United States Securities Brokerage Market Size, Share, and COVID-19 Impact Analysis, By Establishment Type (Investment Firms, Banks, Exclusive Brokers, and Others), By Type (Stock Exchanges, Derivatives & Commodities Brokerage, Equities Brokerage, Bonds Brokerage, and Others), and United States Securities Brokerage Market Insights, Industry Trend, Forecasts to 2033

Industry: Banking & FinancialUnited States Securities Brokerage Market Insights Forecasts to 2033

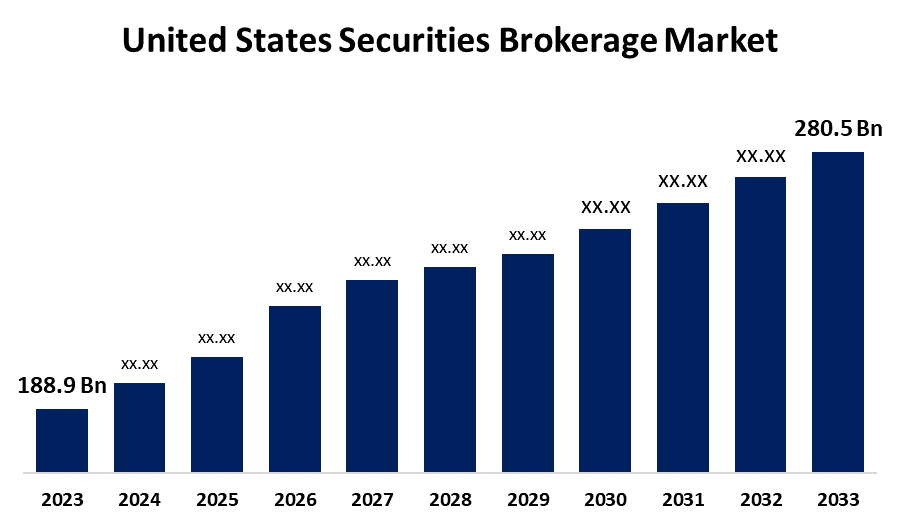

- The United States Securities Brokerage Market Size was valued at USD 188.9 Billion in 2023.

- The Market is growing at a CAGR of 4.03% from 2023 to 2033

- The U.S. Securities Brokerage Market Size is expected to reach USD 280.5 billion by 2033

Get more details on this report -

The United States Securities Brokerage Market is anticipated to exceed USD 280.5 billion by 2033, growing at a CAGR of 4.03% from 2023 to 2033. The increasing online trading platforms and mobile applications, growing knowledge of a range of investment products among agencies, and the growing number of players aiming to create higher revenue for wealth creation, management, and retirement are driving the growth of the securities brokerage market in the United States.

Market Overview

Securities Brokerage is a securities business unit that assists an individual or an organization carry out the purchase, sale, or exchange of securities in exchange for a fee, commission, or some other type of remuneration. Securities brokers assist clients by trading, investing, and offering advice. They are required to comprehend every client’s needs and provide tailored solutions. The brokers can charge a set fee for their services or take a cut of the investment profits made by the customer. The confidence that is fostered by the Securities and Exchange Commission’s regulation of securities brokers contributes to the expansion of the US securities brokerage sector. Investors are using the securities broker’s services for a range of assets, including mutual funds and annuities. The market is moving toward online brokers who charge less and provide more customized solutions as required by the consumer, as a result of the evolving and expanding needs of the customer. There is a growing adoption of modern technology to reach a broader group of audience and improve customer services. Artificial Intelligence (AI) and Machine Learning (ML) are two of the most popular technologies that are employed in a variety of jobs, including employing chatbots to handle both new and existing customers and manage customer portfolios, enhance risk assessment, do algorithmic trading, and perform predictive analysis.

Report Coverage

This research report categorizes the market for the US securities brokerage market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the securities brokerage market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the securities brokerage market.

United States Securities Brokerage Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 188.9 billion |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 4.03% |

| 2033 Value Projection: | USD 280.5 billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Establishment Type, By Type, and COVID-19 Impact Analysis |

| Companies covered:: | Charles Schwab, Vanguard, Fidelity, JP Morgan, E-Trade, Merril Edge, Interactive Brokers, Webull, Robinhood, Ally Invest, Firstrade, and Others Key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Owing to the higher returns on securities as compared to traditional investment options, there is rising demand for securities brokers in developed economies. Further, the increasing inclination towards online brokers that offer more customizable solutions among customers is driving the market growth. The emergence of online trading platforms and mobile applications, along with the increased popularity of various investment options such as annuity and mutual fund investments, are also driving the market. The numerous local and international players offering online security brokerage services on behalf of clients provide investment consulting which are fiercely competitive US securities brokerage sector.

Restraining Factors

The high risks associated with stock and securities trading are the significant factors responsible for restraining the market expansion. Further, the security brokerage market companies are highly prone and vulnerable to cyber-attacks and fraud may hamper the market growth.

Market Segmentation

The United States Securities Brokerage Market share is classified into establishment type and type.

- The investment firms segment is anticipated to witness the highest CAGR growth during the forecast period.

The United States securities brokerage market is segmented by establishment type into investment firms, banks, exclusive brokers, and others. Among these, the investment firms segment is anticipated to witness the highest CAGR growth during the forecast period. These institutions specialize in providing services linked to investments. There are many different kinds of investment options and concepts available in the financial market. Individuals frequently hire investment firms services to aid and direct them in making informed decisions because there is high risk involved in the finance industry.

- The stock exchanges segment dominated the market with the largest market share during the forecast period.

The United States securities brokerage market is segmented by type into stock exchanges, derivatives & commodities brokerage, equities brokerage, bonds brokerage, and others. Among these, the stock exchanges segment dominated the market with the largest market share during the forecast period. A number of factors such as growing public interest in the share market, expanding awareness, an increase in service providers, and a higher return on investment when traded correctly are driving the market growth in the stock exchange segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US securities brokerage market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Charles Schwab

- Vanguard

- Fidelity

- JP Morgan

- E-Trade

- Merril Edge

- Interactive Brokers

- Webull

- Robinhood

- Ally Invest

- Firstrade

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2023, Fidelity Investments, a leading global fixed income investment manager, announced the launch of Fidelity Municipal Core Plus Bond Fund (FMBAX), adding to Fidelity’s diverse lineup of active fixed income strategies reaching across the risk spectrum.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Securities Brokerage Market based on the below-mentioned segments:

United States Securities Brokerage Market, By Establishment Type

- Investment Firms

- Banks

- Exclusive Brokers

- Others

United States Securities Brokerage Market, By Type

- Stock Exchanges

- Derivatives & Commodities Brokerage

- Equities Brokerage

- Bonds Brokerage

- Others

Need help to buy this report?