growth is fueled by rising investments in renewable energy, supportive government policies, and technological advancements in blade materials and design. Increasing demand for offshore and onshore wind projects, along with goals for carbon neutrality and energy independence, make rotor blades essential to the nation's clean energy transition. Furthermore, in October 2022, Ventus introduced TripleCMAS to transform the wind turbine rotor and swept area into a condition monitoring and alarm system. The second-generation data-driven rotor monitoring system relies on data wirelessly gathered from the rotor. It will transform the rotor and the entire swept area into a measuring instrument for wind turbines.

Report Coverage

This research report categorizes the market for the US rotor blade market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. rotor blade market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA rotor blade market.

United States Rotor Blade Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | XX% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 260 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Location of Deployment, By Blade Material |

| Companies covered:: | GE Vernova, TPI Composites Inc., Siemens Gamesa Renewable Energy, LM Wind Power, Nordex USA, Inc., Vestas-American Wind Technology, Inc., Avangrid Renewables, and Others |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

Driving factors of the U.S. rotor blade market include the expansion of wind energy capacity, declining costs of wind power, and advancements in composite materials for lighter, more efficient blades. Federal and state-level incentives, coupled with growing corporate demand for clean energy, further support development. Grid modernization efforts also contribute to increased wind energy integration and rotor blade demand.

Restraining Factors

The U.S. rotor blade market faces restraints from strict regulations, political opposition, supply chain disruptions, and environmental concerns, including wildlife impact and blade disposal, which collectively hinder smooth project execution and expansion.

Market Segmentation

The U.S. United States rotor blade market share is classified into location of deployment, distribution channel.

- The onshore segment accounted for the largest share of the US rotor blade market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of location of deployment, the United States rotor blade market is divided into onshore and offshore. Among these, the onshore segment accounted for the largest share of the United States rotor blade market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is due to its cost-effectiveness, easier accessibility, and mature infrastructure. Onshore wind projects are quicker to develop and maintain, making them more attractive for investors and developers compared to offshore installations, which require higher capital and complex logistics.

- The glass fiber segment accounted for a substantial share of the U.S. rotor blade market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of blade material, the U.S. rotor blade market is divided into carbon fiber, glass fiber, and others. Among these, the glass fiber segment accounted for a substantial share of the U.S. rotor blade market in 2023 and is anticipated to grow at a rapid pace during the projected period. This is due to its cost-effectiveness and favourable mechanical properties. Glass fiber composites are widely used in wind turbine blades, offering a balance between strength and affordability. This widespread adoption makes glass fiber a preferred material in the industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the USA rotor blade market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GE Vernova

- TPI Composites Inc.

- Siemens Gamesa Renewable Energy

- LM Wind Power

- Nordex USA, Inc.

- Vestas-American Wind Technology, Inc.

- Avangrid Renewables

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2022, GE revealed the introduction of its 3MW Sierra onshore wind turbine in North America, with a 140-meter rotor and multiple hub heights. The Sierra turbines will be built at GE's facility in Pensacola, Florida, and many components of the turbine will be produced in North America.

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the US rotor blade market based on the below-mentioned segments:

United States Rotor Blade Market, By Location of Deployment

- Onshore

- Offshore

United States Rotor Blade Market, By Blade Material

- Carbon Fiber

- Glass Fiber

- Other

Need help to buy this report?