United States Surgical Equipment Market Size, Share, and COVID-19 Impact Analysis, By Product (Surgical Sutures & Staplers, Handheld Surgical Devices, and Electrosurgical Devices), By Application (Neurosurgery, Plastic & Reconstructive Surgery, Wound Closure, Obstetrics & Gynecology, Cardiovascular, Orthopedic, and Others), and United States Surgical Equipment Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Surgical Equipment Market Insights Forecasts to 2033

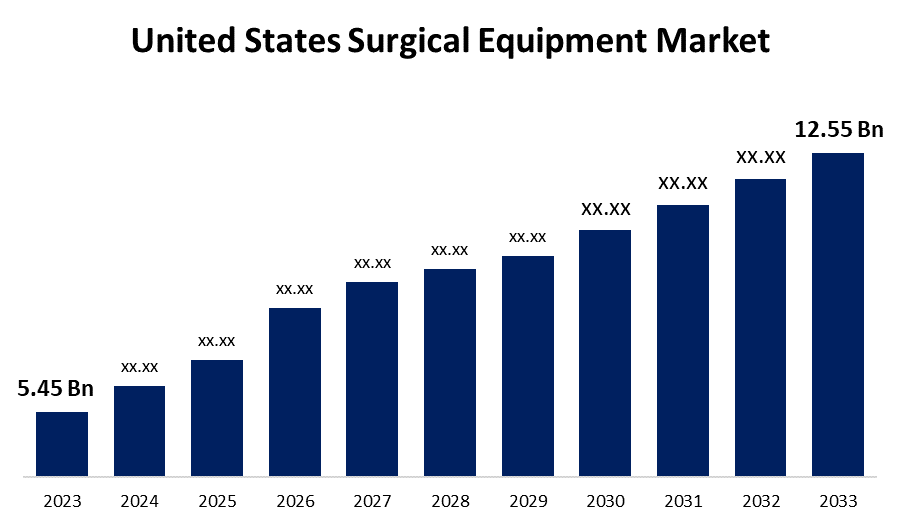

- The U.S. Surgical Equipment Market Size was valued at USD 5.45 Billion in 2023.

- The Market Size is Growing at a CAGR of 8.70% from 2023 to 2033

- The U.S. Surgical Equipment Market Size is expected to reach USD 12.55 Billion by 2033

Get more details on this report -

The United States Surgical Equipment Market Size is anticipated to Exceed USD 12.55 Billion by 2033, Growing at a CAGR of 8.70% from 2023 to 2033. The growing incidences of chronic diseases and the rising number of surgical procedures (particularly minimally invasive surgeries) are driving the growth of the surgical equipment market in the US.

Market Overview

Surgical equipment is the tool used by surgeons to perform specific actions or carry out desired effects during a surgery or operation. These devices or tools are used for tasks including cutting, gripping, dissecting, holding, suturing, or retracting. The demand for new powered surgical devices has increased as a result of the enormous popularity of minimally invasive treatments, and it is anticipated that this will present a large commercial opportunity for both established and emerging surgical equipment producers. The technological developments in surgical equipment and growing investments by industry participants are anticipated to drive market growth. There is an increasing need for cutting-edge and creative surgical instruments in the healthcare industry. The use of portable instruments is becoming more common in healthcare settings, particularly in hospitals. Thus, the creation of novel dilators and retractors results in a large boost in revenue for the surgical equipment sector. Furthermore, the development of better products utilized in imaging for surgical prospects is anticipated to have a significant positive impact on the surgical equipment market.

Report Coverage

This research report categorizes the market for the US surgical equipment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States surgical equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US surgical equipment market.

