United States Specialty Injectable Generics Market Size, Share, and COVID-19 Impact Analysis, By Type (Drugs, Biologics), By Application (Oncology, Cardiovascular, CNS, Infectious Diseases, Autoimmune Disorders, Others), By Distribution Channel (Hospitals, Retail Pharmacy, Others), and United States Specialty Injectable Generics Market Insights Forecasts to 2033

Industry: HealthcareUnited States Specialty Injectable Generics Market Insights Forecasts to 2033

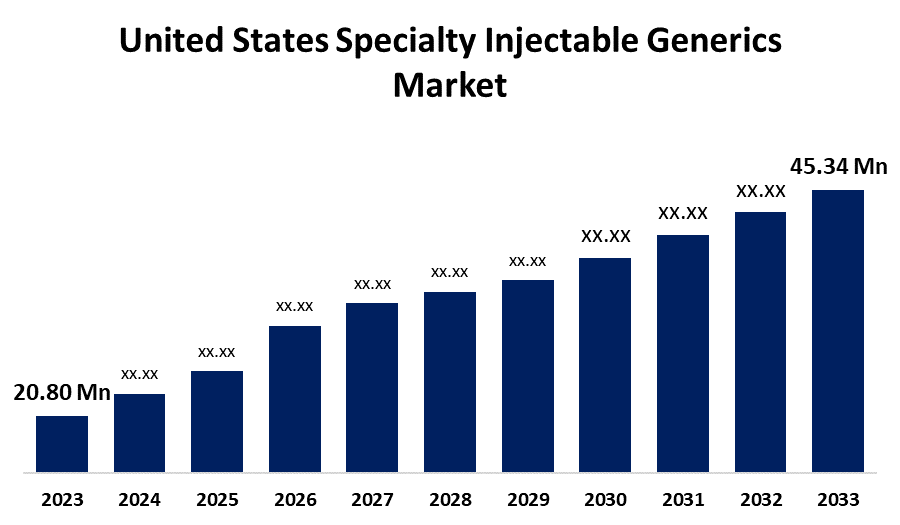

- The United States Specialty Injectable Generics Market Size was valued at USD 20.80 Million in 2023

- The Market Size is Growing at a CAGR of 8.1% from 2023 to 2033

- The United States Specialty Injectable Generics Market Size is Expected to Reach USD 45.34 Million by 2033

Get more details on this report -

The United States Specialty Injectable Generics Market Size is expected to reach USD 45.34 Million by 2033, at a CAGR of 8.1% during the forecast period of 2023–2033.

Market Overview

Injectable drugs are drugs that are administered to a patient's body through a needle and a syringe. Injectable drugs are given and preferred to use because they are directly introduced into the bloodstream and take effect immediately and effectively, as opposed to oral medications. Not only does the United States have well-developed healthcare facilities, but it also has favorable government regulations and legislation that allow patients to easily access injectable treatments. Spending on specialty medications has increased as generics become more widely available on the market. Specialty injectable generics include a diverse range of medications, including biosimilars and complex generics. These medications are used to treat complex and chronic conditions like cancer, autoimmune disorders, rare diseases, and others that necessitate specialized care. The market's primary focus is on providing cost-effective alternatives to branded biologics and specialty drugs, thereby increasing patient and healthcare system access to these treatments.

Report Coverage

This research report categorizes the market for the United States Specialty Injectable Generics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States Specialty Injectable Generics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States specialty injectable generics market.

United States Specialty Injectable Generics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 20.80 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.1% |

| 2033 Value Projection: | USD 45.34 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Distribution |

| Companies covered:: | Pfizer, Inc., Teva Pharmaceutical Industries Ltd., Baxter International, Novartis AG, Fresenius SE & Co. KgaA, Par Pharmaceutical, Hikma Pharmaceuticals PLC, Dr. Reddy's Laboratories, Sagent Pharmaceuticals, Inc., Mylan N.V., and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Specialty injectable generics include a diverse range of medications, including biosimilars and complex generics. These medications are used to treat complex and chronic conditions like cancer, autoimmune disorders, rare diseases, and others that necessitate specialized care. The market is primarily focused on providing cost-effective alternatives to the branded biologic. The rising prevalence of chronic diseases is a major driving force behind the growth of the U.S. specialty injectable generics market. Chronic diseases are long-term, often incurable conditions that necessitate continuous monitoring and treatment. These diseases include cancer, diabetes, autoimmune disorders, cardiovascular disease, and others. In the United States, the number of people diagnosed with chronic diseases has steadily increased. Factors contributing to this demographic shift include an aging population, sedentary lifestyles, poor dietary habits, and environmental factors.

