United States Silage Additives Market Size, Share, and COVID-19 Impact Analysis, By Type (Organic Acids, Enzymes, Inoculants, and Others), By Crop (Alfalfa, Corn, Sorghum, and Others), and United States Silage Additives Market Insights Forecasts to 2033

Industry: HealthcareUnited States Silage Additives Market Insights Forecasts to 2033

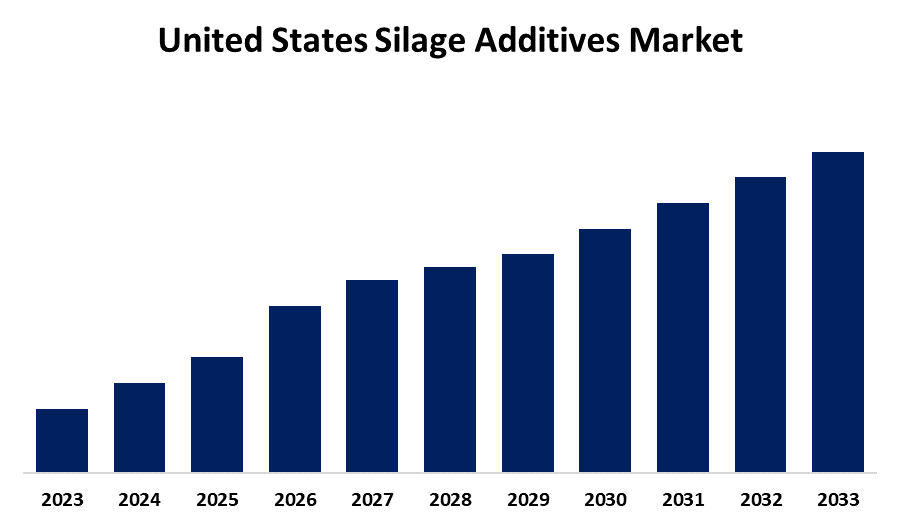

- The Market Size is Growing at a CAGR of 4.8% from 2023 to 2033

- The US Silage Additives Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The US Silage Additives Market Size is Anticipated to Hold a Significant Share by 2033, Growing at a CAGR of 4.8% from 2023 to 2033.

Market Overview

Silage additives in the United States are defined as additives that can be added during fermentation to improve the quality and preservation of silage. Organic acids, enzymes, and bacterial inoculants enhance fermentation efficiency and retention of nutrients. Major driving factors for the market growth include growing demand for high-quality livestock feed, improved additive technology that facilitates fermentation, a growing number of livestock requiring proper feed management, and awareness among farmers about the nutritional benefits of better silage. Government initiatives play a huge role in supporting this market by offering research grants in the area of silage fermentation and the effectiveness of additives. In addition, education programs are developed to enlighten farmers on the advantages and applications of these products while regulatory frameworks enable safety and efficiency in creating a reliable marketplace. Sustainable initiatives further encourage practices that improve feed efficiency and promote environmental stewardship in the agricultural industry. As a whole, such forces will create a good and dynamic market for additives in silage in the United States, which should be relevant to the business of today's livestock world.

Report Coverage

This research report categorizes the market for the United States silage additives market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States silage additives market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each United States silage additives market sub-segment.

United States Silage Additives Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.8% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Crop |

| Companies covered:: | Addcon Group, Lallemand Animal Nutrition, Chr. Hansen, DuPont (Danisco Animal Nutrition), Kemin Industries, AGROBIO, BASF, Elanco Animal Health, ForFarmers, Cargill Animal Nutrition, Inovatech, Pioneer Hi-Bred International (DuPont Pioneer), and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

High demand for quality feedstock in the livestock sector, requiring more effective preservation, is the most significant growth-pushing factor in the U.S. silage additives market. New developments in additive formulation have further increase the efficiency of fermentation, thus making them attractive to producers. Moreover, the stress put on feed management efficiency increases with rising animal numbers. A rising consciousness of the superior nutritional quality of the superior silage also propels farmers toward adopting additives. An emphasis on good health and productivity in cattle and livestock results in the growing use of silage additives as an essential product in agricultural field.

Restraining Factors

The silage additives market faces some restraint factors, as premium products are costly; awareness among some farmers is poor, and regulatory challenges may deter new product development and acceptance.

Market Segment

The U.S. Silage Additives market share is classified into type and crop.

- The inoculants segment is expected to hold the largest market share through the forecast period.

The US Silage Additives market is by type into organic acids, enzymes, inoculants, and others. Among these, the inoculants segment is expected to hold the largest market share through the forecast period. This is attributed to their efficiency in enhancing fermentation processes and nutritional quality of silage while also increasing adoption by farmers seeking to optimize livestock feed.

- The corn segment is expected to hold the largest market share through the forecast period.

The US Silage Additives market is segmented by crop into alfalfa, corn, sorghum, and others. Among these, the corn segment is expected to hold the largest market share through the forecast period. This is attributed to the fact that maize is the leading feed crop in livestock, thus requiring improved solutions for the management of silage, improving fermentation, and nutritional values.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States silage additives market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Addcon Group

- Lallemand Animal Nutrition

- Chr. Hansen

- DuPont (Danisco Animal Nutrition)

- Kemin Industries

- AGROBIO

- BASF

- Elanco Animal Health

- ForFarmers

- Cargill Animal Nutrition

- Inovatech

- Pioneer Hi-Bred International (DuPont Pioneer)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2022, Alltech announced Egalis, a new range of high-quality silage inoculants that maximize nutrient quality retention and reduce dry matter loss.

Market Segment

This study forecasts regional and country revenue from 2022 to 2033. Spherical Insights has segmented the United States Silage Additives market based on the below-mentioned segments:

United States Silage Additives Market, By Type

- Organic Acids

- Enzymes

- Inoculants

- Others

United States Silage Additives Market, By Crop

- Alfalfa

- Corn

- Sorghum

- Others

Need help to buy this report?