United States Shrimp Market Size, Share, and COVID-19 Impact Analysis, By Environment (Farmed, Wild), By Domestic Production and Imports (Domestic Production, Imports), By Species (Penaeus Vannamei, Penaeus Monodon, Macrobrachium Rosenbergii, and Others), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Hotels and Restaurants, Online Stores, and Others) and United States Shrimp Market Insights Forecasts to 2033

Industry: Food & BeveragesUnited States Shrimp Market Size Insights Forecasts to 2033

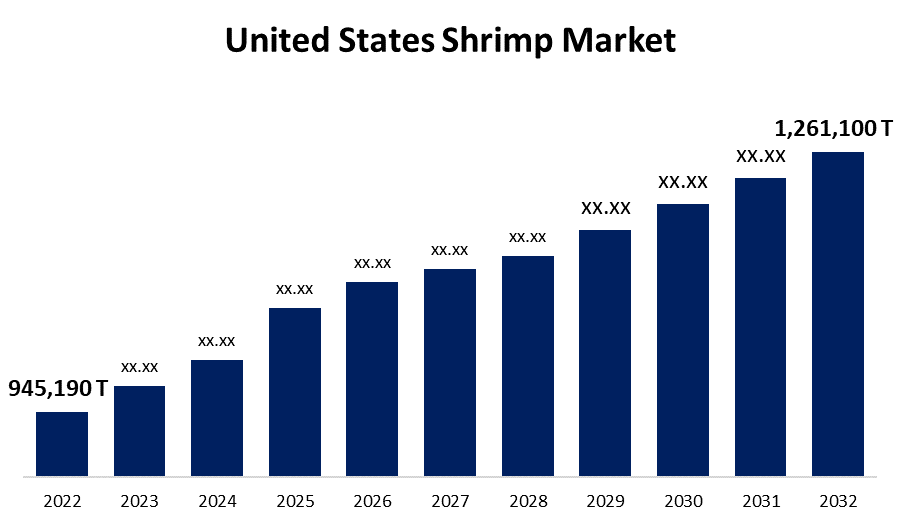

- The United States Shrimp Market Size was valued at 945,190 Tons in 2023.

- The Market Size is Growing at a CAGR of 2.93% from 2023 to 2033.

- The United States Shrimp Market Size is Expected to Reach 1,261,100 Tons by 2033.

Get more details on this report -

United States Shrimp Market Size is expected to reach 1,261,100 Tons by 2033, at a CAGR of 2.93% during the forecast period 2023 to 2033.

Market Overview

Shrimp are decapod shellfish with long bodies and primarily swimming movements, most commonly caridea and dendrobranchiata. More contract definitions may be restricted to caridea, smaller species of either bunch or marine species. Shrimp may be synonymous with prawn in a broader sense, encompassing stalk-eyed swimming shellfish with long contract strong tails (midriffs), long hairs (radio wires), and slim legs. Any small shellfish that resembles a shrimp is commonly referred to as one. Crabs and lobsters have strong walking legs, whereas shrimp have lean, delicate legs that they primarily use for roosting. Shrimp are plentiful and limitless. Thousands of species have adapted to a wide range of environments. On most coasts and estuaries, as well as in streams and lakes, they can be found bolstering close to the seafloor. A few species flip off the seafloor and plunge into the silt to avoid predators. They usually live between the ages of one and seven. Shrimp are frequently singular, even though they can form huge schools amid the spawning season.

Report Coverage

This research report categorizes the market for the United States shrimp market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States shrimp market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States shrimp market.

United States Shrimp Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | 945,190 Tons |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 2.93% |

| 2032 Value Projection: | 1,261,100 Tons |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Environment, By Domestic Production and Imports , By Species, By Distribution Channel |

| Companies covered:: | Admiralty Island Fisheries, Inc., Beaver Street Fisheries, Dulcich Inc., Gulf Shrimp Co. LLC, Millennium Ocean Star Corporation, NaturalShrimp Inc., Pacific American Fish Company Inc., Paul Piazza & Son Inc., Sysco Corporation, The American Shrimp Company, and Others, |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Consumers' growing awareness of the health benefits of products is strengthening the market. Because of its high protein content and low levels of calories, fat, and cholesterol, shrimp is recognized as a nutritious seafood choice. This trend of health-consciousness has resulted in a shift in consumer preferences toward healthier food options, such as shrimp. Consumers are becoming more proactive in terms of diet management and the search for healthier protein sources. Shrimp's nutritional profile is in line with these requirements, making it an appealing option for health-conscious people. Shrimp also contains important vitamins and minerals, such as selenium and omega-3 fatty acids, which promote heart health and cognitive function. Consumers are actively incorporating shrimp into their meal plans as they become more educated about its nutritional value. This increased awareness has resulted in increased consumption of shrimp, catalyzing the growth of the shrimp market in the United States.

