United States Surgical Dressings Market Size, Share, and COVID-19 Impact Analysis, By Product (Primary, Secondary, and Others), By Application (Diabetes-related Surgeries, Cardiovascular-related Surgeries, Ulcers, Burns, Transplant Sites, and Others), By End Use (Hospitals, Specialty Clinics, Home Healthcare, Ambulatory Surgery Centers, and Others), and U.S. Surgical Dressings Market Insights, Industry Trend, Forecasts to 2033.

Industry: HealthcareUnited States Surgical Dressings Market Insights Forecasts to 2033

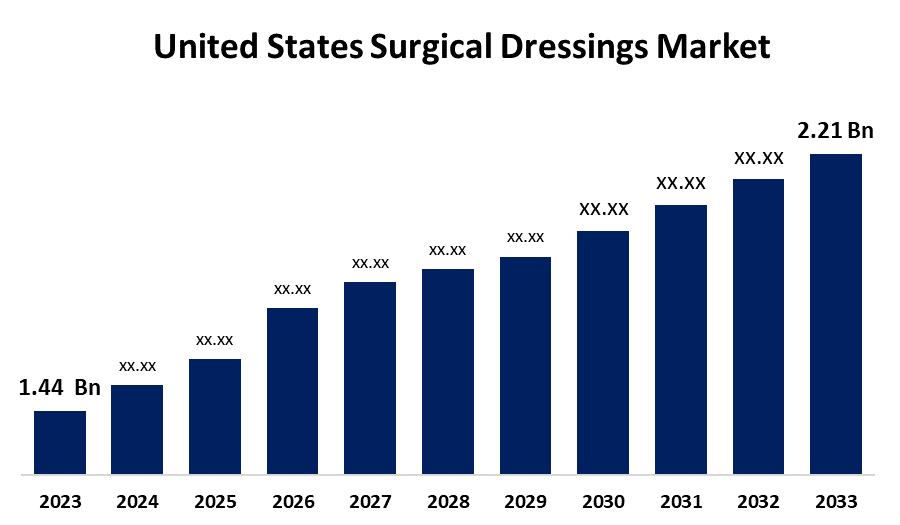

- The United States Surgical Dressings Market Size Was Estimated at USD 1.44 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.38% from 2023 to 2033

- The USA Surgical Dressings Market Size is Expected to Reach USD 2.21 Billion by 2033

Get more details on this report -

The United States Surgical Dressings Market Size is Expected to reach USD 2.21 Billion by 2033, Growing at a CAGR of 4.38% from 2023 to 2033

Market Overview

The purchasing and selling of goods to cover and shield wounds or incisions during and after surgery is referred to as the surgical dressings market in the United States. This market contains a broad variety of materials, such as gauze, pads, bandages, and cutting-edge wound care products made to aid in wound closure, encourage healing, and prevent infection. The market is expanding due to increasing surgical procedures, and the frequency of chronic wounds, including pressure ulcers and diabetic foot ulcers, is one of the reasons propelling the market's expansion. Additionally, the market for surgical dressings is greatly influenced by the rising number of organ transplant procedures because of the increased need for specific wound care products after the procedure. Furthermore, government initiatives and policies aid in market expansion. For instance, in April 2024, skin substitute grafts with reissued Local Coverage Determinations (LCDs) for the treatment of diabetic foot ulcers and venous leg ulcers.

Report Coverage

This research report categorizes the market for the U.S. surgical dressings market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US surgical dressings market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA surgical dressings market.