United States Surgical Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.45 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 8.70% |

| 2033 Value Projection: | USD 12.55 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 231 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application |

| Companies covered:: | Johnson & Johnson, Stryker, Boston Scientific, Inc, Integra LifeSciences, Hospira, Becton, Dickinson and Company, Zimmer Biomet Holdings, Inc, Thompson Surgical Instruments, Inc, CooperSurgical, Inc, Aspen Surgical, Arthrex, Inc., and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The increased need for surgical interventions for diagnosis, treatment, and management due to the rising incidence of chronic diseases including diabetes, cancer, and cardiovascular disease is anticipated to drive the market expansion. Since these disorders frequently call for specialized surgical instruments, diagnostic tools, and monitoring systems, the surgical equipment market benefits from this development. Further, the increased demand for minimally invasive surgery due to several benefits including smaller incisions, reduced pain, shorter hospital stays, and quicker recovery times for patients are propelling the market growth. In addition, the increase in the elderly population is also responsible for driving the market as they are more vulnerable to intestinal, gastric, and ophthalmic diseases, among other illnesses.

Restraining Factors

The risk of infection is increased for surgical instruments if they are not properly sterilized. Such exposure may lead to infections at the surgical site. This drawback may hamper the market for surgical equipment.

Market Segmentation

The United States Surgical Equipment Market share is classified into product and application.

- The surgical sutures & staplers segment dominates the US surgical equipment market with the largest share in 2023.

The United States surgical equipment market is segmented by product into surgical sutures & staplers, handheld surgical devices, and electrosurgical devices. Among these, the surgical sutures & staplers segment dominates the US surgical equipment market with the largest share in 2023. Surgical sutures & staplers are essential instruments used in surgery for tissue approximation and wound closure. Further, these devices have fewer time requirements, consistent safety and efficacy in wound closure, and a lower chance of infection following surgery. These kinds of applications help the market expand. Further, a few major players in the US surgical equipment market are working to bring cutting-edge surgical sutures to improve patient outcomes and fuel the market expansion.

- The plastic & reconstructive surgery segment is expected to grow at the fastest CAGR during the forecast period.

Based on the application, the U.S. surgical equipment market is divided into neurosurgery, plastic & reconstructive surgery, wound closure, obstetrics & gynecology, cardiovascular, orthopedic, and others. Among these, the plastic & reconstructive surgery segment is expected to grow at the fastest CAGR during the forecast period. Plastic surgeons utilize specialized devices called plastic surgery instruments to manipulate, cut, shape, and remove tissue during surgical procedures. These tools are made to be precise and accurate when carrying out intricate surgical procedures. In 2022, the United States performed around 26.2 million surgical, minimally invasive reconstructive, and cosmetic treatments, according to a 2023 article published by the American Society of Plastic Surgeons. This represented a 19% rise in treatments for cosmetic surgery, which is a key driver of market expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. surgical equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Johnson & Johnson

- Stryker

- Boston Scientific, Inc

- Integra LifeSciences

- Hospira

- Becton, Dickinson and Company

- Zimmer Biomet Holdings, Inc

- Thompson Surgical Instruments, Inc

- CooperSurgical, Inc

- Aspen Surgical

- Arthrex, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2024, Alcon, the global leader in eye care dedicated to helping people see brilliantly, announced that UNITY Vitreoretinal Cataract System (VCS) and UNITY Cataract System (CS) have received U.S. Food and Drug Administration (FDA) 510(k) clearance. These innovations are the first to be introduced from Alcon’s highly anticipated Unity portfolio.

- In December 2023, Quantum Surgical announced that it made the first sale of its Epione surgical robot platform in the U.S. Epione is designed to treat inoperable tumors in the abdomen, including the liver, kidney, and pancreas.

- In June 2023, STERIS plc announced that the company has signed a definitive agreement to purchase the surgical instrumentation, laparoscopic instrumentation and sterilization container assets from Becton, Dickinson and Company (“BD”) for $540 million (“the Transaction”).

- In April 2022, Carl Zeiss Meditec announced the acquisition of two manufacturers of surgical instruments (Kogent Surgical, LLC and Katalyst Surgical, LLC) to further strengthen its positioning as a solution provider.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Surgical Equipment Market based on the below-mentioned segments:

US Surgical Equipment Market, By Product

- Surgical Sutures & Staplers

- Handheld Surgical Devices

- Electrosurgical Devices

US Surgical Equipment Market, By Application

- Neurosurgery

- Plastic & Reconstructive Surgery

- Wound Closure

- Obstetrics & Gynecology

- Cardiovascular

- Orthopedic

- Others

Need help to buy this report?