United States Smart Weapons Market Size, Share, and COVID-19 Impact Analysis, By Product (Missiles, Munitions, Guided Projectiles, Guided Rockets, and Directed Energy Weapons), By Platform (Air, Land, and Naval), and By US Smart Weapons Market Insights, Industry Trend, Forecasts to 2033.

Industry: Aerospace & DefenseUnited States Smart Weapons Market Insights Forecasts to 2033

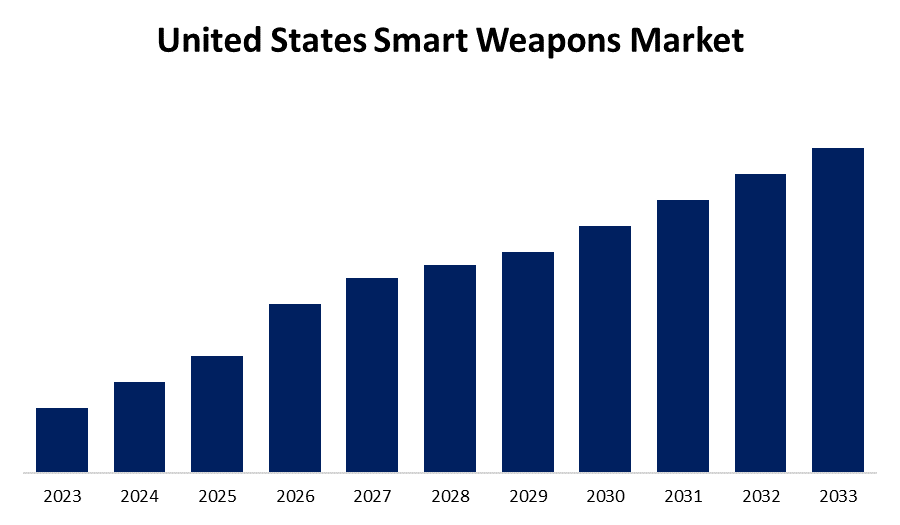

- The Market Sze is Growing at a CAGR of XX% from 2023 to 2033

- The U.S. Smart Weapons Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The US Smart Weapons Market Size is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of XX% from 2023 to 2033.

Market Overview

Munitions are controlled by computers. Advanced weaponry comprises precise guided bombs with high accuracy, intelligent bullets capable of altering their path, and smart land mines that self-deactivate at a predetermined time. Sophisticated technology provides the military with smarter ways to eliminate the enemy, with some strategies aimed at reducing or eliminating collateral damage. The use of intelligent weaponry has altered the way wars are fought and their tactics. Cruise missiles rely on data from the navigation satellite to stay on track and oriented throughout their journey. Smart guns have features that enable them to function solely when triggered by an approved individual, therefore decreasing instances of misuse, theft, and self-injury involving guns. Smart weapons are equipped with security measures such as RFID chips, fingerprint recognition, biometric sensors, mechanical locks, and magnetic kits. In April 2023, Biofire, a company from the United States, revealed their creation of smart guns that incorporate biometric recognition, ensuring only authorized individuals can use them. What makes the Biofire Smart Gun stand out is its unique fingerprint and facial recognition system. The grip now includes a fingerprint sensor, while the rear of the weapon now features a facial recognition sensor. Additionally, the Biofire intelligent firearm will automatically lock when the user releases their grip on the gun.

Report Coverage

This research report categorizes the market for the US smart weapons market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States smart weapons market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. smart weapons market.

United States Smart Weapons Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | XX% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Platform |

| Companies covered:: | BAE, Boeing, General Dynamics Corporation, Lockheed Martin Corporation, MBDA, Northrop Grumman Corporation, Raytheon Company, a Raytheon Technologies company, Rheinmetall AG, Textron Inc., Thales Group, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The rising demand for extremely accurate weapons, driven by escalating geopolitical conflicts and cross-border issues, among other factors, is fueling the expansion of the market. The reason for the increased popularity of these weapons is their affordability, improved accuracy, flexibility, extended range, and short training requirements. Additionally, the increasing amount of rearming and updating initiatives by armed forces is expected to increase the need for these weapons. The expected market growth is anticipated to be driven by factors such as growing defense spending, expanding military ranks, and acquiring advanced weapons for special operations.

Restraining Factors

The manufacturers and service providers of defense systems had to cut back on expansion and research and development investments in order to endure the drop in revenue and operational performance in the defense sector.

Market Segmentation

The US smart weapons market share is classified into product and platform.

- The missiles segment is expected to hold a significant market share through the forecast period.

The United States smart weapons market is by product into missiles, munitions, guided projectiles, guided rockets, and directed energy weapons. Among these, the missiles segment is expected to hold a significant market share through the forecast period. The missile sector is likely to continue its dominance as defense forces' demand for advanced guided missiles rises. In September 2019, BAE Systems agreed to a contract valued at USD 2,680 million with the U.S. and nine other nations to supply a semi-guided missile weapons system until 2025.

- The land segment is expected to dominate the US smart weapons market during the projected period.

Based on the platform, the United States smart weapons market is divided into air, land, and naval. Among these, the land segment is expected to dominate the US smart weapons market during the projected period. The rise in defense expenditure, the fast expansion of armed forces, and the increasing purchase of intelligent weapons will drive growth in the sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States smart weapons market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companie

- BAE

- Boeing

- General Dynamics Corporation

- Lockheed Martin Corporation

- MBDA

- Northrop Grumman Corporation

- Raytheon Company, a Raytheon Technologies company

- Rheinmetall AG

- Textron Inc.

- Thales Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, Raytheon, a business of RTX, received a $345 million contract from the U.S. Air Force to manufacture and provide over 1,500 Storm Breaker smart weapons. Storm Breaker, the top air-to-surface weapon, is able to target moving objects in any weather with its multi-effects warhead and tri-mode seeker while being network-enabled.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Smart Weapons Market based on the below-mentioned segments:

United States Smart Weapons Market, By Product

- Missiles

- Munitions

- Guided Projectiles

- Guided Rockets

- Directed Energy Weapons

United States Smart Weapons Market, By Platform

- Air

- Land

- Naval

Need help to buy this report?