United States Surgical Dressings Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.44 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.38% |

| 2033 Value Projection: | USD 2.21 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Product, By Application, By End Use and COVID-19 Impact Analysis |

| Companies covered:: | Smith+Nephew, Mölnlycke Health Care AB, Convatec Group PLC, Essity, Cardinal Health, MIMEDX Group, Inc., Urgo Medical North America, DeRoyal Industries, Inc., Coloplast Corp, 3M, INTEGRA LIFESCIENCES, Medline Industries, LP., and Others key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The primary factor propelling the expansion of the surgical dressings market in the United States is the rising prevalence of both acute and chronic wounds, including burns, pressure ulcers, diabetic ulcers, and venous leg ulcers. Furthermore, it is anticipated that technologies like 3D printing and smart dressings would improve the functionality of surgical dressings. Additionally, there is a significant degree of innovation as market participants strive to develop novel dressings utilizing cutting-edge technology to enhance and broaden their product offerings. In addition, high amounts of mergers and acquisitions are occurring in the market as well, with established firms purchasing upstarts to increase their market share and diversify their product lines.

Restraining Factors

The market for surgical dressings in the United States is constrained by factors like the high price of sophisticated wound care products, strict FDA restrictions, and restrictive reimbursement guidelines. Market expansion is also impacted by supply chain interruptions and competition from substitute wound care products.

Market Segmentation

The U.S. surgical dressings market share is classified into product, application, and end use.

- The primary segment accounted for the largest market share of 38.24% in 2023 and is estimated to grow at a significant CAGR during the projected period.

Based on the product, the U.S. surgical dressings market is classified into primary, secondary, and others. Among these, the primary segment accounted for the largest market share of 38.24% in 2023 and is estimated to grow at a significant CAGR during the projected period. This segment is expanding because of the development of foam, hydrocolloid, and film dressings, which are materials designed to promote quicker healing and lower the risk of infection. In addition, materials like hydrogel and alginate dressings are becoming more and more well-liked because of their capacity to retain moisture and their biodegradable alternatives, which improve patient safety and environmental sustainability. Additionally, research is showing that primary dressings have favorable results.

- The cardiovascular-related surgeries segment accounted for a significant market share in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the application, the U.S. surgical dressings market is divided into diabetes-related surgeries, cardiovascular-related surgeries, ulcers, burns, transplant sites, and others. Among these, the cardiovascular-related surgeries segment accounted for a significant market share in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is growing, driven by the high volume of heart-related surgeries, including valve replacements and coronary artery bypass grafting (CABG).

- The hospitals segment anticipated the largest market share in 2023 and is estimated to grow at a significant CAGR during the forecast period.

Based on the end use, the U.S. surgical dressings market is divided into hospitals, specialty clinics, home healthcare, ambulatory surgery centers, and others. Among these, the hospitals segment anticipated the largest market share in 2023 and is estimated to grow at a significant CAGR during the forecast period. Hospitals frequently use cutting-edge wound care tools and therapies to improve patient outcomes. This covers customized dressings, cutting-edge equipment, and creative treatments. Furthermore, hospitals deal with a large number of patients who have a variety of chronic illnesses, including diabetes, peripheral vascular diseases, and pressure injuries, which makes comprehensive wound care services necessary.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. surgical dressings market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Smith+Nephew

- Mölnlycke Health Care AB

- Convatec Group PLC

- Essity

- Cardinal Health

- MIMEDX Group, Inc.

- Urgo Medical North America

- DeRoyal Industries, Inc.

- Coloplast Corp

- 3M

- INTEGRA LIFESCIENCES

- Medline Industries, LP.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2024, MicroMatrix Flex was introduced to the US market by Integra LifeSciences Corporation. This cutting-edge dual-syringe system makes it simple to blend and apply MicroMatrix paste precisely in hard-to-reach places, which helps create a consistent wound surface in challenging-to-treat wound locations.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. surgical dressings market based on the below-mentioned segments:

U.S. Surgical Dressings Market, By Product

- Primary

- Secondary

- Others

U.S. Surgical Dressings Market, By Application

- Diabetes-related Surgeries

- Cardiovascular-related Surgeries

- Ulcers

- Burns

- Transplant Sites

- Others

U.S. Surgical Dressings Market, By Application

- Hospitals

- Specialty Clinics

- Home Healthcare

- Ambulatory Surgery Centers

Need help to buy this report?