United States Sterilization Services Market Size, Share, and COVID-19 Impact Analysis, By Service (Validation Sterilization Services and Contract Sterilization Services), By Delivery Mode (Offsite and Onsite), and U.S. Sterilization Services Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Sterilization Services Market Insights Forecasts to 2033

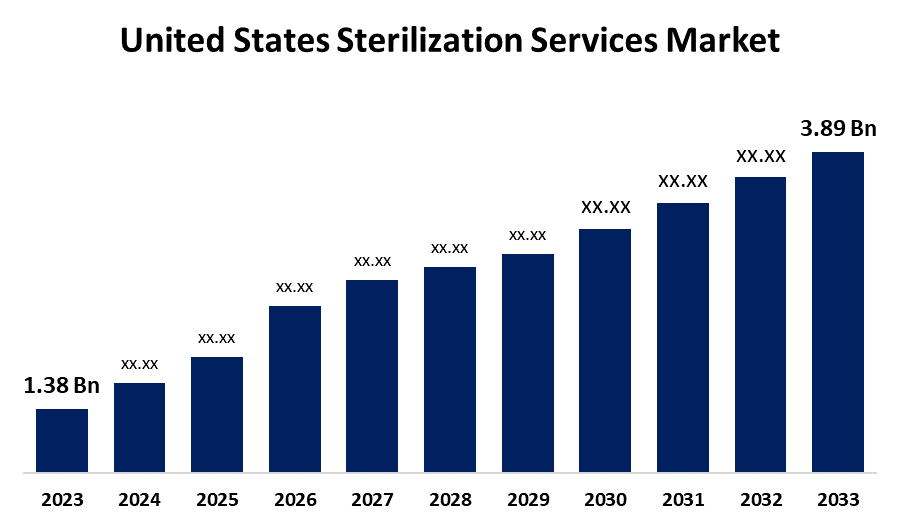

- The United States Sterilization Services Market Size Was Estimated at USD 1.38 Billion in 2023.

- The Market Size is Growing at a CAGR of 10.92% from 2023 to 2033

- The USA Sterilization Services Market Size is Expected to Reach USD 3.89 Billion by 2033

Get more details on this report -

The United States Sterilization Services Market Size is Expected to reach USD 3.89 Billion by 2033, Growing at a CAGR of 10.92% from 2023 to 2033.

Market Overview

The market for sterilization services in the United States is the sector that specializes in offering specific procedures and methods for getting rid of microorganisms from medical equipment, devices, and other materials used in healthcare environments. The country's market is expanding due to factors such as an increase in surgical procedures, a rise in hospital-acquired infections (HAIs), an aging population, an increase in the incidence of chronic diseases, and government and regulatory bodies' initiatives to ensure that hospitals and research centers adopt essential sterilization standards. These factors are forcing healthcare facilities to implement stringent sterilization protocols to ensure patient safety and regulatory compliance. Additionally, the increasing prevalence of infectious diseases in the population demands the sanitization and sterilization process, which further fuels the country’s expanding sterilization services demand. In addition, the healthcare and pharmaceutical industry's technological evaluation and ongoing research and development activities are driving market expansion in sterilization technology of the market.

Report Coverage

This research report categorizes the market for the U.S. sterilization services market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US sterilization services market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA sterilization services market.

United States Sterilization Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 1.38 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 10.92% |

| 2033 Value Projection: | USD 3.89 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Service, By Delivery Mode |

| Companies covered:: | STERIS, ASP (Fortive), Andersen Sterilizers, Sterigenics U.S., LLC - A Sotera Health company, VPT Rad, Inc., Infinity Laboratories, Prince Sterilization Services, LLC, Midwest Sterilization Corporation, E-BEAM Services, Inc, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The United States sterilization services market is expanding more quickly due to the rising demand for sterilization services from several prominent businesses, including the pharmaceutical, healthcare, and other consumer sectors. Additionally, The US healthcare sector, dominated by aging and surgical procedures, is experiencing a surge in demand for sterilization services to maintain sterile equipment and reduce infection risks. In addition, the market expansion is supported by the cost advantages and improved sterilizing services provided by outside vendors. It is also anticipated that market participants will benefit from the strong development potential of emerging economies.

Restraining Factors

The high expense of sophisticated sterilization technologies, strict regulations, and environmental issues with specific sterilization techniques like ethylene oxide are some of the obstacles facing the US industry for sterilization services. Additionally, despite rising demand for infection control measures, market expansion is constrained by smaller healthcare facilities' lack of knowledge about professional sterilization services.

Market Segmentation

The U.S. sterilization services market share is classified into service and delivery mode.

- The contract sterilization services segment accounted for the largest market share of 64.57% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the service, the U.S. sterilization services market is divided into validation sterilization services and contract sterilization services. Among these, the contract sterilization services segment accounted for the largest market share of 64.57% in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is growing due to contract sterilization services being used by hospitals and manufacturers to maximize productivity and guarantee adherence to strict guidelines. In addition, these services also offer capacity flexibility, which frees companies from the financial burden of fixed facility investments and enables them to scale operations up or down in response to demand.

- The offsite segment accounted for the highest market share of 62.17% in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the delivery mode, the U.S. sterilization services market is classified into offsite and onsite. Among these, the offsite segment accounted for the highest market share of 62.17% in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is driven by outsourcing convenience and cost analysis. In addition, providers maintain high standards and hire qualified personnel, guaranteeing adherence to state laws. Additionally, these services have created demand by cutting expenses and time, which makes them an ideal option for hospitals looking for quick and easy sterilization solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. sterilization services market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- STERIS

- ASP (Fortive)

- Andersen Sterilizers

- Sterigenics U.S., LLC - A Sotera Health company

- VPT Rad, Inc.

- Infinity Laboratories

- Prince Sterilization Services, LLC

- Midwest Sterilization Corporation

- E-BEAM Services, Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2024, Prince Sterilization Services' management team announced a partnership with Los Angeles-based private equity firm Vance Street Capital to support the company's further growth. The purpose of this strategic partnership is to support Prince Sterilizing Services' expansion in the sterilizing markets for pharmaceuticals and medical devices.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. sterilization services market based on the below-mentioned segments:

U.S. Sterilization Services Market, By Service

- Validation Sterilization Services

- Contract Sterilization Services

U.S. Sterilization Services Market, By Delivery Mode

- Offsite

- Onsite

Need help to buy this report?