United States Solar Energy Market Size, Share, and COVID-19 Impact Analysis, By Technology (Photovoltaic Systems, Concentrated Solar Power Systems), By End User (Residential, Commercial, Industrial), and United States Solar Energy Market Insights Forecasts to 2033

Industry: Energy & PowerUnited States Solar Energy Market Insights Forecasts to 2033

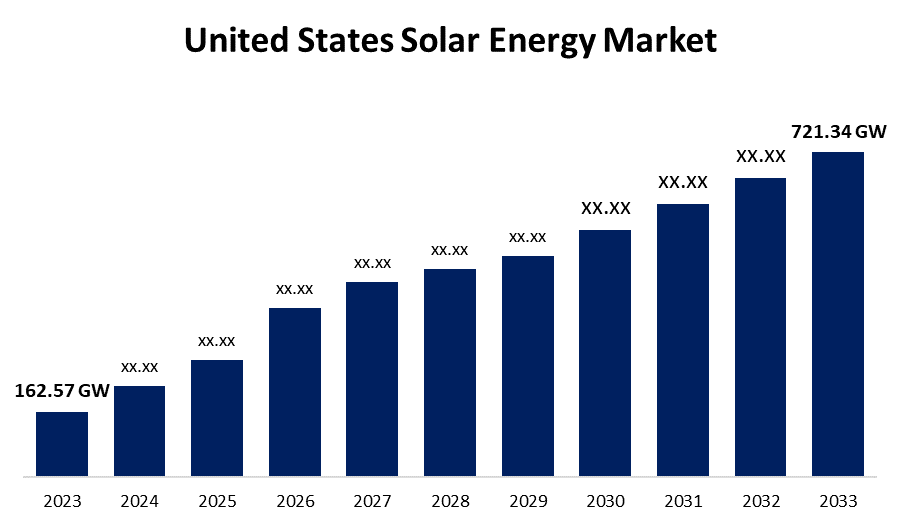

- The United States Solar Energy Market was valued at 162.57 Giga Watt (GW) in 2023.

- The Market is Growing at a CAGR of 16.07% from 2023 to 2033.

- The United States Solar Energy Market is Expected to Reach 721.34 Giga Watt (GW) by 2033.

Get more details on this report -

The United States Solar Energy Market Size is Expected to Reach 721.34 Giga Watt (GW) by 2033, at a CAGR of 16.07% during the forecast period 2023 to 2033.

Market Overview

Power from solar radiation, which can be captured and converted into a number of energy sources, such as heat and electricity, is referred to as "solar energy". It provides a desirable alternative to conventional fossil fuels, which are limited and contribute to climate change due to their abundance and renewable nature. Solar energy can be captured using a variety of technologies. For instance, photovoltaic cells use solar radiation's heat to generate electricity, while concentrated solar power systems use the same radiation to generate hot water for multiple uses or directly convert sunlight into electricity. Solar energy has several advantages, including lowering greenhouse gas emissions and reducing reliance on fossil fuels, as well as promoting a cleaner and more sustainable energy future. Furthermore, the increase in energy demand brought on by a population boom is the main factor propelling the growth in the United States solar energy market. A surge in demand for sustainable energy resources has been observed around the world, accompanied by favorable government regulations that have boosted market growth. Consequently, this increases consumer demand for sustainable energy sources like solar power. Furthermore, the market for solar energy is anticipated to grow due to the decrease in carbon emissions and the increased demand for inexpensive energy production.

Report Coverage

This research report categorizes the market for United States solar energy market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States solar energy market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States solar energy market.

United States Solar Energy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | 162.57 Giga Watt |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 16.07% |

| 2033 Value Projection: | 721.34 Giga Watt |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By End User, and COVID-19 Impact Analysis. |

| Companies covered:: | Hanwha Corporation, Canadian Solar Inc., Jinko Solar Holding Co. Ltd, SOLV Energy, 8minute Solar Energy, CubicPV, Arcadis, First Solar Inc., NextEra Energy Inc., SunPower Corporation, Renewable Energy Systems Ltd, Rosendin Electric Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Growing environmental concerns brought on by the release of harmful greenhouse gases that cause air pollution, there will likely be a greater demand for solar energy, which is a clean and sustainable energy source. For instance, converting from fossil fuels to solar power could result in a large reduction in carbon dioxide emissions, which raise global temperatures and fuel climate change. Furthermore, United States governments have implemented policies and financial incentives to encourage the installation of solar energy systems. These policies consist of grants, tax credits, feed-in tariffs, and net metering initiatives. These regulations promote the uptake of solar photovoltaic systems by lowering initial costs, enhancing investment returns, and streamlining grid integration. Thus, such factors are boosting the market growth in the forecast period.

Restraining Factors

Although the cost of solar panels has decreased over time, United States governments, businesses, and individuals may still find it difficult to afford the initial costs of solar systems. Thus, it is anticipated that the high initial cost of solar energy installation will hamper the growth of the solar energy sector.

Market Segment

- In 2023, the photovoltaic systems segment accounted for the largest revenue share over the forecast period.

Based on the technology, the United States solar energy market is segmented into photovoltaic systems, and concentrated solar power systems. Among these, the photovoltaic systems segment has the largest revenue share over the forecast period. PV systems are frequently used in distributed generation to enable individual residences and businesses to generate power. As a result, there is less dependency on centralized power plants and increased energy resilience. In order to provide clean energy and reduce power costs, these systems are commonly installed on the rooftops of commercial and residential buildings. Customers gain financially from the ability to feed excess power into the grid as a result of net metering.

- In 2023, the commercial segment is expected to hold the largest share of the United States solar energy market during the forecast period.

Based on the end user, the United States solar energy market is classified into residential, commercial, and industrial. Among these, the commercial segment is expected to hold the largest share of the United States solar energy market during the forecast period. The demand for a wide range of commercial goods has increased as a result of global industrialization and population growth. The rise in output led to an increase in the demand for power, which in turn led to a boom in the use of solar concentrators in the electrical production industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States solar energy market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hanwha Corporation

- Canadian Solar Inc.

- Jinko Solar Holding Co. Ltd

- SOLV Energy

- 8minute Solar Energy

- CubicPV

- Arcadis

- First Solar Inc.

- NextEra Energy Inc.

- SunPower Corporation

- Renewable Energy Systems Ltd

- Rosendin Electric Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- On August 2023, Arcadis, a global design and consultancy firm for natural and built assets, announced that it will provide full architectural and engineering design services to solar manufacturing innovator CubicPV ("Cubic") for its 10-gigatonne (GW) silicon wafer manufacturing facility in the United States.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States solar energy market based on the below-mentioned segments:

United States Solar Energy Market, By Technology

- Photovoltaic Systems

- Concentrated Solar Power Systems

United States Solar Energy Market, By End User

- Residential

- Commercial

- Industrial

Need help to buy this report?