United States Small Kitchen Appliances Market Size, Share, and COVID-19 Impact Analysis, By Product (Coffee Makers, Air Fryers, Egg Cookers, Toasters, Rice Cookers & Steamers, and Others), By Distribution Channel (Supermarkets & Hypermarkets, Online Stores, Electronic Stores, Exclusive Brand Outlets, and Others), and U.S. Small Kitchen Appliances Market Insights, Industry Trend, Forecasts to 2033.

Industry: Consumer GoodsThe United States Small Kitchen Appliances Market Insights Forecasts to 2033

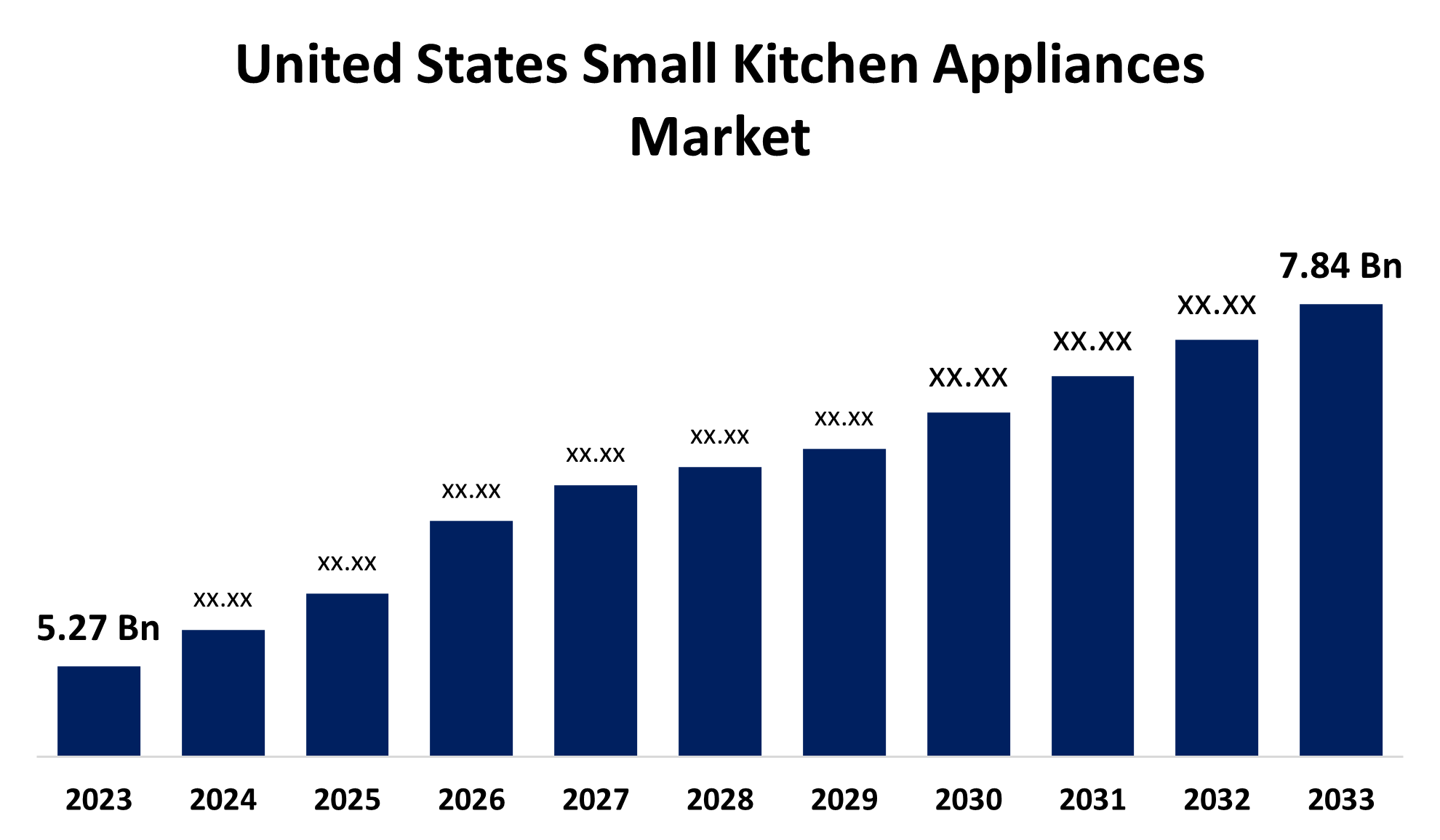

- The United States Small Kitchen Appliances Market Size was estimated at USD 5.27 billion in 2023.

- The United States Market Size is Growing at a CAGR of 4.05% from 2023 to 2033

- The USA Small Kitchen Appliances Market Size is Expected to Reach USD 7.84 billion by 2033

Get more details on this report -

The United States Small Kitchen Appliances Market Size is Expected to Reach USD 7.84 billion By 2033, Growing at a CAGR of 4.05% from 2023 to 2033.

