United States Tuberculosis (TB) Diagnostics Market Size, Share, and COVID-19 Impact Analysis, By Type (Culture-Based Diagnostics, Sputum Smear Microscopy, Rapid Molecular Diagnostics, and Others), By End-User (Diagnostics Laboratories and Hospitals), and US Tuberculosis (TB) Diagnostics Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Tuberculosis (TB) Diagnostics Market Insights Forecasts to 2033

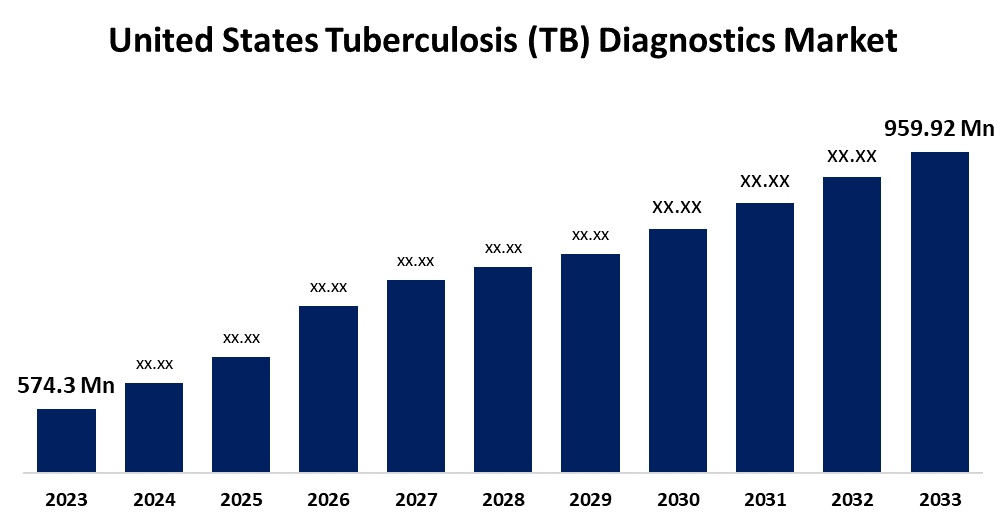

- The U.S. Tuberculosis (TB) Diagnostics Market Size was valued at USD 574.3 Million in 2023.

- The Market is Growing at a CAGR of 5.27% from 2023 to 2033

- The U.S. Tuberculosis (TB) Diagnostics Market Size is Expected to Reach USD 959.92 Million by 2033

Get more details on this report -

The U.S. Tuberculosis (TB) Diagnostics Market Size is Anticipated to Exceed USD 959.92 Million by 2033, Growing at a CAGR of 5.27% from 2023 to 2033.

Market Overview

Tuberculosis diagnostics refers to all the methods and technologies used to detect Mycobacterium tuberculosis, the agent that causes tuberculosis, in patients. It depends on detection processes for proper treatment as well as the control of the spread of TB. Factors driving the United States market for TB diagnostics include rising cases of TB, particularly in the population that is highly at risk, increasing prevalence of drug-resistant strains for which rapid and reliable diagnostic tests are needed, progress in molecular diagnostics, which has increased access to reliable diagnoses, and the resultant early intervention, and government plans that define the TB diagnostics environment. The growth in this market also supports increased funding and resources for TB research and control programs from the CDC and NIH. Public health efforts in consciousness and early screening campaigns related to TB also contribute to this growth. Governmental and non-governmental organizations also have fruitful collaboration that boosts diagnostic capability and delivers innovative solutions to those affected by the disease. In the U.S. market, positive growth is in store for the TB diagnostics market in the years ahead; however, advances in technology and sound measures in public health are expected to continue contributing to this growth.

Report Coverage

This research report categorizes the market for the US tuberculosis (TB) diagnostics market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States tuberculosis (TB) diagnostics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. tuberculosis (TB) diagnostics market.

United States Tuberculosis (TB) Diagnostics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 574.3 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.27% |

| 2033 Value Projection: | USD 959.92 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 199 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Type, By End-User, and COVID-19 Impact Analysis. |

| Companies covered:: | F. Hoffmann-La Roche Ltd., bioMérieux SA, QIAGEN, BD, Cepheid (Danaher), Thermo Fisher Scientific Inc., Abbott, Hologic Inc, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

There are multiple major drivers for the United States TB diagnostics market. First, the rising incidence of tuberculosis, especially among the at-risk population, requires better diagnostics. Furthermore, the increasing prevalence of drug-resistant strains of TB has heightened the demand for quicker and more accurate diagnostic tools. Additionally, advancements in diagnostics technology, such as molecular assays, can provide point-of-care testing, thus facilitating earlier detection and faster treatment. Public health implications of TB have thus led to growing awareness and educational initiatives, increasing the demand for better diagnostic solutions. Such demands underscore the imperative need for effective TB diagnostics to be put into place to combat this infectious disease.

Restraining Factors

Despite a critical and increasing need for advanced diagnostics technologies for these diseases, there are a few limitations that may hamper the market growth over the forecast period. For example, technical complexities associated with tuberculosis diagnostics can act as a major restraining factor for the market during the forecast period.

Market Segmentation

The US tuberculosis (TB) diagnostics market share is classified into type and end-user.

- The rapid molecular diagnostics segment is expected to hold a significant market share through the forecast period.

The United States tuberculosis (TB) diagnostics market is segmented, by type into culture-based diagnostics, sputum smear microscopy, rapid molecular diagnostics, and others. Among these, the rapid molecular diagnostics segment is expected to hold a significant market share through the forecast period. Such high-speed molecular diagnostics with efficiency and accuracy in the diagnosis of TB are showing growth in this segment. Moreover, new product launches into the rapid molecular diagnostics segment are also expected to contribute to the growth of the same during the forecast period.

- The diagnostics laboratories segment is expected to dominate the US tuberculosis (TB) diagnostics market during the projected period.

Based on the end-user, the United States tuberculosis (TB) diagnostics market is divided into diagnostics laboratories and hospitals. Among these, the diagnostics laboratories segment is expected to dominate the US tuberculosis (TB) diagnostics market during the projected period. The growth of this segment is highly influenced by the strong presence of diagnostic laboratories across the country. The segment is also witnessing growth apart from this because the diagnosis of TB is increasingly being carried out in diagnostic laboratories.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States tuberculosis (TB) diagnostics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- F. Hoffmann-La Roche Ltd.

- bioMérieux SA

- QIAGEN

- BD

- Cepheid (Danaher)

- Thermo Fisher Scientific Inc.

- Abbott

- Hologic Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2022, Thermo Fisher Scientific Inc. Launched the SeqStudio Flex Series Genetic Analyzer. The device is capable of identifying infectious diseases, including tuberculosis.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States tuberculosis (TB) diagnostics market based on the below-mentioned segments:

United States Tuberculosis (TB) Diagnostics Market, By Type

- Culture-based Diagnostics

- Sputum Smear Microscopy

- Rapid Molecular Diagnostics

- Others

United States Tuberculosis (TB) Diagnostics Market, By End-User

- Diagnostics Laboratories

- Hospitals

Need help to buy this report?