United States Solo Travel Market Size, Share, and COVID-19 Impact Analysis, By Travel Type (Adventure & Extreme Travel, Leisure & Vacation Travel, Business Travel, Safari & Wildlife Travel, Eco Travel, and Others), By Traveler Type (International and Domestic), By Booking Mode (Online Travel Agents and Agencies (OTAs), Marketplace Booking, and Direct Booking), and U.S. Solo Travel Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsUnited States Solo Travel Market Insights Forecasts to 2033

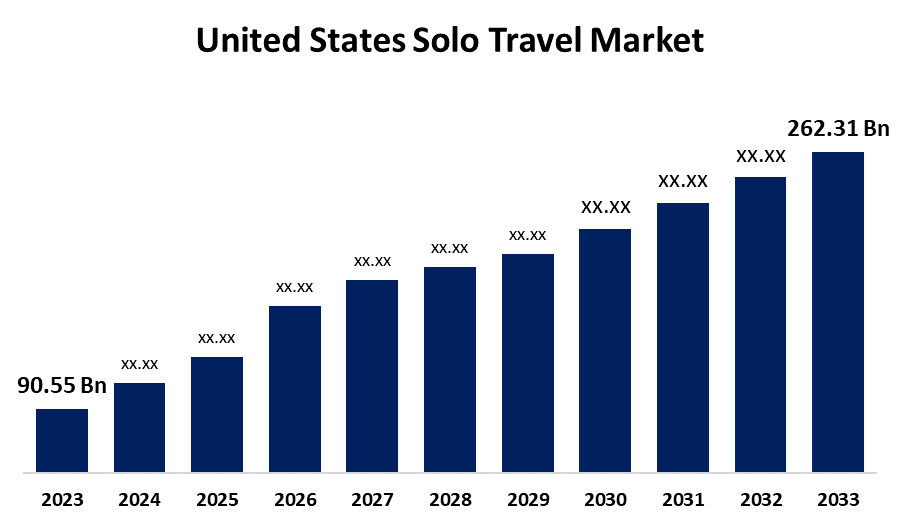

- The United States Solo Travel Market Size Was Estimated at USD 90.55 Billion in 2023.

- The Market Size is Growing at a CAGR of 11.22% from 2023 to 2033

- The USA Solo Travel Market Size is Expected to Reach USD 262.31 Billion By 2033

Get more details on this report -

The United States Solo Travel Market Size Expected to reach USD 262.31 Billion By 2033, Growing at a CAGR of 11.22% from 2023 to 2033.

Market Overview

The market for solo travel in the United States is the area of the travel industry that serves those who choose to travel alone rather than in groups. The industry is growing as a result of societal trends and changing traveler preferences. In addition, personalized and adaptable travel experiences are sought after by people, who embrace the independence and self-determination that solo travel provides. The increasing popularity of remote work has also prompted people to travel to novel places while maintaining their job obligations. Additionally, the U.S. Travel Association is a national non-profit organization that represents every aspect of the American travel industry, which is a major driver of the country's economic prosperity. In addition, increasing travel to and within the United States is the goal to support the economy and future development of our country. Furthermore, technological developments have greatly improved the experience of traveling alone. The proliferation of mobile applications for booking accommodations, managing transportation, and real-time navigation has made many of the difficulties that come with independent travel easier to handle.

Report Coverage

This research report categorizes the market for the U.S. solo travel market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US solo travel market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA solo travel market.

United States Solo Travel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 90.55 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 11.22% |

| 2033 Value Projection: | USD 262.31 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Travel Type, By Traveler Type, By Booking Mode and COVID-19 Impact Analysis |

| Companies covered:: | Intrepid Travel, G Adventures, Austin Adventures, Trafalgar, Booking Holdings Inc., Airbnb Inc., Contiki Holidays Limited, Solos Holidays Ltd., EF Education First Ltd. (EF Go Ahead Tours), WeRoad and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The US solo travel market has grown due to the growing popularity of traveling alone across all age groups, increased disposable income, and the desire for distinctive and customized travel experiences are all factors contributing to this market expansion. Additionally, travel planning has become more flexible due to the increasing use of remote and hybrid work models, which free solo travelers from the limitations of traditional office-based employment. In addition, the rise of social media platforms has been instrumental in promoting solo travel, as bloggers and influencers offer their travelogues and advice, pushing others to begin a solo trip.

Restraining Factors

There are several obstacles facing the US solo travel market, including safety issues, particularly for women, increased prices because there are no shared expenses, and stigma associated with traveling alone. Although solo travel is becoming more and more popular among Millennials and Gen Z, these factors may discourage potential solo travelers, limiting the market's growth.

Market Segmentation

The U.S. solo travel market share is classified into travel type, traveler type, and booking mode.

- The leisure & vacation travel segment accounted for the largest market share of 28.54% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the travel type, the U.S. solo travel market is divided into adventure & extreme travel, leisure & vacation travel, business travel, safari & wildlife travel, eco-travel, and others. Among these, the leisure & vacation travel segment accounted for the largest market share of 28.54% in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is driven by the demand for leisure, cultural discovery, and self-improvement. In addition, leisure travel has become more convenient and appealing because of the numerous U.S. tourism and hospitality businesses that provide customized packages, hotels that are suitable for single travelers, and group tours for independent tourists.

- The domestic segment accounted for the largest market share of 61.55% in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the traveler type, the U.S. solo travel market is categorized into international and domestic. Among these, the domestic segment accounted for the largest market share of 61.55% in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is growing due to many people traveling alone inside their nations to experience different activities, cultures, and landscapes at their speeds. In addition, solo travel offers a more customized and adaptable itinerary than group travel, enabling visitors to explore locations according to their interests and timetables.

- The online travel agents and agencies (OTAs) segment accounted for the highest market share of 50.19% in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the booking mode, the U.S. solo travel market is classified into online travel agents and agencies (OTAs), marketplace booking, and direct booking. Among these, the online travel agents and agencies (OTAs) segment accounted for the highest market share of 50.19% in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is growing because of its ease of use, extensive selection, and excellent online interface. Additionally, OTAs are becoming more and more popular among solo travelers as a result of improvements in digital technology that have made them easier to use and more accessible.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. solo travel market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Intrepid Travel

- G Adventures

- Austin Adventures

- Trafalgar

- Booking Holdings Inc.

- Airbnb Inc.

- Contiki Holidays Limited

- Solos Holidays Ltd.

- EF Education First Ltd. (EF Go Ahead Tours)

- WeRoad

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2023, JetBlue Travel Products launched a retail offering on Paisly.com in partnership with baggage firms Briggs & Riley and Solo. The goal of this collaboration was to give consumers travel bags while they accrued TrueBlue points.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. solo travel market based on the below-mentioned segments:

U.S. Solo Travel Market, By Travel Type

- Adventure & Extreme Travel

- Leisure & Vacation Travel

- Business Travel

- Safari & Wildlife Travel

- Eco Travel

- Others

U.S. Solo Travel Market, By Traveler Type

- International

- Domestic

U.S. Solo Travel Market, By Booking Mode

- Online Travel Agents and Agencies (OTAs

- Marketplace Booking

- Direct Booking

Need help to buy this report?