United States Spray Adhesive Market Size, Share, and COVID-19 Impact Analysis, By Chemistry (Epoxy, Polyurethane, Synthetic Rubber, Vinyl Acetate Ethylene, Others), By End User (Transportation, Construction, Furniture, Packaging, Textile, Others), and United States Spray Adhesive Market Insights Forecasts to 2033

Industry: Chemicals & MaterialsUnited States Spray Adhesive Market Insights Forecasts to 2033

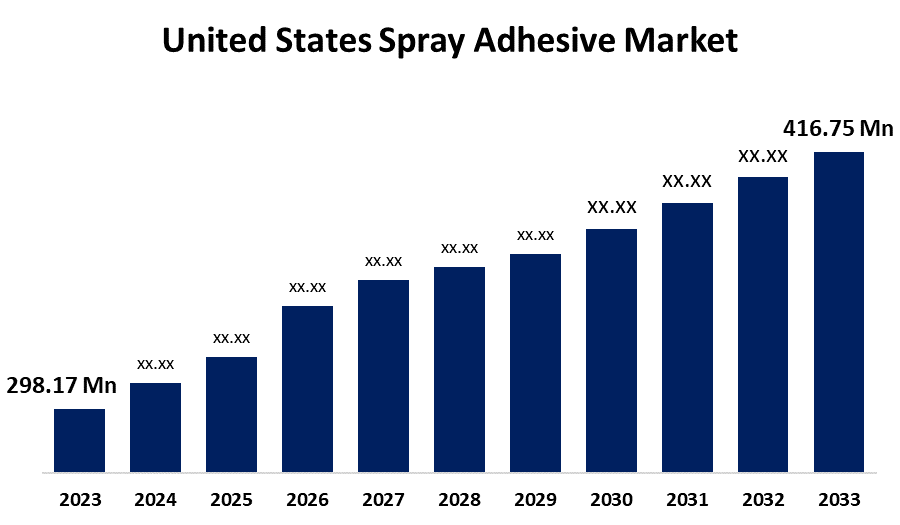

- The United States Spray Adhesive Market Size was valued at USD 298.17 Million in 2023.

- The Market Size is Growing at a CAGR of 3.4% from 2023 to 2033.

- The United States Spray Adhesive Market Size is Expected to Reach USD 416.75 Million by 2033.

Get more details on this report -

The United States Spray Adhesive Market Size is expected to reach USD 416.75 Million by 2033, at a CAGR of 3.4% during the forecast period 2023 to 2033.

Market Overview

Spray adhesives are multi-functional adhesives that are sprayed onto a surface from a pressurized container. They are made from epoxy, polyurethane, synthetic rubber, and vinyl acetate-ethylene and require little time to set and form bonds. Spray adhesives are a type of adhesive that is stored in aerosol cans and primarily used in various industrial applications. They are excellent substitutes for traditional glues or tapes because they are simple to use and dry much faster than regular glue. Once applied, the spray wets the base of the joining surfaces and consistently transfers loads between them, resulting in improved ground holding. Spray adhesives, as opposed to traditional tape, hot, and white glue, provide improved heat and moisture resistance, as well as a wider coverage with less waste, helping to a controlled spray mechanism. As a result, they are widely used in many industries, including transportation, packaging, automobiles, footwear, leather, construction, and furniture.

Report Coverage

This research report categorizes the market for the United States spray adhesive market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States spray adhesive market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States spray adhesive market.

Driving Factors

Spray adhesives play an important and indispensable role in the ever-changing automotive industry, owing to their distinctive and exceptional properties. These adhesives, which are known for their high bonding strength, quick drying times, and ease of application, have become the preferred choice for a variety of automotive manufacturing processes. Spray adhesives have proven to be the most effective solution for bonding lightweight materials, attaching upholstery, and assembling intricate components. As the automotive industry continues to push the boundaries and embrace developments, the demand for efficient and high-performance adhesives grows. Spray adhesives, with their remarkable ability to bond a variety of materials and withstand extreme conditions, are ideal for meeting these changing needs. They have become an essential component of automotive manufacturing, ensuring longevity, dependability, and efficiency in all aspects.

Restraining Factors

Spray adhesives are critical components used in various applications, including bonding different materials, laminating, and joining surfaces. The quality and performance of spray adhesives heavily rely on the raw materials used in their formulation. These materials typically include synthetic resins, solvents, additives, and propellants, which are subject to price volatility, supply-demand imbalances, and geopolitical factors. As raw material costs increase, manufacturers may be compelled to pass on these expenses to end-users in the form of higher product prices. This may result in reduced demand, especially in price-sensitive industries, affecting the United States spray adhesives market growth.

Market Segment

- In 2023, the synthetic rubber segment accounted for the largest revenue share over the forecast period.

Based on the chemistry, the United States spray adhesive market is segmented into epoxy, polyurethane, synthetic rubber, vinyl acetate ethylene, and others. Among these, the synthetic rubber segment has the largest revenue share over the forecast period. When it comes to cost, synthetic rubber outperforms natural rubber by providing a more predictable and stable pricing structure. This advantage translates into better cost control for adhesive manufacturers, making synthetic rubber an extremely appealing option for them. In an industry where cost-effectiveness is critical, synthetic rubber's consistent and predictable cost gives it a clear advantage over natural rubber.

- In 2023, the transportation segment accounted for the largest revenue share over the forecast period.

Based on the end user, the United States spray adhesive market is segmented into transportation, construction, furniture, packaging, textile, and others. Among these, the transportation segment has the largest revenue share over the forecast period. To improve fuel efficiency, the transportation industry is increasingly turning to lightweight materials. This trend has increased demand for spray adhesives, which are commonly used to bond these lightweight materials together. Spray adhesives are ideal for this application because they can form strong bonds with a wide variety of materials.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States spray adhesive market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Henkel Corporation

- The 3M Company

- HB Fuller Adhesives LLC

- Avery Dennison Corporation

- BASF Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2021, Henkel Corporation, a leading provider of adhesive technologies, and FREEDM Systems Engineering Research Center formed an exciting new partnership. This collaboration intends to delve deeply into the field of materials technology and its profound impact on power electronics applications. By conducting extensive research and analysis, the two organizations hope to unlock innovative solutions that will transform the industry.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States spray adhesive market based on the below-mentioned segments:

United States Spray Adhesive Market, By Chemistry

- Epoxy

- Polyurethane

- Synthetic Rubber

- Vinyl Acetate Ethylene

- Others

United States Spray Adhesive Market, By End User

- Transportation

- Construction

- Furniture

- Packaging

- Textile

- Others

Need help to buy this report?