United States Sterilization Equipment Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Thermal Sterilizers, Chemical/Gas Sterilizers, and Others), By End User (Hospitals & Specialty Clinics, Pharmaceutical & Medical Device Manufacturers, and Others), and United States Sterilization Equipment Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Sterilization Equipment Market Insights Forecasts to 2033

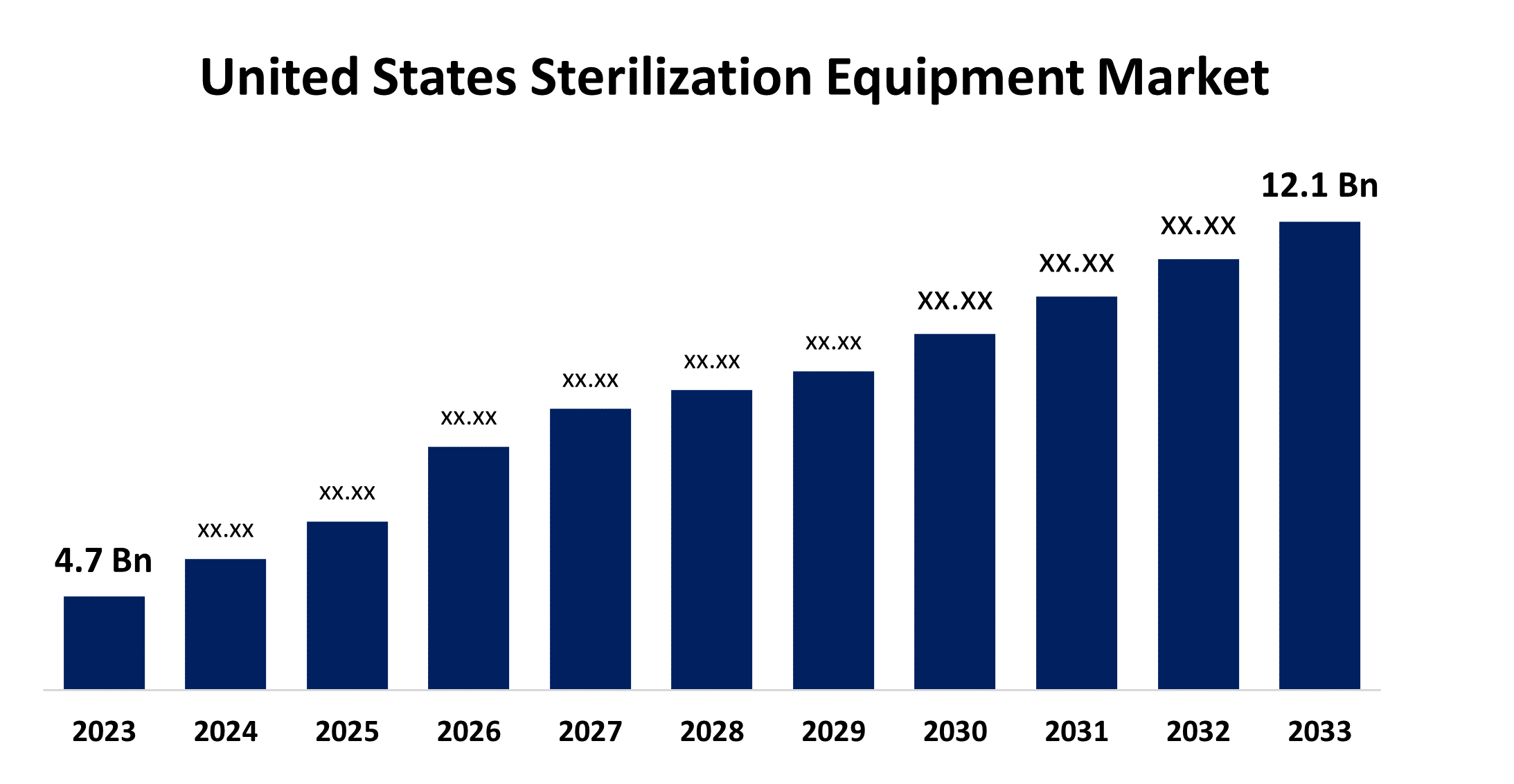

- The United States Sterilization Equipment Market Size was valued at USD 4.7 Billion in 2023.

