United States Short-term Vacation Rental Market Size, Share, and COVID-19 Impact Analysis, By Accommodation Type (Homes, Condominium, Apartments, and Others), By Booking Mode (Online and Offline), and United States Short-term Vacation Rental Market Insights, Industry Trend, Forecasts to 2033.

Industry: Consumer GoodsU.S. Short-term Vacation Rental Market Insights Forecasts to 2033

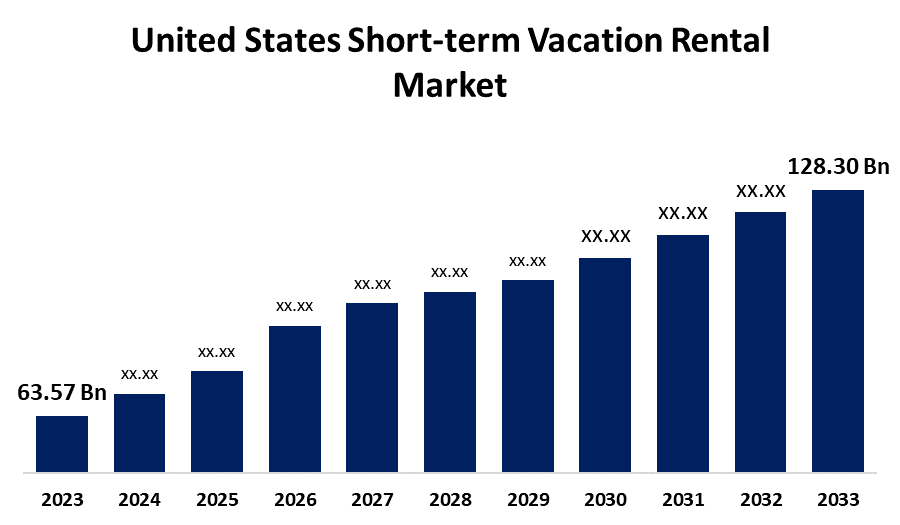

- The United States Short-term Vacation Rental Market Size was estimated at USD 63.57 Billion in 2023.

- The Market Size is Growing at a CAGR of 7.27% from 2023 to 2033

- The USA Short-term Vacation Rental Market Size is Expected to Reach USD 128.30 Billion by 2033

Get more details on this report -

The US Short-term Vacation Rental Market Size is Expected to Reach USD 128.30 Billion by 2033, growing at a CAGR of 7.27% from 2023 to 2033

Market Overview

The U.S. short-term vacation rental market refers to the rental of residential properties for short periods, typically ranging from a few days to a few weeks, to travelers seeking temporary accommodations. These rentals are typically listed on online platforms such as Airbnb, Vrbo, Booking.com, and others, offering travelers an alternative to traditional hotels. The properties can range from individual rooms, apartments, and houses, to luxury estates. The demand for short-term holiday rentals is driven by travelers' increasing desire for distinctive and customized experiences. In contrast to conventional hotels, short-term rentals provide a variety of lodging choices, including individual residences, apartments, cabins, and even opulent villas, enabling visitors to fully experience the customs and ways of life of the area. In addition, modern travelers who are looking for more personalized and genuine travel experiences may find this variation appealing. Furthermore, one of the main factors boosting demand has been technology. The booking of vacation rentals has been transformed by Airbnb, VRBO, and Booking.com due to their user-friendly interfaces, thorough reviews, and easy booking procedures, which have increased customer accessibility and confidence.

Report Coverage

This research report categorizes the market for the U.S. short-term vacation rental market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. short-term vacation rental market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. short-term vacation rental market.

United States Short-term Vacation Rental Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 63.57 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 7.27% |

| 023 – 2033 Value Projection: | USD 128.30 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 103 |

| Segments covered: | By Accommodation Type, By Booking Mode |

| Companies covered:: | Airbnb, Inc., Booking Holdings Inc., Expedia, Inc., Evolve Vacation Rental., Extended Stay America, AvantStay, Inc., Vacasa LLC, Sonder Holdings Inc., Wyndham Destinations, Inc., NOVASOL A/S, and Others |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

The market is expanding significantly as the demand for high-quality lodging continues to rise, the market has shifted from a peer-to-peer model to a professional property management and business strategy that provides reliable, expert services. In addition, the rise of remote work has led to an increase in demand for longer-term short-term rentals. Many people now combine work and travel, renting homes for weeks or even months at a time, particularly in desirable locations with strong internet access. Furthermore, the use of smart home devices and automation systems is rising in short-term rental properties, improving guest experiences and enhancing operational efficiency for hosts.

Restraining Factors

The U.S. short-term vacation rental market faces challenges due to regulations requiring property registration, taxes, and annual rental limitations, which are being implemented by local governments to address housing affordability issues while balancing the advantages of short-term rentals with the availability of affordable homes. Additionally, the increase in short-term rentals in popular locations could result in lower host booking rates, which could have an impact on earnings.

Market Segmentation

The United States short-term vacation rental market share is classified into accommodation type and booking mode.

- The homes segment accounted for the largest share of 34.58% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the accommodation type, the U.S. short-term vacation rental market is divided into homes, condominium, apartments, and others. Among these, the homes segment accounted for the largest share of 34.58% in 2023 and is expected to grow at a significant CAGR during the forecast period. These rentals provide unique accommodations that accommodate a range of tourist preferences, from comfortable cabins to roomy family homes, frequently furnished with fully functional kitchens and private features like patios or pools. In addition, rental properties are becoming a more appealing choice for extended stays or work-friendly settings as more people can travel while keeping their habits due to the growth of remote work.

- The online segment accounted for the highest share of 92.38% in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the booking mode, the U.S. short-term vacation rental market is divided into online and offline. Among these, the online segment accounted for the highest share of 92.38% in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is growing due to online resources that provide thorough property information, reviews, and real-time availability, allowing tourists to look for, evaluate, and reserve lodging from any location. In addition, modern consumers who value efficiency and transparency in vacation planning will find this smooth process appealing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. short-term vacation rental market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Airbnb, Inc.

- Booking Holdings Inc.

- Expedia, Inc.

- Evolve Vacation Rental.

- Extended Stay America

- AvantStay, Inc.

- Vacasa LLC

- Sonder Holdings Inc.

- Wyndham Destinations, Inc.

- NOVASOL A/S

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2022, Zumper launched its short-term rental product, allowing users to find annual, monthly, and nightly rentals on one platform.

Market Segment

- This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. short-term vacation rental market based on the below-mentioned segments

United States Short-term Vacation Rental Market, By Accommodation Type

- Homes

- Condominium

- Apartments

- Others

United States Short-term Vacation Rental Market, By Booking Mode

- Online

- Offline

Need help to buy this report?