Market Overview

The market for compact, space-efficient kitchen equipment that helps with meal preparation and other kitchen duties is referred to as the small kitchen appliances market in the United States. Products including coffee makers, toasters, air fryers, deep fryers, blenders, juicers, and multipurpose cookers are all part of this market. These appliances are usually small, lightweight, and made to perform particular activities connected to cooking. These devices are utilized on platforms like tabletops and countertops to do specific household tasks. The market is expanding because an increasing interest in home cooking, rising disposable incomes, and the ease of online shopping have all contributed to this upward trend. More and more consumers are looking for multipurpose, inventive equipment that may streamline their culinary procedures and save them time. Additionally, the industry has witnessed an increase in demand for smart and energy-efficient kitchen equipment. To improve user experience, manufacturers are responding by launching goods that use cutting-edge technology like IoT and AI. It is anticipated that these trends will persist, propelling the market's expansion.

Report Coverage

This research report categorizes the market for the U.S. small kitchen appliances market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. small kitchen appliances market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. small kitchen appliances market.

United States Small Kitchen Appliances Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.27 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.05% |

| 2033 Value Projection: | USD 7.84 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Distribution Channel |

| Companies covered:: | Ninja (SharkNinja, LLC), Hamilton Beach, GE Appliances (a Haier Company), Bella Housewares (Gather), Russell Hobbs (Spectrum brands), Kenmore (Transform Holdco LLC), Panasonic Corporation, Cuisinart, SMEG USA, Inc, Tefal S.A.S. (T-fal) and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The market is expanding significantly due to the demand for small, space-efficient appliances that may fit in small kitchen spaces, which is being driven by the rise in single-person homes and the popularity of smaller living spaces. In addition, the market is growing due to time-saving appliances such as slow cookers, quick pots, and multipurpose gadgets that can replace numerous kitchen gadgets, which have become popular in the United States due to customers' busy lifestyles. Additionally, small kitchen appliance sales in the US increased significantly as a result of an increase in e-commerce sites offering attractive prices and offers. Furthermore, the small kitchen appliance industry is expected to continue expanding as more companies introduce innovative products.

Restraining Factors

The USA small kitchen appliances market faces challenges since manufacturers may find it expensive and time-consuming to comply with FDA and CPSC standards for kitchen appliances. In addition, the market is fiercely competitive, with several brands selling comparable goods. Manufacturers' profit margins may be lowered by price wars brought on by fierce rivalry.

Market Segmentation

The US small kitchen appliances market share is classified into the product and the distribution channel.

- The coffee makers segment accounted for the largest share of 20.58% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the product, the U.S. small kitchen appliances market is divided into coffee makers, air fryers, egg cookers, toasters, rice cookers & steamers, and others. Among these, the coffee makers segment accounted for the largest share of 20.58% in 2023 and is expected to grow at a significant CAGR during the forecast period. The rising demand for coffee makers in the United States is a result of people's preference for preparing their favorite drinks at home. In addition, modern coffee makers that incorporate cutting-edge features like smartphone connectivity and programmed settings improve customer convenience and satisfy the rising demand for coffee made at home.

- The electronic stores segment accounted for the highest share of 40.05% in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the application, the US small kitchen appliances market is divided into supermarkets & hypermarkets, online stores, electronic stores, exclusive brand outlets, and others. Among these, the electronic stores segment accounted for the highest share of 40.05% in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is growing due to electronic stores providing a large range of small kitchen appliances, such as air fryers, coffee makers, blenders, and toaster ovens, so that consumers can easily compare brands, features, and costs in one location. Additionally, these stores draw customers searching for cutting-edge or premium kitchen solutions since they carry high-end appliances that might not be easily found through conventional retail channels.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. small kitchen appliances market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ninja (SharkNinja, LLC)

- Hamilton Beach

- GE Appliances (a Haier Company)

- Bella Housewares (Gather)

- Russell Hobbs (Spectrum brands)

- Kenmore (Transform Holdco LLC)

- Panasonic Corporation

- Cuisinart

- SMEG USA, Inc

- Tefal S.A.S. (T-fal)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2024, KitchenAid unveiled its newest product, the automatic grain and rice cooker, which offers a convenient solution for preparing grains and beans. With 21 presets, users can easily prepare a wide range of grains without having to constantly measure or watch. The cooking procedure is streamlined since the device precisely delivers the necessary amount of water based on the grains input.

Market Segment

This study forecasts revenue at USA, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. small kitchen appliances market based on the below-mentioned segments:

United States Small Kitchen Appliances Market, By Product

- Coffee Makers

- Air Fryers

- Egg Cookers

- Toasters

- Rice Cookers & Steamers

- Others

United States Small Kitchen Appliances Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Online Stores

- Electronic Stores

- Exclusive Brand Outlets

- Others

Need help to buy this report?