- The Market Size is Growing at a CAGR of 9.92% from 2023 to 2033

- The U.S Sterilization Equipment Market Size is Expected to reach USD 12.1 Billion by 2033

Get more details on this report -

The United States Sterilization Equipment Market is anticipated to exceed USD 12.1 billion by 2033, growing at a CAGR of 9.92% from 2023 to 2033. The growing number of surgeries, and hospital admission rate are driving the growth of the sterilization equipment market in the United States.

Market Overview

Sterilization equipment is a set of devices or machinery designed to eliminate or remove all types of microorganisms, involving any transmissible agents from objects or surfaces to prevent contamination or hospital-acquired infections. Heat sterilizers, ethylene oxide sterilizers, and radiation sterilizers are the various sterilization equipment used to sterilize medical devices in hospitals and biopharmaceutical companies. Sterilization is a crucial procedure to control microbial contamination thereby maintaining product quality. Sterilization equipment is used for sterilization of different equipment used in hospitals ranging from general health care practices such as wound dressings to more specialized devices such as stents. The integration of robotics and automation technology for sterilization increases accuracy and efficiency with reduced human error. Further, the development and utilization of eco-friendly sterilization methods such as low-temperature hydrogen peroxide gas plasma and ozone sterilization provide sterilization for sensitive instruments.

Report Coverage

This research report categorizes the market for the US sterilization equipment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the sterilization equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the sterilization equipment market.

United States Sterilization Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 4.7 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.92% |

| 2033 Value Projection: | USD 12.1 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 207 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By End User |

| Companies covered:: | STERIS, ASP, 3M, Sotera Health, Andersen Sterilizers, Fortive, Noxilizer Inc., Continental Equipment Company, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising prevalence of chronic conditions like diabetes as per estimations has significantly increased hospital admission rates which ultimately leads to drive the market demand for sterilization equipment. According to the National Center for Biotechnology Information (NCBI), there were 13 billion surgical procedures conducted in the US between the period of January 2019 to January 2021. Sterilization of medical equipment used in surgical procedures is necessary after every surgery to prevent the spread of any infection. Thus, the increasing number of surgical procedures surging the demand for sterilization.

Restraining Factors

The inappropriate sterilization process causes the risk of hospital-acquired infections as adherence of the bacteria to the medical devices spreads infections to the patients. Thus, inadequate reprocessing and a lack of skilled professionals can lead to the spread of infections which ultimately results in restraining the market growth.

Market Segmentation

The United States Sterilization Equipment Market share is classified into product type and end user.

- The chemical/gas sterilizers segment dominated the market with the largest market share in 2023.

The United States sterilization equipment market is segmented by product type into thermal sterilizers, chemical/gas sterilizers, and others. Among these, the chemical/gas sterilizers segment dominated the market with the largest market share in 2023. Chemical/gas sterilizer involves the use of chemical agents such as ethylene oxide, hydrogen peroxide, or chlorine dioxide to accomplish sterilization widely in healthcare facilities. The benefits of chemical sterilizers such as low processing time and use in sterilizing temperature-sensitive products are driving the market.

- The hospitals & specialty clinics segment held a significant share of the United States sterilization equipment market in 2023.

The United States sterilization equipment market is segmented by end user into hospitals & specialty clinics, pharmaceutical & medical device manufacturers, and others. Among these, the hospitals & specialty clinics segment held a significant share of the United States sterilization equipment market in 2023. Sterilization is a crucial procedure in hospitals to prevent hospital-acquired infections through medical instruments and maintain a sterile and hygienic environment for any surgical procedure. The rising prevalence of hospital-acquired infection and increasing initiatives to control the spread of infection in hospitals are expected to drive market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US sterilization equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- STERIS

- ASP

- 3M

- Sotera Health

- Andersen Sterilizers

- Fortive

- Noxilizer Inc.

- Continental Equipment Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent developments

- In April 2023, Telstar and Picarro have entered into an alliance to solidify the development of end-to-end complete solutions for industries that use and produce ethylene oxide integrated with cutting-edge EtO monitoring technology into new sterilization plants, offering customers unmatched safety, efficiency, and compliance with international standards.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Sterilization Equipment Market based on the below-mentioned segments:

United States Sterilization Equipment Market, By Product Type

- Thermal Sterilizers

- Chemical/Gas Sterilizers

- Others

United States Sterilization Equipment Market, By End User

- Hospitals & Specialty Clinics

- Pharmaceutical & Medical Device Manufacturers

- Others

Need help to buy this report?