United States Solar Microinverter Market Size, Share, and COVID-19 Impact Analysis, By Application (Residential, Commercial, and Industrial), By Power Rating (Below 300 Watts, 300 Watts, and Above 1 kW), and the United States Solar Microinverter Market Insights Forecasts 2023 - 2033.

Industry: Electronics, ICT & MediaThe United States Solar Microinverter Market Insights Forecasts to 2033

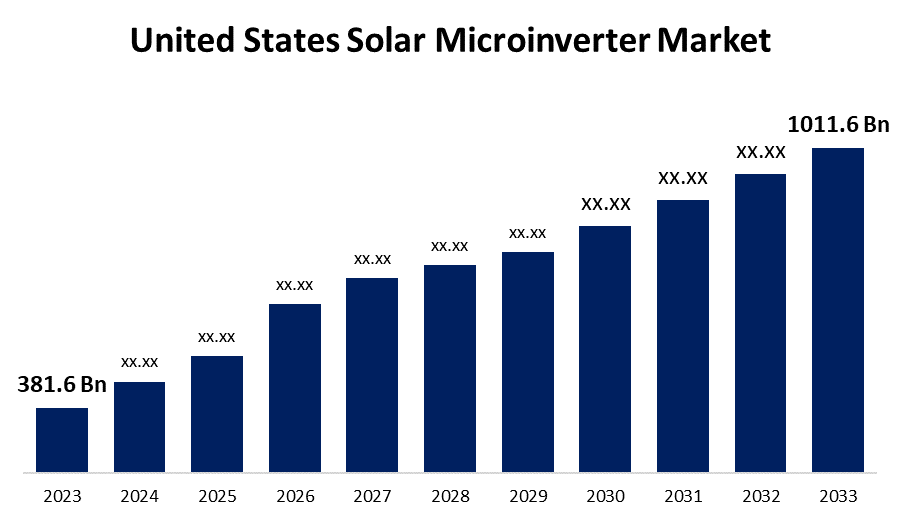

- The United States Solar Microinverter Market Size was valued at USD 381.6 Million in 2023

- The Market Size is Growing at a CAGR of 10.24% from 2023 to 2033.

- The United States Solar Microinverter Market Size is Expected to Reach USD 1011.6 Million by 2033.

Get more details on this report -

The United States Solar Microinverter Market size is expected to reach USD 1011.6 Million by 2033, at a CAGR of 10.24% during the forecast period 2023 to 2033.

Market Overview

A solar microinverter refers to electronic devices that convert the waveform of the current produced by photovoltaic (PV) cells. It works in a parallel circuit because it is used to change direct current (DC) to alternating current (AC). Solar microinverters can maintain a uniform flow of energy despite panel shading and have advantages such as enormous design flexibility and the ability to extract maximum energy from solar panels using maximum point tracking (MPPT) technology. Rapid growth in renewable energy investment is a major factor driving the growth of the United States solar microinverter market. Furthermore, ongoing advancements in the research and development of solar micro inverters are expected to bode well for the growth of the United States solar micro inverters market over the forecast period. In addition, rising demand from residential and consumer markets is expected to positively impact the growth of the United States solar microinverter market in the coming years. Moreover, there has been an increase in the development of solar power projects in the region. Along with this, the increasing popularity of crystalline silicon PV modules has increased the demand for solar microinverters across the country.

Report Coverage

This research report categorizes the market for the United States solar microinverter market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States solar microinverter market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States solar microinverter market.

United States Solar Microinverter Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 381.6 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 10.24% |

| 2033 Value Projection: | USD 1011.6 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Application, By Power Rating |

| Companies covered:: | Enphase Energy, APsystems, Alternate Power System, Inc., Growatt New Energy, SunPower Corporations, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The United States solar microinverter market is primarily driven by regulatory frameworks and policies to develop solar infrastructure and rapid adoption of advanced technologies. Additionally, the increase in demand for safe and sustainable energy sources, along with several improvements in battery storage technology, are also impacting the growth of the market. Growing concerns about climate change and the need for clean energy sources have increased the demand for solar energy systems, including solar microinverters. The federal and state governments in the United States have introduced various incentives and policies to encourage the adoption of solar energy, making it more affordable and attractive to consumers.

Restraining Factors

Interoperability refers to the ability of different systems and devices to successfully interact and cooperate. In terms of microinverters interoperability with other parts such as energy management platforms or smart home systems is essential. Limited availability or compatibility issues with assistive technologies linked to data communication protocols such as Modbus, Zigbee, or Wi-Fi standards can hinder seamless integration and data transmission. Lack of robust interoperability will reduce the overall value of microinverters, making it difficult for end users to monitor, manage, and optimize their solar power systems.

Market Segment

- In 2023, the residential segment accounted for the largest revenue share over the forecast period.

Based on application, the United States solar microinverter market is segmented into residential, commercial, and industrial. Among these, the residential segment accounted for the largest revenue share over the forecast period. This is attributed to the growing implementation of solar energy systems in homes. Solar micro inverters are preferred for residential installations due to their higher efficiency and better performance in shaded conditions.

- In 2023, the below 300 Watts segment accounted for the largest revenue share over the forecast period.

Based on power rating, the United States solar microinverter market is segmented into below 300 watts, 300 watts, and above 1 kW. Among these, the below 300 Watts segment accounted for the largest revenue share over the forecast period. This is attributed to the solar microinverters with power ratings below 300 Watts are commonly used for residential applications, where individual panels have lower power outputs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States solar microinverter market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Enphase Energy

- APsystems

- Alternate Power System, Inc.

- Growatt New Energy

- SunPower Corporations

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2023, Enphase Energy, Inc., a global energy technology company and the world's leading supplier of microinverter-based solar and battery systems, announced the launch of the new IQ8 commercial microinverter featuring the IQ8P-3P microinverter for the small commercial solar market. The IQ8P-3P Microinverter enables peak output power up to 480 W, supporting small three-phase commercial applications and new, high-power solar panels.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States Solar Microinverter Market based on the below-mentioned segments:

United States Solar Microinverter Market, By Application

- Residential

- Commercial

- Industrial

United States Solar Microinverter Market, By Power Rating

- Below 300 Watts

- 300 Watts

- Above 1 kW

Need help to buy this report?