United States Smart Pet Feeder Market Size, Share, and COVID-19 Impact Analysis, By Pet (Dogs and Cats), By Capacity (Up To 3L, 3L To 5L, and More Than 5L), and by United States Smart Pet Feeder Market Insights Forecasts to 2033

Industry: HealthcareUnited States Smart Pet Feeder Market Insights Forecasts to 2033

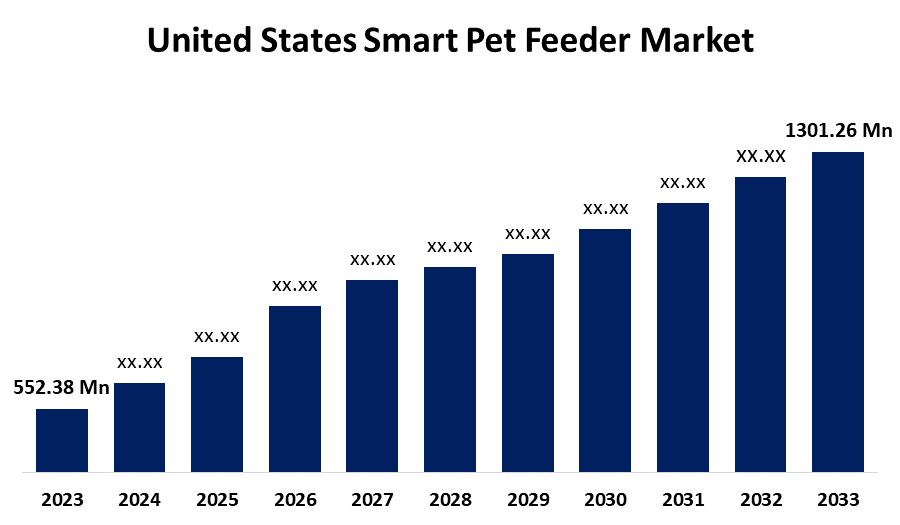

- The United States Smart Pet Feeder Market Size was valued at USD 552.38 Million in 2023.

- The Market is growing at a CAGR of 8.95% from 2023 to 2033

- The United States Smart Pet Feeder Market Size is Expected to Reach USD 1301.26 Million by 2033

Get more details on this report -

The United States Smart Pet Feeder Market is Anticipated to Exceed USD 1301.26 Million by 2033, growing at a CAGR of 8.95% from 2023 to 2033.

Market Overview

The United States smart pet feeder market refers to the industry focused on the development, production, and distribution of automated pet feeding solutions integrated with advanced technologies. Smart pet feeders are designed to dispense food in controlled portions at scheduled intervals, often featuring connectivity options such as Wi-Fi, mobile applications, and artificial intelligence to monitor pet nutrition. These devices cater to pet owners seeking convenience, precise feeding schedules, and remote monitoring capabilities. The market is experiencing significant growth due to increasing pet adoption rates and the rising preference for technology-driven pet care solutions. Several factors are driving the expansion of the United States smart pet feeder market. The increasing number of pet owners, coupled with growing awareness of pet health and nutrition, is fueling demand for automated feeding solutions. Advancements in IoT and AI-driven pet care technologies are enhancing the functionality and appeal of smart pet feeders. Additionally, the rise in disposable income and the trend of pet humanization are further contributing to market growth. Government initiatives promoting pet welfare and regulations ensuring the safety and quality of pet care products are influencing market dynamics. Standards for smart device connectivity and cybersecurity measures for IoT-enabled pet products also play a crucial role in industry development.

Report Coverage

This research report categorizes the market for the United States smart pet feeder market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States smart pet feeder market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each United States smart pet feeder market sub-segment.

United States Smart Pet Feeder Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 552.38 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.95% |

| 2033 Value Projection: | USD 1301.26 Million |

| Historical Data for: | 2021-2022 |

| No. of Pages: | 197 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Pet, By Capacity |

| Companies covered:: | Dogness Group, Dokoo, Faroro, Sure Pet care (Allflex group), Xiaomi, TESLA Solar, s.r.o., Skymee, Aqara (Lumi United Technology), Pet Marvel Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The United States smart pet feeder market is driven by rising pet ownership, increasing consumer awareness of pet health, and the growing demand for convenience-driven pet care solutions. The trend of pet humanization, where pets are treated as family members, has led to higher spending on advanced pet care technologies. Integration of IoT, artificial intelligence, and mobile applications in smart pet feeders enhances real-time monitoring and automated scheduling, further fueling market adoption. Additionally, increasing disposable income, a busy lifestyle requiring automated solutions, and advancements in pet nutrition analytics contribute to market growth. The expansion of the e-commerce sector also supports widespread product availability.

Restraining Factors

The United States smart pet feeder market faces challenges such as high product costs, cybersecurity concerns with IoT-enabled devices, limited consumer awareness in certain demographics, and potential technical malfunctions affecting feeding accuracy and reliability.

Market Segment

The U.S. smart pet feeder market share is classified into pets and product.

- The dogs segment is expected to hold the largest market share through the forecast period.

The US smart pet feeder market is segmented by pets into dogs and cats. Among these, the dogs segment is expected to hold the largest market share through the forecast period. The high adoption rate of dogs as pets, coupled with increased spending on advanced pet care products, is a key factor driving this dominance. Additionally, the larger food consumption requirements of dogs compared to cats make automated feeding solutions particularly beneficial for dog owners.

- The 3l to 5l segment is expected to hold the largest market share through the forecast period.

The US smart pet feeder market is segmented by capacity into up to 3l, 3l to 5l, and more than 5l. Among these, the 3l to 5l segment is expected to hold the largest market share through the forecast period. This capacity range offers an optimal balance between compact design and sufficient food storage, making it suitable for both cats and medium-to-large-sized dogs. The increasing demand for automated feeding solutions that provide extended food storage while maintaining freshness and portion control is driving the dominance of this segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States smart pet feeder market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dogness Group

- Dokoo

- Faroro

- Sure Pet care (Allflex group)

- Xiaomi

- TESLA Solar, s.r.o.

- Skymee

- Aqara (Lumi United Technology)

- Pet Marvel Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2024, Penthouse Paws launched the Automatic Cat Feeder, a programmable device designed to ensure cats receive timely meals, even in the owner's absence. With a 6-liter capacity, food-grade plastic construction, and backup battery mode, it guarantees safety and convenience. Notable features include a 10-second voice message for comfort and a bite-proof cable for safety, making it a must-have for responsible cat owners.

Market Segment

This study forecasts regional and country revenue from 2022 to 2033. Spherical Insights has segmented the United States smart pet feeder market based on the below-mentioned segments:

United States Smart Pet Feeder Market, By Pet

- Dogs

- Cats

United States Smart Pet Feeder Market, By Capacity

- Up To 3L

- 3L To 5L

- More Than 5L

Need help to buy this report?