United States Senior Living Market Size, Share, and COVID-19 Impact Analysis, By Facility (Skilled Nursing Facility, Assisted Living Facility, Active Adult (55+) Communities & Independent Living, and Memory Care), and U.S. Senior Living Market Insights, Industry Trend, Forecasts to 2033

Industry: Construction & ManufacturingUnited States Senior Living Market Insights Forecasts to 2033

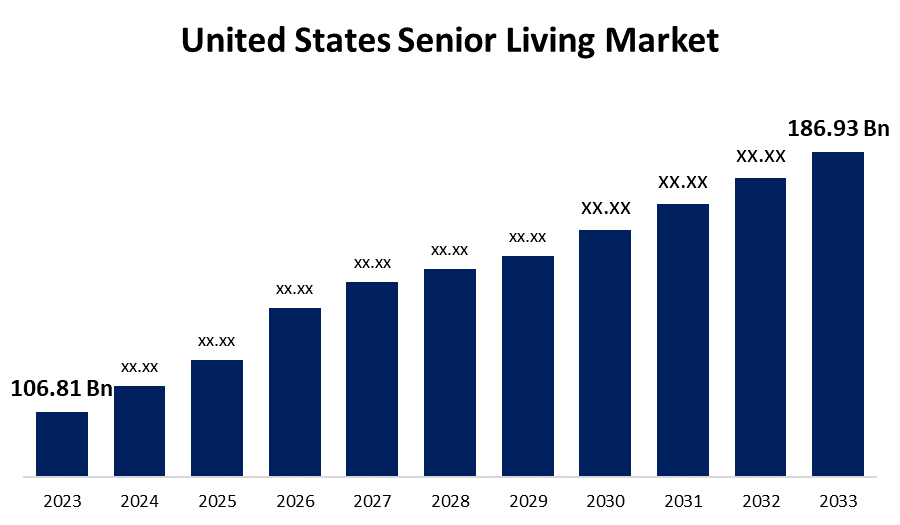

- The US Senior Living Market Size was valued at USD 106.81 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.76% from 2023 to 2033

- The U.S. Senior Living Market Size is Expected to Reach USD 186.93 Billion by 2033

Get more details on this report -

The US Senior Living Market is Anticipated to Exceed USD 186.93 Billion by 2033, growing at a CAGR of 5.76% from 2023 to 2033.

Market Overview

Senior living refers to a variety of housing and lifestyle choices designed for older individuals who face health challenges like reduced mobility and increased vulnerability to sickness due to aging. The U.S. Census Bureau predicts that the population over 85 years old will increase significantly from 6.7 million in 2020 to 14.4 million in 2040, and 18.6 million in 2050. By 2028, there will be approximately 622,000 more seniors aged 85 and above in the country due to a national median increase of 1.5% per year from 2022 to 2028. The need for services is not only based on urgency, as numerous elderly individuals are seeking out physical, mental, and social well-being, creating a wider variety of possibilities in the field. The combination of slowdowns and inventory reductions emphasize the urgent necessity for future senior care and wellness. Senior living and care operators are prioritizing margin improvement in 2024. This requires a careful balance between adjusting rates appropriately and increasing occupancy levels across different properties. The business sector is actively working to enhance profits by increasing sales, improving prices, and adjusting operational expenses when possible. Different choices for strategic redesign are being considered in order to enhance profit margins.

Report Coverage

This research report categorizes the market for the U.S. senior living market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US senior living market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. senior living market.

United States Senior Living Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 106.81 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 5.76% |

| 023 – 2033 Value Projection: | USD 186.93 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Facility |

| Companies covered:: | Brookdale Senior Living Inc., Five Star Senior Living, Sunrise Senior Living, Holiday Retirement, Kisco Senior Living Company, LCS, Erickson Senior Living, Atria Senior Living Inc., Senior Lifestyle, Sonida Senior Living, Ventas, Watermark Retirement Communities, Ensign Group Inc., Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

Improvements in healthcare have greatly influenced the senior housing industry, increased life span and encouraging more healthy aging. This has led to an increase in the need for independent and assisted living facilities that provide a wide range of medical care and wellness programs. The combination of telemedicine and remote monitoring improves the quality of care, attracting seniors and their families. Specialized nursing care units offer 24/7 monitoring, meals, and support for daily tasks, as well as access to therapy and rehabilitation services. Affordability and consumer decisions are impacted by economic factors like income levels and healthcare costs. Economic recessions may lead to an increase in the demand for subsidized or cost-effective options, whereas periods of prosperity can drive the expansion of upscale senior living options.

Restraining Factors

The negative perception of old-age homes due to social stigma affects family decisions and choices for senior living, leading to decreased demand.

Market Segmentation

The United States senior living market share is classified into facility.

- he active adult (55+) communities & independent living segment is expected to hold the largest market share through the forecast period.

The US senior living market is segmented by facility into skilled nursing facility, assisted living facility, active adult (55+) communities & independent living, and memory care. Among them, the active adult (55+) communities & independent living segment is expected to hold the largest market share through the forecast period. This growth is fueled by the rising population of baby boomers looking for active, hassle-free living in age-restricted neighbourhoods. Important factors consist of the need for interaction, availability of leisure facilities, and the attraction of moving to smaller, easier-to-manage homes. Furthermore, the increasing accessibility of health and wellness programs designed for active seniors also contributes to the demand in this market segment. In April 2024, Del Webb, the leading developer of active adult communities for those 55 and older, introduced its newest community in Dallas, Del Webb at Legacy Hills. The opening event is expected to happen later this summer.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States senior living market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Brookdale Senior Living Inc.

- Five Star Senior Living

- Sunrise Senior Living

- Holiday Retirement

- Kisco Senior Living Company

- LCS

- Erickson Senior Living

- Atria Senior Living Inc.

- Senior Lifestyle

- Sonida Senior Living

- Ventas

- Watermark Retirement Communities

- Ensign Group Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, the Centers for Medicare & Medicaid Services revealed on July 8 that more than 400 individuals have enlisted in a new program designed to improve dementia care. The GUIDING an Improved Dementia Experience Model, starting on July 1, intends to lessen the load on unpaid caregivers through offering care coordination, management, and respite services.

- In May 2024, PACS Group declared their plans to purchase the operations of 53 skilled nursing facilities, along with assisted and independent living facilities, located in eight different states. This growth will bring PACS Group into five additional markets nationwide.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Senior Living Market based on the below-mentioned segments:

United States Senior Living Market, By Facility

- Skilled Nursing Facility

- Assisted Living Facility

- Active Adult (55+) Communities & Independent Living

- Memory Care

Need help to buy this report?