United States Surgical Staplers Market Size, Share, and COVID-19 Impact Analysis, By Product (Linear stapler, Circular stapler, Skin stapler, Endoscopic stapler, and Others), By Technology (Manual and Powered), By Usability (Reusable and Disposable), By Surgery (Gynaecology, Cardiac, Bariatric, Colorectal, and Others), By End-use (Hospitals, Ambulatory surgical centers, and Others), and United States Surgical Staplers Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Surgical Staplers Market Insights Forecasts to 2033

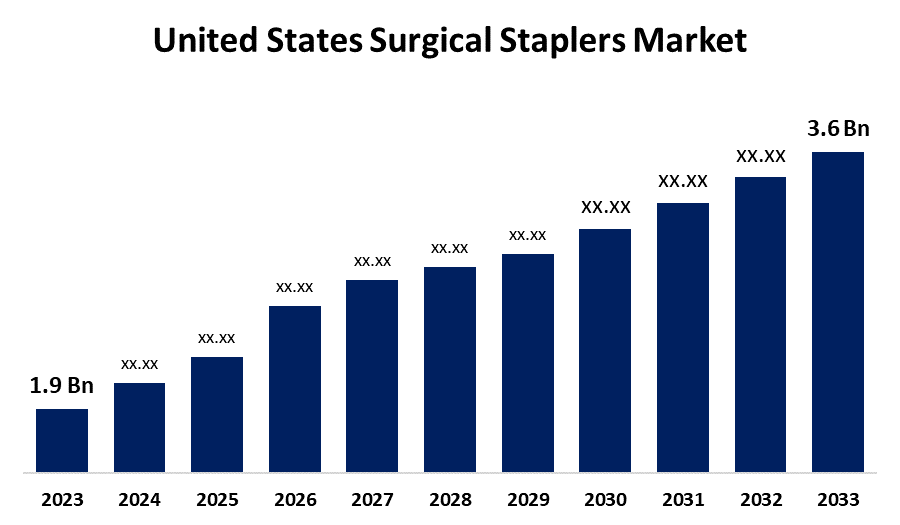

- The U.S. Surgical Staplers Market Size was valued at USD 1.9 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.60% from 2023 to 2033

- The U.S. Surgical Staplers Market Size is Expected to Reach USD 3.6 Billion by 2033

Get more details on this report -

The United States Surgical Staplers Market Size is anticipated to Exceed USD 3.6 Billion by 2033, Growing at a CAGR of 6.60% from 2023 to 2033. The Growing number of surgical procedures, increasing adoption of staplers over sutures, and technological advancements are driving the Growth of the surgical staplers Market in the US.

Market Overview

Surgical staples are medical devices that are used outside the body to close large wounds or surgical cuts on a patient’s skin or scalp. These tools enable surgeons to handle the broadest range of tissues. Staples could be a preferable choice for sutures or stitches in certain situations as they don’t dissolve when wounds or incisions heals, in contrast to stitches. The American Hospital Association estimates that 53 million outpatient and 51 million inpatient procedures were carried out in the United States in the most recent year. About 42.4% of Americans, according to the Centres for Disease Control and Prevention (CDC), are obese, which raises the demand for procedures to treat obesity-related health problems. Surgeons can ensure optimal staple creation and tissue management by using real-time feedback from sophisticated sensors installed in surgical staplers.

Report Coverage

This research report categorizes the market for the US surgical staplers market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States surgical staplers market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US surgical staplers market.

United States Surgical Staplers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.9 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.60% |

| 2033 Value Projection: | USD 3.6 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 196 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Technology, By Usability, By Surgery, By End-use |

| Companies covered:: | 3M, B. Braun Melsungen AG, CONMED Corporation, Ethicon (Johnson & Johnson), CooperSurgical Inc., Hologic, Inc., Dextera Surgical Inc., Intuitive Surgical Inc., Medtronic plc, Smith & Nephew PLC, Integra Life Sciences, Reach Surgical, Lexington Medical, Inc., and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

An enormous 310 million major procedures are carried out annually worldwide, with 40–50 million of those in the United States. The increased number of surgical procedures in the US is responsible for propelling the market demand for surgical staplers. The increased adoption of staplers over sutures owing to the less pain during removal as compared to the suture group is responsible for driving the market demand. With the development of minimally invasive surgery, lightweight, linear laparoscopic staplers that could swiftly cut and seal blood arteries and tissue were created for small holes. Further, the availability of modern-day staplers enables surgeons to use the type of staplers as per the need of surgical procedures are driving the market. The use of technologically advanced staplers such as robotic staplers for patients is bolstering the market growth.

