United States Smart Air Purifier Market Size, Share, and COVID-19 Impact Analysis, By Type (Dust collectors, Fume & smoke collectors, Others), By Technique (High-Efficiency Particulate Air (HEPA), Thermodynamic sterilization (TSS), Ultraviolet germicidal irradiation, Ionizer purifiers, Activated carbon filtration, Others), By End-User (Residential, Commercial, Others), and United States Smart Air Purifier Market Insights Forecasts 2023 – 2033

Industry: Semiconductors & ElectronicsUnited States Smart Air Purifier Market Size Insights Forecasts to 2033

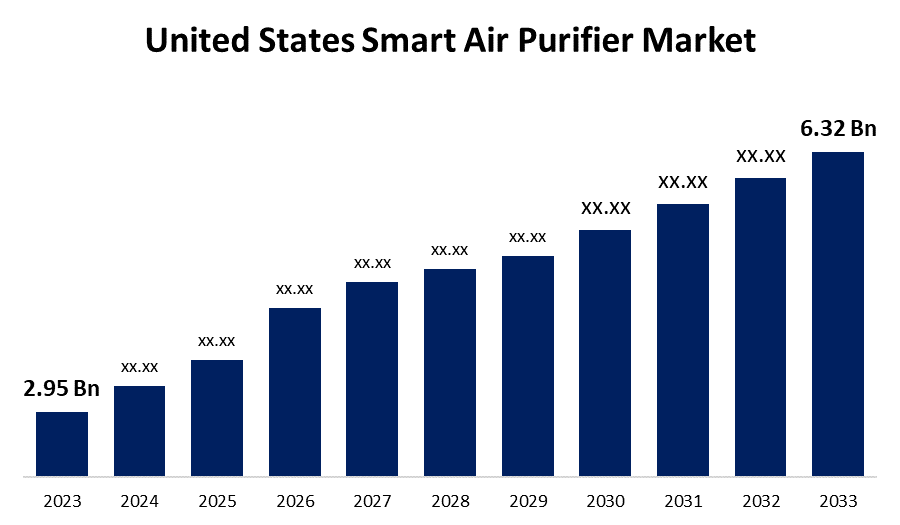

- The United States Smart Air Purifier Market Size was valued at USD 2.95 Billion in 2023.

- The Market Size is Growing at a CAGR of 7.92% from 2023 to 2033.

- The United States Smart Air Purifier Market Size is Expected to Reach USD 6.32 Billion by 2033.

Get more details on this report -

The United States Smart Air Purifier Market Size is Expected to Reach USD 6.32 Billion by 2033, at a CAGR of 7.92% during the forecast period 2023 to 2033.

Market Overview

An air purifier is a device that purifies the air by removing dust particles, dust mites, mold, pet dander, smoke particles, vehicle exhaust, cooking smoke, and gaseous pollutants. Smart air purifiers enable monitoring and control of air quality via a smartphone-enabled app that also generates real-time quality data readings. The smart air purifier also tracks indoor air quality over time, allowing users to see when the air quality is best and worst. The deterioration of air quality as a result of high levels of smoking and pollution is expected to drive the smart air purifier market. Furthermore, rising awareness about smart air purifiers will aid in the growth of the smart air purifiers market over the forecast period. Furthermore, high levels of pollution increase the risk of respiratory diseases, heart disease, asthma, fatigue, eye irritation, and other conditions. To meet rising demand, manufacturers prioritize product innovation and new product launches.

Report Coverage

This research report categorizes the market for the United States smart air purifier market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States smart air purifier market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States smart air purifier market.

United States Smart Air Purifier Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.95 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.92% |

| 2033 Value Projection: | USD 6.32 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Technique, By End- User |

| Companies covered:: | Sharp Corporation, Dyson Limited, Xiaomi Corporation, Honeywell International, Inc., Hamilton Beach Brands, Inc, Koninklijke Philips NV, LG Electronics, Inc.(LG Corp), IQAir North America, Inc, Havells India Ltd., Daikin Industries, Ltd, Coway Co., Ltd., Levoit (Vesync Co., Ltd.), Unilever PLC (Blueair AB), Smart Air Filters Pvt Ltd., Whirlpool Corporation, Winix Inc., and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

These devices incorporate AI and machine learning algorithms, which is a cutting-edge technology in the smart air purifier market. Smart air purifiers may provide personalized air quality management solutions due to the integration of AI and ML. These devices can record user preferences for filter usage, operational modes, and air quality levels and then respond with personalized purification settings. Furthermore, as a result of advancements in AI and machine learning, the development of ecosystems for smart homes, and increased demand in emerging markets, the market for smart air purifiers is rapidly expanding. As people become more aware of the harmful health effects of household air pollution, a massive market for domestic air purifiers for improving indoor air quality and cooling has emerged. The demand for a higher standard of living, as well as a focus on personal health and hygiene, is increasing.

