United States Sand Control Systems Market Size, Share, and COVID-19 Impact Analysis, By Location (Onshore, Offshore), By Application (Cased Hole, Open Hole), and United States Sand Control Systems Market Insights Forecasts to 2033

Industry: Energy & PowerUnited States Sand Control Systems Market Insights Forecasts to 2033

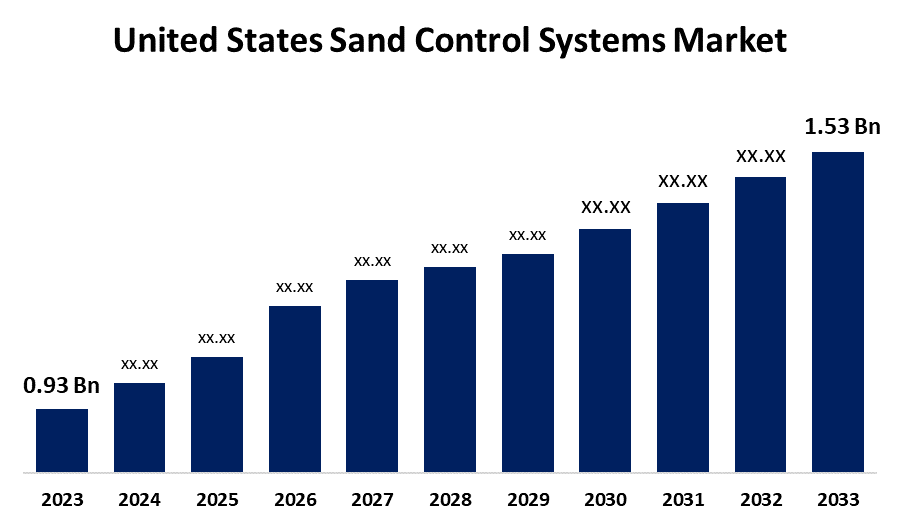

- The United States Sand Control Systems Market Size was valued at USD 0.93 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.10% from 2023 to 2033.

- The United States Sand Control Systems Market Size is Expected to Reach USD 1.53 Billion by 2033.

Get more details on this report -

The United States Sand Control Systems Market Size is Expected to Reach USD 1.53 Billion by 2033, at a CAGR of 5.10% during the forecast period 2023 to 2033.

Market Overview

Sand control is a means of controlling sand production into a wellbore, which is a basic requirement for many oil and gas-producing wells worldwide. Sand migration within the reservoir can be a significant impediment to good production, resulting in reduced production rates, sand bridging, equipment erosion, and sand disposal and removal. Sand control systems are made up of systems or equipment that help to eliminate sand forms and mixing. The system plays a key role in the overall completion process, as well as improving a well's performance and output. They also aid in reducing downhole cavities, hardware degradation, and sand formation in the wellbore. Sand control systems are a critical aspect of the oil and gas industry. The majority of the United States oil and gas wells are drilled into unconsolidated sandstones, which produce sand as well as liquids. Sand production issues include blocking perforation burrows, collection in surface separators, sanding up the production span, and the possibility of downhole and surface equipment failure due to erosion. There are several approaches to controlling sand production from wells. The decisions range from simple alterations in operating procedures to costly consummations, such as sand combination or rock pressing. Sand control relies on site-specific factors, working techniques, and financial concerns.

Report Coverage

This research report categorizes the market for United States sand control systems market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States sand control systems market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States sand control systems market.

United States Sand Control Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 0.93 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.10% |

| 2033 Value Projection: | USD 1.53 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Location, By Application |

| Companies covered:: | Schlumberger Limited, Baker Hughes Incorporated, Halliburton Company, Hughes, Inc., Oil States International Inc., Tendaka, Mitchell Industries, Welltec International, Packers Plus Energy Services Inc., Superior Energy Services Inc., Weatherford International Ltd., and Others Key Vendors |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Managing operations in United States oil fields is becoming increasingly efficient in response to the harsh market climate. This is due to better drilling and sand control techniques, longer laterals, and more fracking processes. Enhanced oil production is the process of obtaining oil that cannot be recovered using primary or secondary oil recovery methods. It is also referred to as tertiary recovery. Oil producers throughout the world are anticipated to use sophisticated manufacturing processes including sand control techniques to improve rig operations. This, in turn, is expected to boost future market demand for sand control systems and equipment, offsetting falling crude oil prices.

Restraining Factors

Drilling HPHT exploratory wells is a high-risk, high-cost operation with extremely high incident exposure levels. Sand production poses many safety risks, which are a problem for HPHT well operations. Handling HPHT fluid in surface equipment is a significant problem due to corrosion, erosion, sand, wax, and hydrate development. This presents a difficult situation for sand control solutions and service providers.

Market Segment

- In 2023, the onshore segment accounted for the largest revenue share over the forecast period.

Based on the location, the United States sand control systems market is segmented into onshore, and offshore. Among these, the onshore segment has the largest revenue share over the forecast period. Sand control equipment/tools are installed in onshore oil and gas wellbores to boost flow rate and filter sand during extraction. Sand management options include gravel packs, screens, or a mix of the two. Most onshore deposits are cemented and include older sands, necessitating sand control systems to filter sand. Sand management strategies are designed based on the type of well, its size, and other sand particle qualities such as permeability and porosity.

- In 2023, the cased hole segment accounted for the largest revenue share over the forecast period.

On the basis of application, the United States sand control systems market is segmented into cased hole and open hole. Among these, the cased hole segment has the largest revenue share over the forecast period. Cased-hole sand control systems are more commonly used for technical reasons related to hole stability. In a cased-hole completion, production casing is installed in the reservoir to ensure safe operations. It also serves as a barrier, keeping sediments, undesirable fluids, and gasses from entering the wellbore.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States sand control systems market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Schlumberger Limited

- Baker Hughes Incorporated

- Halliburton Company, Hughes, Inc.

- Oil States International Inc.

- Tendaka

- Mitchell Industries

- Welltec International

- Packers Plus Energy Services Inc.

- Superior Energy Services Inc.

- Weatherford International Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States Sand Control Systems Market based on the below-mentioned segments:

United States Sand Control Systems Market, By Location

- Onshore

- Offshore

United States Sand Control Systems Market, By Application

- Cased hole

- Open hole

Need help to buy this report?