United States Safety Helmets Market Size, Share, and COVID-19 Impact Analysis, By Material (Polyethylene, Acrylonitrile Butadiene Styrene, and Polycarbonate), By Product (Hard Hats and Bump Caps), and by United States Safety Helmets Market Insights Forecasts to 2033

Industry: Construction & ManufacturingUnited States Safety Helmets Market Insights Forecasts to 2033

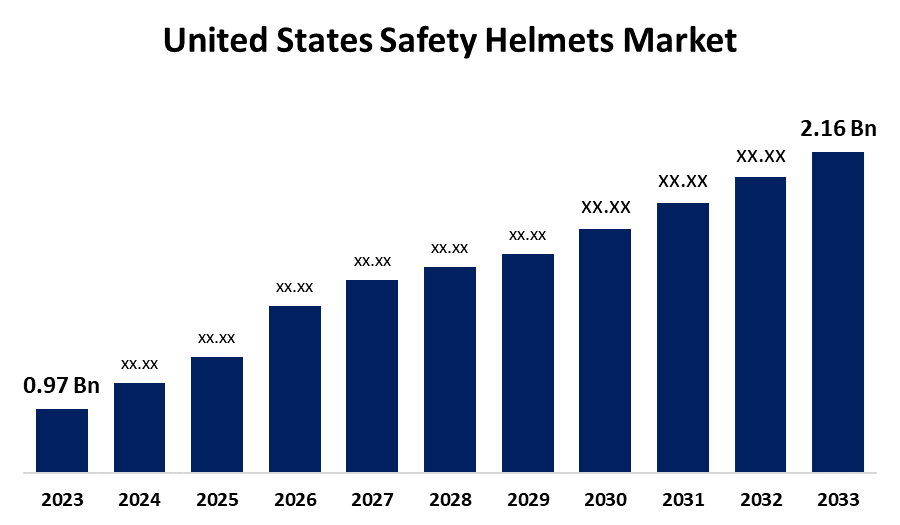

- The United States Safety Helmets Market Size was valued at USD 0.97 Billion in 2023.

- The Market is growing at a CAGR of 8.33% from 2023 to 2033

- The United States Safety Helmets Market Size is Expected to Reach USD 2.16 Billion by 2033

Get more details on this report -

The United States Safety Helmets Market is Anticipated to Exceed USD 2.16 Billion by 2033, growing at a CAGR of 8.33% from 2023 to 2033.

Market Overview

The United States safety helmet market incorporates the production, distribution, and utilization of protective headgear designed to safeguard individuals across various sectors, including construction, manufacturing, mining, and transportation. These helmets are engineered to mitigate the risk of head injuries by absorbing and deflecting impact forces encountered in hazardous environments. The market is experiencing significant growth, driven by stringent safety regulations and an increasing emphasis on workplace safety. The U.S. government has implemented various stringent safety regulations to mandate the use of safety helmets by workers in high-risk environments, further fueling the market growth. Additionally, the Occupational Safety and Health Administration (OSHA) enforces regulations that require employers to provide appropriate personal defending equipment, including safety helmets, to employees exposed to potential head injuries. These regulatory frameworks aim to enhance worker safety and reduce industrial hazards. Government initiatives further bolster the market by promoting safety awareness and compliance. Programs such as the National Safety Stand-Down, organized by OSHA, encourage employers to discuss safety measures, including the proper use of protective equipment like helmets, with their workers. Such initiatives underscore the critical importance of head protection and contribute to the increasing adoption of safety helmets across industries.

Report Coverage

This research report categorizes the market for the United States safety helmets market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States safety helmets market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each United States safety helmets market sub-segment.

Driving Factors

The United States safety helmet market is driven by multiple factors, including stringent workplace safety regulations, increasing awareness of occupational hazards, and advancements in helmet technology. The Occupational Safety and Health Administration (OSHA) mandates protective headgear in high-risk industries such as construction, manufacturing, and mining, ensuring compliance and fostering market growth. Rising workplace accident rates have intensified the demand for impact-resistant and ergonomically designed helmets. Additionally, technological innovations, such as smart helmets with sensors for real-time hazard detection, are further influencing market expansion. Growing investments in infrastructure and industrial projects continue to propel the demand for safety helmets across the nation.

United States Safety Helmets Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 0.97 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.33% |

| 2033 Value Projection: | USD 2.16 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Material, By Product and COVID-19 Impact Analysis |

| Companies covered:: | 3M, Delta Plus Group, Bullard, Honeywell International Inc., MSA, JSP Ltd., Drägerwerk AG & Co. KGaA, Schuberth GmbH, OccuNomix International LLC, Pyramex and others key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Restraining Factors

The United States safety helmet market faces challenges such as high costs associated with advanced helmet technologies, limited awareness in smaller industries, and compliance issues among unregulated sectors. Additionally, discomfort and resistance to adoption due to ergonomic concerns hinder widespread usage, particularly in industries where protective equipment is not strictly enforced.

Market Segment

The U.S. Safety Helmets market share is classified into material and product.

- The polyethylene segment is expected to hold the largest market share through the forecast period.

The US safety helmets market is segmented by material into polyethylene, acrylonitrile butadiene styrene, and polycarbonate. Among these, the polyethylene segment is expected to hold the largest market share through the forecast period. This dominance is attributed to polyethylene's cost-effectiveness, making helmets produced from this material more affordable compared to those made from acrylonitrile butadiene styrene (ABS) or polycarbonate. Additionally, polyethylene helmets offer sufficient impact resistance and durability for various industrial applications, further solidifying their preference among end-users.

- The hard hats segment is expected to hold the largest market share through the forecast period.

The US safety helmets market is segmented by product into hard hats and bump caps. Among these, the hard hats segment is expected to hold the largest market share through the forecast period. This dominance is attributed to the increased demand for hard hats in industries such as mining and construction, where they provide essential protection against falling objects and electrical hazards. Additionally, hard hats offer electric shock protection in workplaces with exposed electrical conductors, further driving their adoption.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States safety helmets market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M

- Delta Plus Group

- Bullard

- Honeywell International Inc.

- MSA

- JSP Ltd.

- Drägerwerk AG & Co. KGaA

- Schuberth GmbH

- OccuNomix International LLC

- Pyramex

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2024, Bastadgruppen’s Guardio, in partnership with Quin, launched an industrial safety helmet equipped with integrated sensor technology known as the Armet PRO helmet. This launch has set a new standard for safety as it detects falls and impacts, reducing the consequences of accidents.

Market Segment

This study forecasts regional and country revenue from 2022 to 2033. Spherical Insights has segmented the United States safety helmets market based on the below-mentioned segments:

United States Safety Helmets Market, By Material

- Polyethylene

- Acrylonitrile Butadiene Styrene

- Polycarbonate

United States Safety Helmets Market, By Product

- Hard Hats

- Bump Caps

Need help to buy this report?