Restraining Factors

Shrimp farming is detrimental to the ecosystem because it causes salinity, mangrove destruction, pollution, sedimentation, land erosion, extinction of marine species, and loss of biodiversity. In general, shrimp aquaculture requires a diverse, dependable, and cost-effective source of seeds. The output would not be possible without such a source of seeds.

Market Segment

- In 2023, the farmed segment accounted for the largest revenue share over the forecast period.

Based on the environment, the United States shrimp market is segmented into farmed, and wild. Among these, the farmed segment has the largest revenue share over the forecast period. Farmed shrimp, also known as aquaculture shrimp, are shrimp that are raised in controlled environments such as ponds or tanks rather than being caught in the wild. This shrimp production method provides several advantages that contribute to its market dominance. It ensures a consistent and dependable supply all year. Farmed shrimp can be produced continuously, unlike wild-caught shrimp, which is subject to fluctuations in availability due to natural factors and fishing restrictions. This consistent supply meets the growing demand for shrimp while reducing reliance on the unpredictability of wild catches.

- In 2023, the imports segment accounted for the largest revenue share over the forecast period.

Based on domestic production and imports, the United States shrimp market is segmented into domestic production, and imports. Among these, the imports segment has the largest revenue share over the forecast period. The United States heavily relies on imported shrimp to meet consumer demand, making it a critical market segment. Imported shrimp helps to grow the market by ensuring a consistent and diverse supply of shrimp products. Shrimp from a variety of countries, including major producers, enter the US market, offering a diverse selection of species, sizes, and preparations. This variety caters to consumer preferences while also expanding available options, thereby stimulating market growth.

- In 2023, the penaeus vannamei segment accounted for the significant revenue share over the forecast period.

Based on the species, the United States shrimp market is segmented into penaeus vannamei, penaeus monodon, macrobrachium rosenbergii, and others. Among these, the penaeus vannamei segment has a significant revenue share over the forecast period. The dominance of Penaeus vannamei, a farmed shrimp species, in the US market is a significant driver of market growth. Penaeus vannamei, also known as white leg shrimp or Pacific white shrimp, has the largest market share in the shrimp industry for a variety of reasons. It is popular due to its rapid growth rate and adaptability to various farming environments. When compared to other shrimp species, this species reaches market size relatively quickly, allowing for more efficient production and shorter production cycles. The ability to efficiently produce large quantities of penaeus vannamei shrimp meets the increasing product demand.

- In 2023, the convenience stores segment accounted for a significant revenue share over the forecast period.

Based on distribution channels, the United States shrimp market is segmented into hypermarkets and supermarkets, convenience stores, hotels and restaurants, online stores, and others. Among these, the convenience stores segment has a significant revenue share over the forecast period. Convenience stores also contribute to market growth by providing consumers with accessible and convenient options for quick and on-the-go purchases. These stores frequently stock pre-packaged shrimp products, including ready-to-eat options, to cater to time-crunched customers looking for a quick seafood solution. Another driving force in the shrimp market is the inclusion of hotels and restaurants as distribution channels. Shrimp is a popular ingredient in restaurants, and demand from the hospitality industry drives overall market growth. To meet consumer demand for shrimp-based dishes, hotels, restaurants, and catering services rely on the availability of high-quality shrimp.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States shrimp market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Admiralty Island Fisheries, Inc.

- Beaver Street Fisheries

- Dulcich Inc.

- Gulf Shrimp Co. LLC

- Millennium Ocean Star Corporation

- NaturalShrimp Inc.

- Pacific American Fish Company Inc.

- Paul Piazza & Son Inc.

- Sysco Corporation

- The American Shrimp Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In February 2022, The Coastal Companies, a leading fresh produce distributor and value-added processor, was acquired by Sysco. The acquisition will be operated as part of FreshPoint, Sysco's specialty produce business, and will allow FreshPoint to improve its service to the critical Mid-Atlantic region, strategically diversify its portfolio by adding retail and ready-to-eat capabilities, and add state-of-the-art facilities with future growth potential.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States Shrimp market based on the below-mentioned segments:

United States Shrimp Market, By Environment

- Farmed

- Wild

United States Shrimp Market, By Domestic Production and Imports

- Domestic Production

- Imports

United States Shrimp Market, By Species

- Penaeus Vannamei

- Penaeus Monodon

- Macrobrachium Rosenbergii

- Others

United States Shrimp Market, By Distribution Channel

- Hypermarkets and Supermarkets

- Convenience Stores

- Hotels and Restaurants

- Online Stores

- Others

Need help to buy this report?