United States Stainless Steel Scrap Market Size, Share, and COVID-19 Impact Analysis, By Type (200 Series, 300 Series, 400 Series, Others), By Application (Automotive, Building & Construction, Metal Products, Mechanical Engineering, Others), and US Stainless Steel Scrap Market Insights Forecasts to 2022 – 2032

Industry: Advanced MaterialsUnited States Stainless Steel Scrap Market Insights Forecasts to 2032

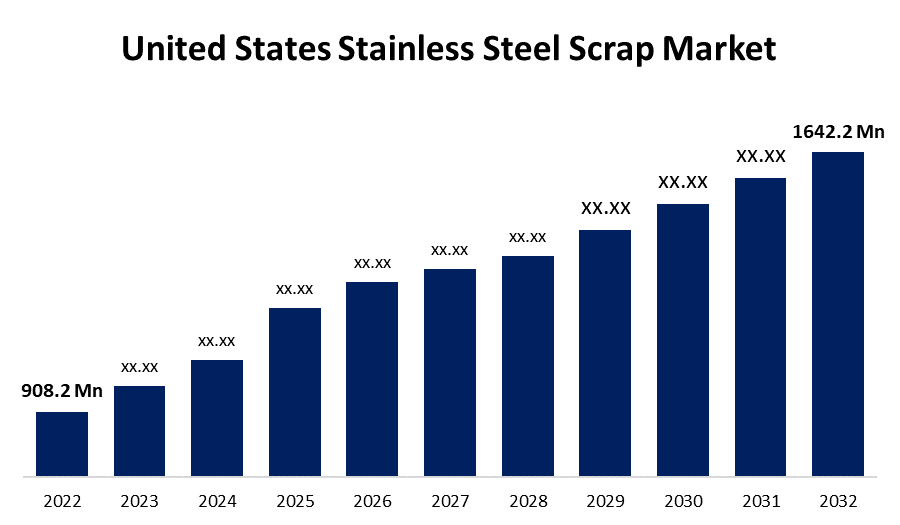

- The United States Stainless Steel Scrap Market Size was valued at USD 908.2 Million in 2022.

- The Market Size is Growing at a CAGR of 6.1% from 2022 to 2032.

- The United States Stainless Steel Scrap Market Size is expected to reach USD 1642.2 Million by 2032.

- The United States is Expected To Grow the fastest during the forecast period.

Get more details on this report -

The United States Stainless Steel Scrap Market Size is expected to reach USD 1642.2 Million by 2032, at a CAGR of 6.1% during the forecast period 2022 to 2032.

Market Overview

Stainless steel scrap is a term that refers to discarded or wasted stainless steel materials that can be recycled to make new stainless steel products. It includes a wide range of products sourced from manufacturing processes, industrial operations, construction projects, and end-of-life consumer goods, such as sheets, coils, pipes, bars, and various structural elements. Nonferrous materials such as nickel or other alloys may also be present in certain types of Stainless Steel Scrap. By directing reusable materials from landfills and lowering the environmental impact of stainless steel production, this scrap plays an important role in the circular economy. Recycling scrap helps to make the metalworking industry more sustainable and efficient by extending the life cycle of stainless steel products. Overall, Stainless Steel Scrap recycling is an important and integral part of a greener, environmentally friendly stainless steel production cycle.

Report Coverage

This research report categorizes the market for the United States Stainless Steel Scrap Market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States Stainless Steel Scrap Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States Stainless Steel Scrap Market.