Restraining Factors

Air purifiers have become expensive due to high maintenance costs, frequent filter replacement, and premium installation fees, preventing market growth during the forecast period. Temperature, particulate matter concentration, the presence of gaseous substances, and the quantity of harmful chemicals or biological agents (such as bacteria, viruses, and fungi) are all measured by a common indoor air quality monitoring sensor.

Market Segment

- In 2023, the dust collectors segment accounted for the largest revenue share over the forecast period.

Based on the type, the United States smart air purifier market is segmented into dust collectors, fume & smoke collectors, and others. Among these, the dust collectors segment has the largest revenue share over the forecast period. A dust-collecting intelligent air purifier is used to collect dust and other contaminants from air discharged from commercial and industrial activities. The rising popularity of dust-collecting smart air purifiers can be attributed to their high filtering efficiency and low maintenance costs. Furthermore, market participants in the smart air purifier market provide smart air purifiers that address smoke and fumes. Furthermore, smart air purifiers are used to remove germs and bacteria, as well as unpleasant odors.

- The high-efficiency particulate air (HEPA) segment is witnessing significant CAGR growth over the forecast period.

Based on technique, the United States smart air purifier market is segmented into high-efficiency particulate air (HEPA), thermodynamic sterilization (TSS), ultraviolet germicidal irradiation, ionizer purifiers, activated carbon filtration, and others. Among these, the high-efficiency particulate air (HEPA) segment is witnessing significant CAGR growth over the forecast period. Smart air purifiers with high-efficiency particulate air technology are becoming increasingly popular due to their effectiveness in removing airborne particles and allergens. HEPA filters absorb particles as small as 0.3 microns with high efficiency, making them extremely useful in improving indoor air quality. These purifiers provide users with simplicity and efficiency when combined with innovative features such as real-time air quality monitoring, remote control, and automation, fueling their popularity among health-conscious consumers looking for efficient and intelligent air purifying solutions.

- In 2023, the residential segment accounted for a significant revenue share over the forecast period.

Based on the end-user, the United States smart air purifier market is segmented into residential, commercial, and others. Among these, the residential segment has a significant revenue share over the forecast period. This sector includes the use of smart air purifiers in homes, private residences, and apartments. Air purifiers are essential household gadgets because poor indoor air quality can cause allergies, asthma, eye infections, and throat infections. Because of their ease of use and excellent efficacy in removing viruses, bacteria, pollen, pet dander, and cooking-related smoke, intelligent air purifiers have seen an increase in demand in the domestic market in recent years.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States smart air purifier market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sharp Corporation

- Dyson Limited

- Xiaomi Corporation

- Honeywell International, Inc.

- Hamilton Beach Brands, Inc

- Koninklijke Philips NV

- LG Electronics, Inc.(LG Corp)

- IQAir North America, Inc

- Havells India Ltd.

- Daikin Industries, Ltd

- Coway Co., Ltd.

- Levoit (Vesync Co., Ltd.)

- Unilever PLC (Blueair AB)

- Smart Air Filters Pvt Ltd.

- Whirlpool Corporation

- Winix Inc.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2022, Atem X, a smart, slim, bionic air purifier, was introduced by IQAir, a Swiss air quality technology expert. It is the most recent addition to IQAir's line of high-performance air purifiers.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States Smart Air Purifier Market based on the below-mentioned segments:

United States Smart Air Purifier Market, By Type

- Dust collectors

- Fume & smoke collectors

- Others

United States Smart Air Purifier Market, By Technique

- High-Efficiency Particulate Air (HEPA)

- Thermodynamic sterilization (TSS)

- Ultraviolet germicidal irradiation

- Ionizer purifiers

- Activated carbon filtration

- Others

United States Smart Air Purifier Market, By End-User

- Residential

- Commercial

- Others

Need help to buy this report?