Restraining Factors

Adverse effects reported due to stapler malfunctions such as misfiring, difficulty firing, failure of the stapler to fire the staple, opening of the staple line or malformation of the staples, and misapplied staples may hamper the market for surgical staplers.

Market Segmentation

The United States Surgical Staplers Market share is classified into product, technology, usability, surgery, and end-use.

- The circular stapler segment dominates the US surgical staplers market with the largest share in 2023.

The United States surgical staplers market is segmented by product into linear stapler, circular stapler, skin stapler, endoscopic stapler, and others. Among these, the circular stapler segment dominates the US surgical staplers market with the largest share in 2023. Circular staplers enable surgeons to securely join tissues together while performing surgery by using the circular compression principle. The rectum, stomach, and esophagus end-to-side and end-to-end anastomoses are the primary uses of circular staplers. The adoption of circular stapler owing to reduced operative time, minimized blood loss, and lower risk of postoperative complications are driving the market.

- The powered segment is expected to hold the largest market share during the forecast period.

The United States surgical staplers market is segmented by technology into manual and powered. Among these, the powered segment is expected to hold the largest market share during the forecast period. Compared to manual staplers, powered surgical staplers offer more uniformity and precision in the creation of staples. The automated system reduces the possibility of misfires and incomplete staple creation by ensuring consistent pressure and staple height. The automated operation and ergonomic design of powered staplers as well as their improved performance and accuracy are responsible for driving the market.

- The disposable segment dominated the market with a significant market share in 2023.

The United States surgical staplers market is segmented by usability into reusable and disposable. Among these, the disposable segment dominated the market with a significant market share in 2023. Disposable surgical staplers have a number of benefits, such as a lower incidence of surgical site infections (SSIs) and time savings because the devices are pre-sterilized. Surgical teams can concentrate more on procedure results and patient care because of this efficiency, which is propelling the market growth.

- The bariatric segment dominates the US surgical staplers market during the forecast period.

Based on the surgery, the U.S. surgical staplers market is divided into gynaecology, cardiac, bariatric, colorectal, and others. Among these, the bariatric segment dominates the US surgical staplers market during the forecast period. Surgical staples are used to firmly close the operative region during bariatric procedures like gastric sleeve, gastric bypass, and duodenal switch, thereby offering a trustworthy, short-term closure at the surgical site. The technological advancements in bariatric surgery techniques and innovations for making bariatric surgeries more effective are driving the market growth.

- The hospitals segment accounted for the largest revenue share of the US surgical staplers market in 2023.

The United States surgical staplers market is segmented by end-use into hospitals, ambulatory surgical centers, and others. Among these, the hospitals segment accounted for the largest revenue share of the US surgical staplers market in 2023. Hospitals offer a wide range of surgical specializations, from general surgery to subspecialty areas like orthopedics, neurology, and cardiology. These varied specialties all use surgical staplers for a variety of procedures, such as tissue resection, anastomosis, and wound closure. Further, the inclination towards minimally invasive surgical techniques in hospitals is driving the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. surgical staplers market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M

- B. Braun Melsungen AG

- CONMED Corporation

- Ethicon (Johnson & Johnson)

- CooperSurgical Inc.

- Hologic, Inc.

- Dextera Surgical Inc.

- Intuitive Surgical Inc.

- Medtronic plc

- Smith & Nephew PLC

- Integra Life Sciences

- Reach Surgical

- Lexington Medical, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, Ethicon, a Johnson & Johnson MedTech company, announced the U.S. launch of the ECHELON LINEAR Cutter. It is the first linear cutter to market with combined innovative and proprietary technologies – 3D-Stapling Technology and Gripping Surface Technology (GST) – two advanced capabilities proven to enable greater staple line security, which can help surgeons reduce risks and support patient outcomes.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Surgical Staplers Market based on the below-mentioned segments:

US Surgical Staplers Market, By Product

- Linear stapler

- Circular stapler

- Skin stapler

- Endoscopic stapler

- Others

US Surgical Staplers Market, By Technology

- Manual

- Powered

US Surgical Staplers Market, By Usability

- Reusable

- Disposable

US Surgical Staplers Market, By Surgery

- Gynaecology

- Cardiac

- Bariatric

- Colorectal

- Others

US Surgical Staplers Market, By End-use

- Hospitals

- Ambulatory surgical centers

- Others

Need help to buy this report?