United States Single-use Bioprocessing Market Size, Share, and COVID-19 Impact Analysis, By Product (Simple and Peripheral Elements, Apparatus and Plants), By Workflow (Upstream, Fermentation, Downstream), and United States Single-use Bioprocessing Market Insights, Industry Trend, Forecasts to 2033.

Industry: HealthcareUnited States Single-use Bioprocessing Market Insights Forecasts to 2033

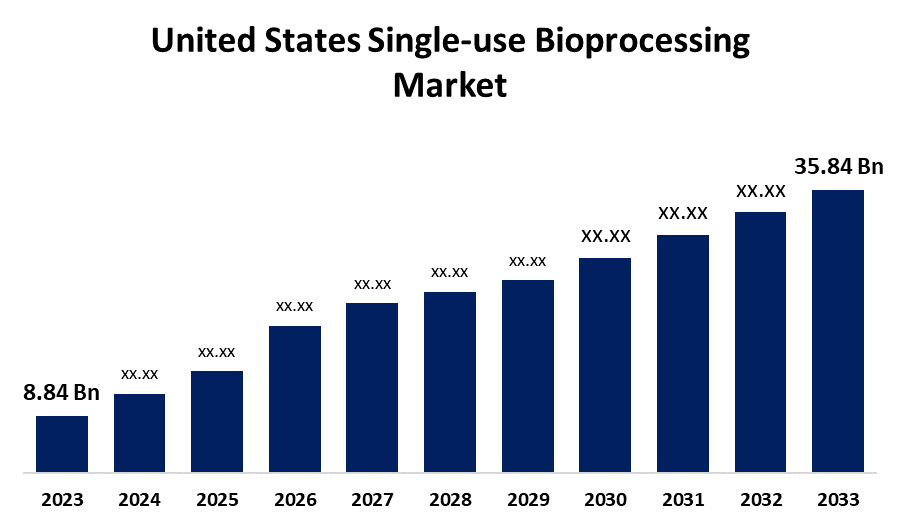

- The U.S. Single-use Bioprocessing Market Size was Valued at USD 8.84 Billion in 2023

- The United States Single-use Bioprocessing Market Size is Growing at a CAGR 15.02% from 2023 to 2033

- The USA Single-use Bioprocessing Market Size is Expected to Reach USD 35.84 Billion By 2033

Get more details on this report -

The USA Single-use Bioprocessing Market Size is Anticipated to exceed USD 35.84 Billion By 2033, Growing at a CAGR of 15.02% from 2023 to 2033. This is due to rising biopharmaceutical production, economic effectiveness, and decreased contamination concerns, the U.S. single-use bioprocessing market is growing.

Market Overview

The United States single-use bioprocessing market targets disposable technology for the production of biopharmaceuticals, such as bioreactors, bags, and filter systems. Such systems minimize risks of contamination, reduce expense, and maximize flexibility. The market growth is promoted by increasing biopharmaceutical demand, improvements in technology, and the movement toward effective, scalable processes for manufacturing. Moreover, the U.S. single-use bioprocessing market is stimulated by growing demand for biopharmaceuticals, growing uptake of personalized medicine, and innovations in disposable bioprocessing technology. Cost-effectiveness, fewer risks of cross-contamination, and shorter production cycles drive uptake. Growing applications of cell and gene therapies and regulatory encouragement for bioprocessing innovation also spur market growth, making single-use systems a prerequisite for contemporary biopharmaceutical production.

Report Coverage

This research report categorizes the market for the US single-use bioprocessing market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. single-use bioprocessing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA single-use bioprocessing market.

United States Single-use Bioprocessing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 8.84 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 15.02% |

| 2033 Value Projection: | USD 35.84 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 96 |

| Segments covered: | By Product, By Workflow |

| Companies covered:: | Lonza, Sartorius AG, Danaher, Thermo Fisher Scientific, Inc., Merck KGaA, Corning Incorporated, Avantor, Inc., Eppendorf SE, Meissner Filtration Products, Inc., PBS Biotech, Inc., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The US single-use bioprocessing market is driven by the fast growth of contract manufacturing organizations (CMOs), which are based on flexible manufacturing. Increased investments in biopharma facilities, higher automation in single-use systems, and improvements in sensor technologies improve process monitoring. Moreover, sustainability efforts encouraging biodegradable materials and energy-efficient production further drive adoption, making single-use systems more critical for next-generation biopharmaceutical manufacturing.

Restraining Factors

High upfront expenses, scalability issues for mass production, plastic waste disposal concerns, supply chain disruptions, and strict regulatory approvals restrict the large-scale implementation of single-use bioprocessing systems in the U.S. market.

Market Segmentation

The United States single-use bioprocessing market share is classified into product and workflow.

- The apparatus & plants segment accounted for the largest share of the US single-use bioprocessing market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of product, the United States single-use bioprocessing market is divided simple & peripheral elements, and apparatus & plants. Among these, the apparatus & plants segment accounted for the largest share of the United States single-use bioprocessing market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This leadership is a result of the widescale application of single-use bioreactors, mixers, and filtration systems in biopharmaceutical production. Their capability of improving process productivity, lowering contamination risk, and facilitating scalable production makes them the largest segment in the industry.

- The upstream segment accounted for a substantial share of the U.S. Single-use Bioprocessing market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of workflow, the U.S. single-use bioprocessing market is divided into upstream, fermentation, and downstream. Among these, the upstream segment accounted for a substantial share of the U.S. Single-use bioprocessing market in 2023 and is anticipated to grow at a rapid pace during the projected period. This is driven by the increased uptake of single-use bioreactors, media bags, and filter systems for media preparation and cell culture. Increased demand for productive, contamination-free production of biopharmaceuticals, especially in monoclonal antibodies and gene therapy, also consolidates the market supremacy of upstream processing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the USA Single-use bioprocessing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lonza

- Sartorius AG

- Danaher

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Corning Incorporated

- Avantor, Inc.

- Eppendorf SE

- Meissner Filtration Products, Inc.

- PBS Biotech, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2024, Freudenberg Medical expanded its biopharma product offering with custom single-use assemblies such as Y-connector manifolds, tubing, and bottle cap assemblies to support critical fluid transfer in the lab and CGMP bioprocesses.

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the US single-use bioprocessing market based on the below-mentioned segments

United States Single-use Bioprocessing Market, By Product

- Simple & Peripheral Elements

- Apparatus & Plants

United States Single-use Bioprocessing Market, By Workflow

- Upstream

- Fermentation

- Downstream

Need help to buy this report?