United States Solar Films Market Size, Share, and COVID-19 Impact Analysis, By Type (Frontsheet, Backsheet, and Encapsulation), By Polymer Type (Fluoropolymer and Non-Fluoropolymer), By Thickness (Less Than 100 mm, 100mm To 500 mm, and More Than 500 mm), By Film Type (Clear (Non-Reflective), Dyed (Non-Reflective), Vacuum Coated (Reflective), High-Performance Films, and Others)), By Application (Construction, Automotive, Marine, and Others), By End-Use (Utility, Residential, Commercial, Industrial, and Military), and United States Solar Films Market Insights, Industry Trend, Forecasts to 2033

Industry: Energy & PowerUnited States Solar Films Market Size Insights Forecasts to 2033

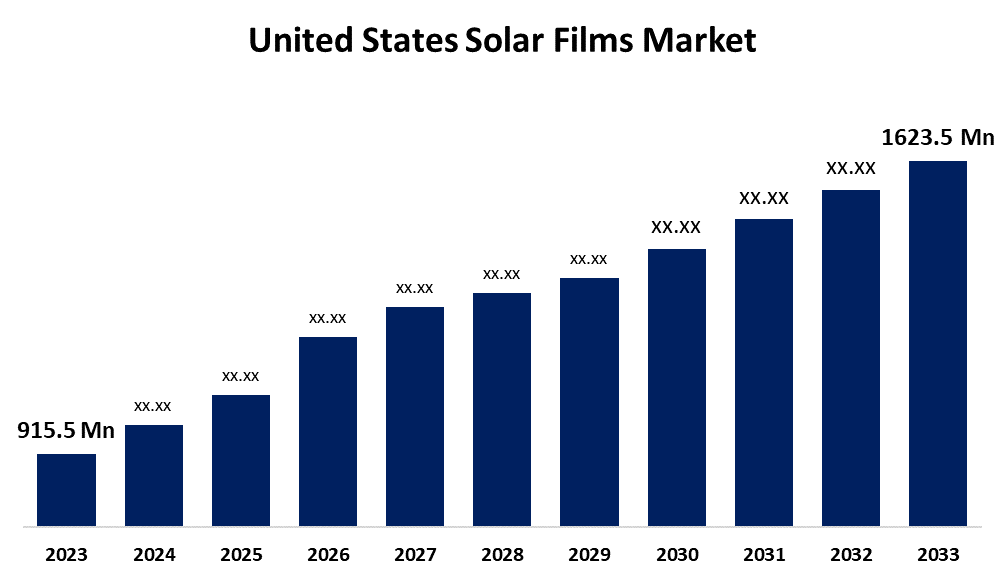

- The U.S. Solar Films Market Size was valued at USD 915.5 Million in 2023.

- The Market Size is Growing at a CAGR of 5.90% from 2023 to 2033

- The U.S. Solar Films Market Size is expected to reach USD 1623.5 Million by 2033

Get more details on this report -

The United States Solar Films Market is anticipated to exceed USD 1623.5 Million by 2033, growing at a CAGR of 5.90% from 2023 to 2033. The growing adoption of solar films in various sectors, awareness of renewable energy, favorable government initiatives & policies, technological advancements, and increased environmental concerns are driving the growth of the solar films market in the US.

Market Overview

Solar films are a type of thin laminate plastic that is used on windows both inside and outside of homes and businesses to cut down heat loss through glass, glare, and sun damage. These films reduce heat gain, block UV rays, and restrict the amount of visible light and glare that enters the area or car. The installation of solar window films lessens the need for air conditioning, which contributes both directly and indirectly to the ozone hole. Furthermore, solar control window coatings can assist reduce the amount of UV light that causes carpets, drapes, furniture, and car dashboards and seats to lose their color. Automobile solar control window films are becoming more and more popular in high-end automobiles to enhance the aesthetics and security of the vehicles. Increased public knowledge of the impact material choices can have on one's environment and health will probably lead to broader adoption and new market opportunities.

Report Coverage

This research report categorizes the market for the US solar films market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States solar films market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US solar films market.

United States Solar Films Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 915.5 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.90% |

| 2033 Value Projection: | USD 1623.5 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 165 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Polymer Type, By Thickness, By Film Type, By Application, By End-Use and COVID-19 Impact Analysis. |

| Companies covered:: | 3M, Johnson Window Films Inc., Mitsubishi Polyester Films, Honeywell International Inc., Jolywood, Dupont, Garware Suncontrol Film, DUNMORE, Polytronix Inc, Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The growing adoption of solar films in various sectors such as building, construction, and automobile industries is driving the market demand. Further, the awareness of renewable energy in the US leads to rising consumer inclination towards renewable electricity infrastructure is expected to drive the market demand. Further, favorable government initiatives & policies for promoting solar films are responsible for significant contribution to market growth. In addition, technological advancements as well as increased environmental concerns are propelling the US solar films market.