United States Stainless Steel Scrap Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 908.2 Million |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.1% |

| 2032 Value Projection: | USD 1642.2 Million |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, and COVID-19 Impact Analysis. |

| Companies covered:: | MB Metals, Inc., Kristi Corp, OmniSource LLC, Bob's Metals Inc., Sriji Enterprises Inc., Greenland Inc., Schnitzer Steel Industries Inc., and Other Key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Stainless Steel Scrap market in the United States has the potential for significant growth, fueled by rising steel demand. The apparent consumption of steel, a primary end-use for iron and steel scrap, increased significantly. This increase in consumption was primarily driven by pig iron, raw steel, and steel castings manufacturers, who accounted for the lion's share of scrap utilization in the domestic steel industry. They use scrap in conjunction with pig iron and direct-reduced iron to manufacture a wide range of steel products for industries ranging from appliances to construction, containers, machinery, oil and gas, transportation, and a variety of other consumer sectors. This increase in steel consumption highlights the critical role that Stainless Steel Scrap plays in meeting the robust demands of these industries, providing a strong impetus for the continued growth of the Stainless Steel Scrap market in the United States in the foreseeable future.

Restraining Factors

The availability of substitute products such as aluminum and carbon steel are expected to hinder the growth of the Stainless Steel Scrap market in the United States. Cost-effectiveness and specific material properties may drive industries to seek alternatives, affecting the country's Stainless Steel Scrap market. This necessitates strategic initiatives within the Stainless Steel Scrap industry to highlight its distinct advantages and maintain competitiveness against substitute products. Furthermore, carbon steel is a prominent substitute for stainless steel in the US market, posing a significant impediment to its growth.

Market Segment

- In 2022, the 300 series segment is expected to hold the largest share of the United States Stainless Steel Scrap market during the forecast period.

Based on the type, the United States Stainless Steel Scrap market is classified into 200 series, 300 series, 400 series, and others. Among these, the 300 series segment is expected to hold the largest share of the United States Stainless Steel Scrap market during the forecast period. The 300 series segment generates significant revenue because it primarily consists of Stainless Steel Scrap made of 304 and 316 stainless steels, which are known for their excellent corrosion resistance, versatility, and widespread use in a variety of industries such as automotive, construction, and manufacturing. With its superior qualities, 300 series Stainless Steel Scrap is in high demand, making it a preferred choice for many applications. Its popularity is driven by the need for long-lasting, corrosion-resistant materials in industries where stainless steel is essential, which is driving the US Stainless Steel Scrap market during the forecast period.

- In 2022, the building & construction segment accounted for the largest revenue share over the forecast period.

Based on the end-user, the United States Stainless Steel Scrap market is segmented into automotive, building & construction, metal products, mechanical engineering, and others. Among these, the building & construction segment has the largest revenue share over the forecast period owing to the widespread use of stainless steel in architectural and structural applications. A constant flow of construction projects, including commercial buildings, residential developments, and infrastructure expansion, drives demand for US Stainless Steel Scrap market during the forecast period. In the United States, the Leadership in Energy and Environmental Design (LEED) certification program and Green Building Codes programs promote sustainable building practices. Using recycled materials, such as steel, can help you earn LEED points.

Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States Stainless Steel Scrap Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- MB Metals, Inc.

- Kristi Corp

- OmniSource LLC

- Bob's Metals Inc.

- Sriji Enterprises Inc.

- Greenland Inc.

- Schnitzer Steel Industries Inc.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2023, Sims Metals agreed to buy Baltimore Scrap, a metal recycler in the northeastern United States, for USD 177 million. Subject to regulatory approval, the transaction is expected to close in October. This will assist the company in expanding its operations in the ferrous and nonferrous metals recycling industry in the United States. Sims Metals recycles stainless steel in addition to lead acid batteries, aluminum, brass, bronze, and platinum.

- In December 2021, SA Recycling, a metal recycling company based in Orange, California, has purchased PSC Metals from Icahn Enterprises. SA Recycling now has 125 scrap metal processing facilities from coast to coast, including 23 shredders and three port loading operations in Long Beach, Los Angeles, and Savannah, Georgia.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the United States Stainless Steel Scrap market based on the below-mentioned segments:

United States Stainless Steel Scrap Market, By Type

- 200 Series

- 300 Series

- 400 Series

- Others

United States Stainless Steel Scrap Market, By Application

- Automotive

- Building & Construction

- Metal Products

- Mechanical Engineering

- Others

Need help to buy this report?