Restraining Factors

The high cost of ordering and storing injectable drugs is a major barrier to market growth. The market for specialty injectable generics can be extremely competitive. Branded biologics frequently like established market dominance, extensive marketing, and physician preferences, making it difficult for generics to grow market. Market access and formulary placement are additional barriers. Payers and pharmacy benefit managers must be convinced of the cost-effectiveness and quality of specialty injectable generics before including them on their formularies.

Market Segment

- In 2023, the biologics segment accounted for the largest revenue share over the forecast period.

Based on the type, the United States specialty injectable generics market is segmented into drugs and biologics. Among these, the biologics segment has the largest revenue share over the forecast period. Biologics are a class of specialty drugs derived from living organisms, such as cells or proteins. They are extremely complex molecules, with intricate structures and functions. The complexity of biologics makes them difficult to replicate as generic drugs. As a result, the development of biosimilars, which are highly similar but not identical to the reference biologic, necessitates extensive research, clinical trials, and oversight by regulators. Biosimilars or generic versions of biologics typically require longer development timelines than traditional small-molecule generics.

- In 2023, the oncology segment accounted for the largest revenue share over the forecast period.

Based on the application, the United States specialty injectable generics market is segmented into oncology, cardiovascular, CNS, infectious diseases, autoimmune disorders, and others. Among these, the oncology segment has the largest revenue share over the forecast period. Oncology treatments are extremely complex and frequently involve a combination of therapies, such as chemotherapy, immunotherapy, and targeted therapies. Many of the oncology medications are specialty injectables, such as monoclonal antibodies and cytotoxic drugs. These drugs require precise formulation and administration, and they are given via injections or infusions.

- In 2023, the hospitals segment accounted for the largest revenue share over the forecast period.

Based on the distribution channel, the United States specialty injectable generics market is segmented into hospitals, retail pharmacy, and others. Among these, the hospitals segment has the largest revenue share over the forecast period. Hospitals have the infrastructure, medical expertise, and resources to efficiently administer and manage specialty injectable medications. This makes them the best option for delivering these drugs. Many specialties injectable generics, particularly biologics and cytotoxic drugs used in oncology, necessitate precise administration, monitoring, and management. These medications frequently require specific infusion protocols, dosing regimens, and potential side effect monitoring. Hospitals have a team of trained healthcare professionals, including oncologists, nurses, and pharmacists, who understand the complexities of these treatments. They can provide the necessary care and assistance to patients receiving specialty injectable generics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States specialty injectable generics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pfizer, Inc.

- Teva Pharmaceutical Industries Ltd.

- Baxter International

- Novartis AG

- Fresenius SE & Co. KgaA

- Par Pharmaceutical

- Hikma Pharmaceuticals PLC

- Dr. Reddy's Laboratories

- Sagent Pharmaceuticals, Inc.

- Mylan N.V.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2023, Teva has announced the launch of a new generic version of Eli Lilly and Company's Trulicity (dulaglutide) for the treatment of type 2 diabetes.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States Specialty Injectable Generics Market based on the below-mentioned segments:

United States Specialty Injectable Generics Market, By Type

- Drugs

- Biologics

United States Specialty Injectable Generics Market, By Application

- Oncology

- Cardiovascular

- CNS

- Infectious Diseases

- Autoimmune Disorders

- Others

United States Specialty Injectable Generics Market, By Distribution Channel

- Hospitals

- Retail Pharmacy

- Others

Need help to buy this report?