Restraining Factors

The availability of alternative solutions over solar films such as smart glasses due to its various advantageous effects is restraining the US solar films market.

Market Segmentation

The United States Solar Films Market share is classified into type, polymer type, thickness, film type, application, and end-use.

- The encapsulation segment dominates the market with the largest market share during the forecast period.

The United States solar films market is segmented by type into frontsheet, backsheet, and encapsulation. Among these, the encapsulation segment dominates the market with the largest market share during the forecast period. Encapsulation films are essential for shielding fragile solar cells from physical harm, dust, and moisture. The long-term durability and dependability of solar systems are ensured by their capacity to seal and secure the solar modules. The rising awareness about the significance of solar panel longevity and efficiency is responsible for driving the market demand.

- The fluoropolymer accounted for the largest revenue share of the United States solar films market in 2023.

The United States solar films market is segmented by polymer type into fluoropolymer and non-fluoropolymer. Among these, the fluoropolymer accounted for the largest revenue share of the United States solar films market in 2023. Solar cells can efficiently catch light because of fluoropolymers' high transparency and superior light transmission qualities. This characteristic increases the total efficiency of solar panels which is the major reason for increased preference for fluoropolymer-based solar films.

- The less than 100 mm segment held the largest market share during the forecast period.

The United States solar films market is segmented by thickness into less than 100 mm, 100mm to 500 mm, and more than 500 mm. Among these, the less than 100 mm segment held the largest market share during the forecast period. Less than 100 mm thick solar films constitute an important market niche that is easily integrated into both conventional and innovative applications due to their versatility, ease of use, and flexibility. The rising demand for environmentally and energy-conscious technological solutions enables innovation and sustainability in a variety of US sectors driving the market for solar films in the less than 100 mm segment.

- The clear (non-reflective) segment dominated the US solar films market with the largest market share in 2023.

Based on the film type, the U.S. solar films market is divided into clear (non-reflective), dyed (non-reflective), vacuum coated (reflective), high-performance films, and others. Among these, the clear (non-reflective) segment dominated the US solar films market with the largest market share in 2023. Clear (non-reflective) films can be used in a variety of applications, including different architectural structures, residential buildings, commercial buildings, public infrastructure, and automobiles, providing a transparent, unobtrusive, and aesthetically pleasing way to harness solar energy. The increasing demand in the nation for sustainable energy solutions that blend in seamlessly with building architecture and optimize natural light transmission is fueling the market expansion.

- The construction segment accounted for the largest market share during the forecast period.

Based on the application, the U.S. solar films market is divided into construction, automotive, marine, and others. Among these, the construction segment accounted for the largest market share during the forecast period. The use of solar films in construction is a response to the building sector's dedication to energy efficiency, sustainable building methods, and reasonably priced solutions, which has led to their widespread adoption in American building projects. The widespread application of solar films in construction-related contexts to enhance building performance is driving market growth.

- The commercial segment dominates the market with the largest revenue share of the U.S. solar films market in 2023.

Based on the end-use, the U.S. solar films market is divided into utility, residential, commercial, industrial, and military. Among these, the commercial segment dominates the market with the largest revenue share of the U.S. solar films market in 2023. Solar films present an alluring option for companies to cut energy expenses and their carbon imprint at the same time. The large surface areas in commercial buildings effectively cover solar films, enabling on-site electricity generation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. solar films market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M

- Johnson Window Films Inc.

- Mitsubishi Polyester Films

- Honeywell International Inc.

- Jolywood

- Dupont

- Garware Suncontrol Film

- DUNMORE

- Polytronix Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2023, DuPont announced it would introduce its latest Tedlar frontsheet materials at the 2023 SNEC International Photovoltaic Power Generation and Smart Energy Exhibition.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Solar Films Market based on the below-mentioned segments:

US Solar Films Market, By Type

- Frontsheet

- Backsheet

- Encapsulation

US Solar Films Market, By Polymer Type

- Fluoropolymer

- Non-Fluoropolymer

US Solar Films Market, By Thickness

- Less Than 100 mm

- 100mm To 500 mm

- More Than 500 mm

US Solar Films Market, By Film Type

- Clear (Non-Reflective)

- Dyed (Non-Reflective)

- Vacuum Coated (Reflective)

- High-Performance Films

- Others

US Solar Films Market, By Application

- Construction

- Automotive

- Marine

- Others

US Solar Films Market, By End-Use

- Utility

- Residential

- Commercial

- Industrial

- Military

Need help to buy this report?