United States Temperature Sensors Market Size, Share, and COVID-19 Impact Analysis, By Technology (Infrared, Thermocouple, Resistance Temperature Detector, Thermistor, Temperature Transmitter, Fiber Optic, and Others), By End User (Chemical & Petrochemical, Oil & Gas, Metal & Mining, Power Generation, Food & Beverage, Automotive, Medical, Aerospace & Military, Consumer Electronics, and Others), and United States Temperature Sensors Market Insights, Industry Trend, Forecasts to 2033

Industry: Semiconductors & ElectronicsUnited States Temperature Sensors Market Insights Forecasts to 2033

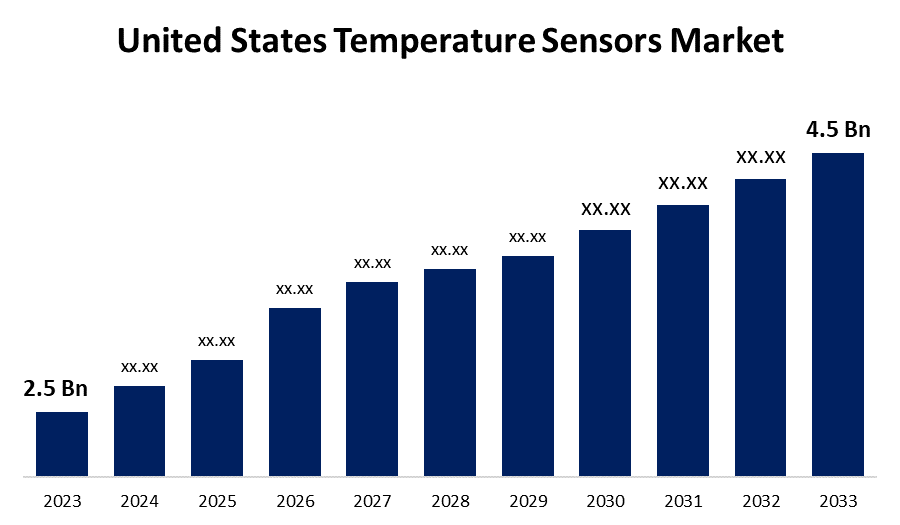

- The U.S. Temperature Sensors Market Size was valued at USD 2.5 Billion in 2023.

- The Market is growing at a CAGR of 6.05% from 2023 to 2033

- The U.S. Temperature Sensors Market Size is expected to reach USD 4.5 Billion by 2033

Get more details on this report -

The United States Temperature Sensors Market is anticipated to exceed USD 4.5 Billion by 2033, growing at a CAGR of 6.05% from 2023 to 2033. The growing industry, rapid factory automation, and rising demand for wearables in consumer electronics are driving the growth of the temperature sensors market in the US.

Market Overview

Temperature sensors are temperature-measuring devices that are composed of high-purity conducting metals. When it detects a temperature change, it produces electrical voltage or resistance. Depending on the technology, there are several types of temperature sensors, including infrared, thermocouples, resistance temperature detectors (RTD), thermistors, and others. The temperature sensor records, monitors, or signals temperature changes by measuring the ambient temperature and converting the input data into electronic data. The proliferation of wireless temperature sensors has been largely attributed to the swift progress made in temperature monitoring technology. Many major manufacturers have been concentrating on integrating cutting-edge ideas like heat and infrared sensors. The use of cutting-edge concepts is anticipated to create significant growth potential for the industry. Another emerging trend in the market is the creation of wireless and remote temperature sensors, which have the advantages of flexibility, low wiring costs, and simple installation, making them perfect for applications in dangerous or difficult-to-reach areas.

Report Coverage

This research report categorizes the market for the US temperature sensors market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States temperature sensors market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US temperature sensors market.

United States Temperature Sensors Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.5 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 6.05% |

| 2033 Value Projection: | USD 4.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 201 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By End User |

| Companies covered:: | Siemens AG, Panasonic Corporation, Honeywell International Inc., Texas Instruments Incorporated, ABB Ltd, Fluke Process Instruments, STMicroelectronics, Emerson Electric Company, NXP Semiconductors NV, Microchip Technology Incorporated, GE Sensing & Inspection Technologies GmbH, Robert Bosch GmbH, and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The automobile sector in the US generates billions of dollars in revenue and employs hundreds of thousands of people both directly and indirectly. Thus, the growing automobile industry is responsible for driving the market. Temperature sensors for industrial automation find applications in a variety of sectors, such as transportation, energy, and manufacturing. The rising demand for wearables in consumer electronics especially in the field of healthcare and diagnosis is driving up the US temperature sensors market.

Restraining Factors

The fluctuation in raw material prices along with supply chain disruption and data security concerns are the factors that restrain the US temperature sensor market.

Market Segmentation

The United States Temperature Sensors Market share is classified into technology and end user.

- The infrared temperature sensors segment dominates the market during the forecast period.

The United States temperature sensors market is segmented by technology into infrared, thermocouple, resistance temperature detector, thermistor, temperature transmitter, fiber optic, and others. Among these, the infrared temperature sensors segment dominates the market during the forecast period. Applications for infrared temperature sensors can be found in a variety of defense settings, including optical target sighting and changeable emissivity measures, which are frequently useful for tracking operations. The rising emphasis on predictive maintenance, automation, and IoT technologies is driving the market.

- The automotive segment is expected to hold the largest market share during the forecast period.

Based on the end user, the U.S. temperature sensors market is divided into chemical & petrochemical, oil & gas, metal & mining, power generation, food & beverage, automotive, medical, aerospace & military, consumer electronics, and others. Among these, the automotive segment is expected to hold the largest market share during the forecast period. An estimated USD 18 billion of the approximately USD 105 billion the automotive industry spends yearly on R&D globally is spent in the US to integrate more sophisticated and modern sensors into cars. The introduction of reliable and efficient electric vehicles by automakers in the region is responsible for propelling the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. temperature sensors market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Siemens AG

- Panasonic Corporation

- Honeywell International Inc.

- Texas Instruments Incorporated

- ABB Ltd

- Fluke Process Instruments

- STMicroelectronics

- Emerson Electric Company

- NXP Semiconductors NV

- Microchip Technology Incorporated

- GE Sensing & Inspection Technologies GmbH

- Robert Bosch GmbH

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2021, Honeywell announced that dnata USA has expanded its deployment of Honeywell ThermoRebellion temperature monitoring solution to support domestic and international passengers at Boston Logan International Airport.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Temperature Sensors Market based on the below-mentioned segments:

US Temperature Sensors Market, By Technology

- Infrared

- Thermocouple

- Resistance Temperature Detector

- Thermistor

- Temperature Transmitter

- Fiber Optic

- Others

US Temperature Sensors Market, By End User

- Chemical & Petrochemical

- Oil & Gas

- Metal & Mining

- Power Generation

- Food & Beverage

- Automotive

- Medical

- Aerospace & Military

- Consumer Electronics

- Others

Need help to buy this report?