United States Steam and Hydrogen Peroxide Biological Indicators Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Self-contained Vials, Spore Strips, and Spore Suspension), By Application (Pharmaceutical & Medical Devices Companies, Healthcare Facilities, and Others), and United States Steam and Hydrogen Peroxide Biological Indicators Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Steam and Hydrogen Peroxide Biological Indicators Market Insights Forecasts to 2033

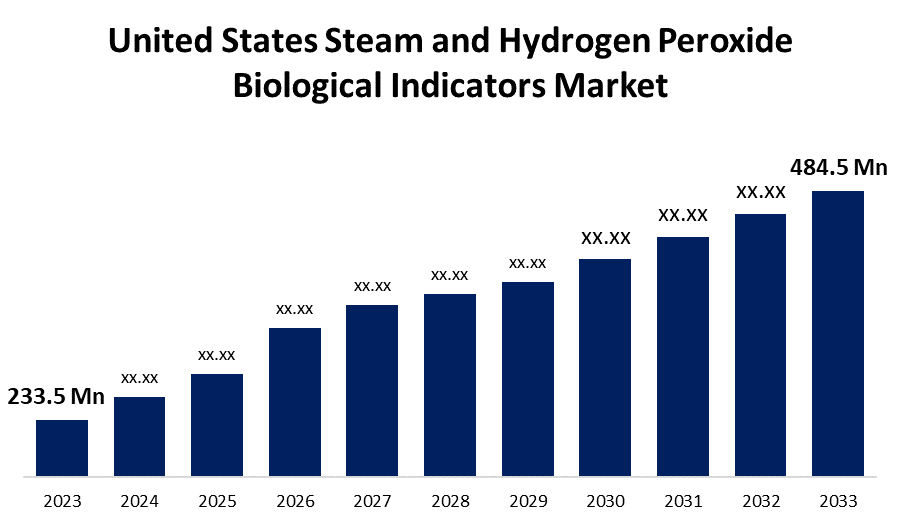

- The U.S. Steam and Hydrogen Peroxide Biological Indicators Market Size was valued at USD 233.5 Million in 2023.

- The Market Size is Growing at a CAGR of 7.57% from 2023 to 2033

- The U.S. Steam and Hydrogen Peroxide Biological Indicators Market Size is Expected to reach USD 484.5 Million by 2033

Get more details on this report -

The United States Steam and Hydrogen Peroxide Biological Indicators Market is anticipated to exceed USD 484.5 Million by 2033, growing at a CAGR of 7.57% from 2023 to 2033. The growing prevalence of surgical-site infection and increasing emphasis on lowering the risk of contamination in pharmaceutical & medical devices companies are driving the growth of the steam and hydrogen peroxide biological indicators market in the US.

Market Overview

Biological indicators are test systems that contain viable microorganisms, providing information on whether necessary conditions were met to kill a specified number of microorganisms for the sterilization process, thereby validating the sterilization process. In biological indicators (BIs), endospores, also known as bacterial spores, are the principal microorganisms selected for treatment as they are resistant to some sterilization procedures. Spores of Geobacillus stearothermophilus are employed in steam and hydrogen BIs that keep an eye on sterilization procedures because of their strong resistance to steam and vaporized hydrogen peroxide. Because BIs offer a precise measurement of the process' lethality, using them to regularly check sterilizers gives assurance regarding the sterilization process' effectiveness. Key players are creating and releasing fast biological indicators to meet the growing demand for rapid biological indicators to maximize the efficiency of the sterilization validation process, which is driving market expansion.

Report Coverage

This research report categorizes the market for the US steam and hydrogen peroxide biological indicators market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States Steam and Hydrogen Peroxide Biological Indicators market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US Steam and Hydrogen Peroxide Biological Indicators market.

United States Steam and Hydrogen Peroxide Biological Indicators Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 233.5 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 7.57% |

| 2033 Value Projection: | USD 484.5 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Application, By Region |

| Companies covered:: | 3M, STERIS, Mesa Labs, Inc., Tuttanauer, ASP, and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

Surgical Site Infection (SSI) cases following abdominal hysterectomy increased by 11% in acute care hospitals in 2021 compared to 2020, according to the CDC 2021 report. Thus, the growing prevalence of surgical-site infection is driving the market demand. Medical devices need to be sterile in order to be released into the healthcare industry. Further, the increased focus on sterilization procedures in pharmaceutical and medical device businesses to reduce the risk of contamination is driving the market.

Restraining Factors

The voluntary recall of a small number of biological indicators because of damage and compromised quality may hamper the adoption of steam and hydrogen peroxide biological indicators. This further results in consumers favoring the available alternatives to the original products. This is likely to restrain the market.

Market Segmentation

The United States Steam and Hydrogen Peroxide Biological Indicators Market share is classified into product type and application.

- The self-contained vials segment dominates the US steam and hydrogen peroxide biological indicators market with the largest share in 2023.

The United States steam and hydrogen peroxide biological indicators market is segmented by product type into self-contained vials, spore strips, and spore suspension. Among these, the self-contained vials segment dominates the US steam and hydrogen peroxide biological indicators market with the largest share in 2023. Vial design reduces the chance of fracturing and avoids premature activation. The growing number of product approvals and launches, as well as the growing demand for self-contained vials among pharmaceutical and medical device firms, are driving the market in the self-contained vials segment.

- The pharmaceutical & medical devices companies segment dominates the US steam and hydrogen peroxide biological indicators market during the forecast period.

Based on the application, the U.S. steam and hydrogen peroxide biological indicators market is divided into pharmaceutical & medical devices companies, healthcare facilities, and others. Among these, the pharmaceutical & medical devices companies segment dominates the US steam and hydrogen peroxide biological indicators market during the forecast period. In pharmaceutical and medical device companies, biological indicators (BIs) are used to verify sterilization procedures and guarantee that products, machinery, and surroundings are free of microbes. The companies' growing R&D initiatives and the growing requirement to adhere to strict government rules to prevent contamination in product batches drive the demand for these biological indicators.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. steam and hydrogen peroxide biological indicators market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M

- STERIS

- Mesa Labs, Inc.

- Tuttanauer

- ASP

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2022, Tuttnauer Ltd, a global leader in infection control solutions, including disinfection and sterilization equipment, announced the immediate acquisition of Prestige Medical Limited, a U.K.-based company specializing in the distribution and manufacturing of sterilization equipment.

- In January 2021, STERIS plc and Cantel Medical Corp (“Cantel”) announced that STERIS has signed a definitive agreement to acquire Cantel, through a U.S. subsidiary. The companies share a similar focus on infection prevention across a range of healthcare Customers. Combined, they would offer a broader set of Customers a more diversified selection of infection prevention and procedural products and services.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Steam and Hydrogen Peroxide Biological Indicators Market based on the below-mentioned segments:

US Steam and Hydrogen Peroxide Biological Indicators Market, By Product Type

- Self-contained Vials

- Spore Strips

- Spore Suspension

US Steam and Hydrogen Peroxide Biological Indicators Market, By Application

- Pharmaceutical & Medical Devices Companies

- Healthcare Facilities

- Others

Need help to buy this report?