United States Tablet Market Size, Share, and COVID-19 Impact Analysis, By Product (Detachable, Slate), By Operating System (Android, IOS, Windows), and United States Tablet Market Insights, Industry Trend, Forecasts to 2033

Industry: Semiconductors & ElectronicsUnited States Tablet Market Insights Forecasts to 2033

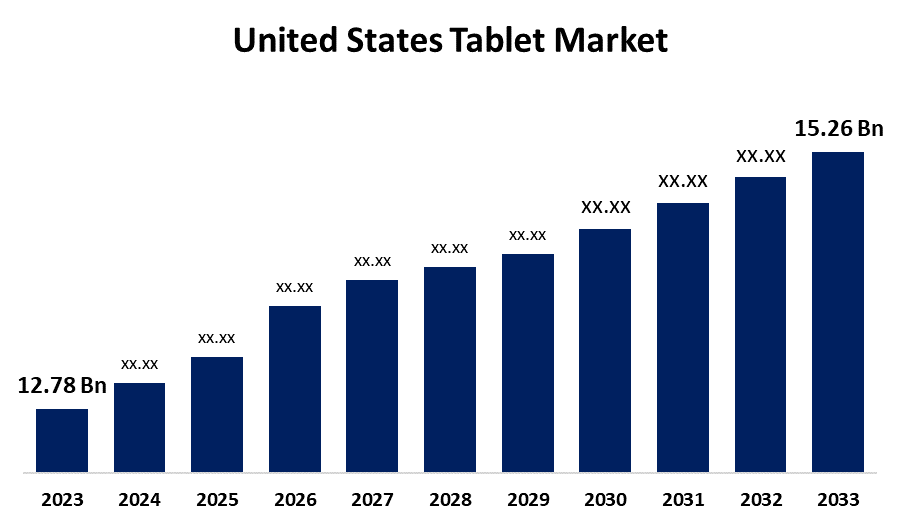

- The U.S. Tablet Market Size was Valued at USD 12.78 Billion in 2023

- The United States Tablet Market Size is Growing at a CAGR of 1.79% from 2023 to 2033

- The USA Tablet Market Size is Expected to Reach USD 15.26 Billion by 2033

Get more details on this report -

The USA Tablet Market Size is anticipated to Exceed USD 15.26 Billion by 2033, Growing at a CAGR of 1.79% from 2023 to 2033. The U.S. tablet market is growing steadily, driven by demand for portable devices, digital learning, and entertainment. Slate tablets and iOS-based devices dominate, with strong contributions from major tech brands.

Market Overview

The U.S. tablet market encompasses the production, distribution, and sale of portable touchscreen computing devices that bridge the functionality gap between smartphones and laptops. These devices are widely used for activities such as reading, entertainment, communication, and productivity, serving both personal and professional needs. The market includes various form factors, including traditional tablets, hybrid models, and convertible devices. Moreover, the U.S. tablet market is driven by the increasing demand for portable computing, the rise of remote work and online education, and growing consumer preference for lightweight, multifunctional devices. Technological advancements such as 5G connectivity, high-resolution displays, and improved battery life further enhance user experience. Additionally, the corporate and healthcare sectors are adopting tablets for efficiency and mobility. For instance, Apple is famous for its innovative electronics and software goods. It develops, produces, and markets goods like iPhone, iPad, Mac computers, Apple Watch, and Apple TV. It also provides the development of some operating systems like iOS and macOS, and services like Apple App Store, Apple Music, and iCloud.

Report Coverage

This research report categorizes the market for the US tablet market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. tablet market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA tablet market.

United States Tablet Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 12.78 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 1.79% |

| 2033 Value Projection: | USD 15.26 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 178 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Operating System and COVID-19 Impact Analysis |

| Companies covered:: | Alcatel, Google, Amazon, Lenovo, Motorola, Asus, Apple, TCL, Microsoft, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The U.S. tablet market is propelled by rising digital content consumption, expanding e-commerce platforms, and integration with smart home systems. Educational institutions increasingly adopt tablets for interactive learning. Enhanced app ecosystems and compatibility with accessories like styluses and keyboards also boost appeal. Moreover, the affordability of entry-level models supports broader market accessibility across demographics. Moreover, in March 2024, Samsung introduced Galaxy Tab S6 Lite (2024), which includes improved performance and innovative functions for business entertainment activities. It has the new and advanced S Pen that supports excellent accuracy and a 10.4-inch screen display, offering video playback for up to 14 hours. It is slender and compatible with other Galaxy products.

Restraining Factors

High competition from smartphones and laptops, limited computing power for intensive tasks, and shorter upgrade cycles restrain the U.S. tablet market. Additionally, saturation in key consumer segments affects growth.

Market Segmentation

The United States tablet market share is classified into product and operating system.

- The slate segment accounted for the largest share of the US tablet market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of product, the United States tablet market is divided into detachable, and slate. Among these, the slate segment accounted for the largest share of the United States tablet market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Their popularity stems from a sleek design, user-friendly interface, and affordability, making them ideal for everyday tasks like media consumption, browsing, and light productivity. This widespread appeal positions slate tablets as the preferred choice among consumers.

- The IOS segment accounted for a substantial share of the U.S. tablet market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of operating system, the U.S. tablet market is divided into android, IOS, and windows. Among these, the IOS segment accounted for a substantial share of the U.S. tablet market in 2023 and is anticipated to grow at a rapid pace during the projected period. This dominance is attributed to the popularity of Apple's iPad lineup, which offers a seamless user experience, robust app ecosystem, and strong brand loyalty. Android follows with a substantial portion of the market, while Windows tablets maintain a minimal presence.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the USA tablet market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Samsung

- Alcatel

- Amazon

- Lenovo

- Motorola

- Asus

- Apple

- TCL

- Microsoft

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, Apple launched a variety of new accessibility features for specially-abled customers. It incorporated new features within its newest iPad version that captures the eye movement of the customer. Based on this feature, it provides ease to specially-abled customers so that they are able to handle the screen. Apple also incorporated a new assistive access feature, which just predefines and classifies all the options in the category for the users classified under the category of cognitively impaired.

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the US tablet market based on the below-mentioned segments:

United States Tablet Market, By Product

- Detachable

- Slate

United States Tablet Market, By Operating System

- Android

- IOS

- Windows

Need help to buy this report?