United States Uterine Fibroid Treatment Market Size, Share, and COVID-19 Impact Analysis, By Procedure Type (Endometrial Ablation, MRI Guided Procedures, Hysterectomy, Myomectomy, Uterine Artery Embolization, Radiofrequency Ablation, and Others), By End User (Hospitals and Ambulatory Surgical Centers), and United States Uterine Fibroid Treatment Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Uterine Fibroid Treatment Market Insights Forecasts to 2033

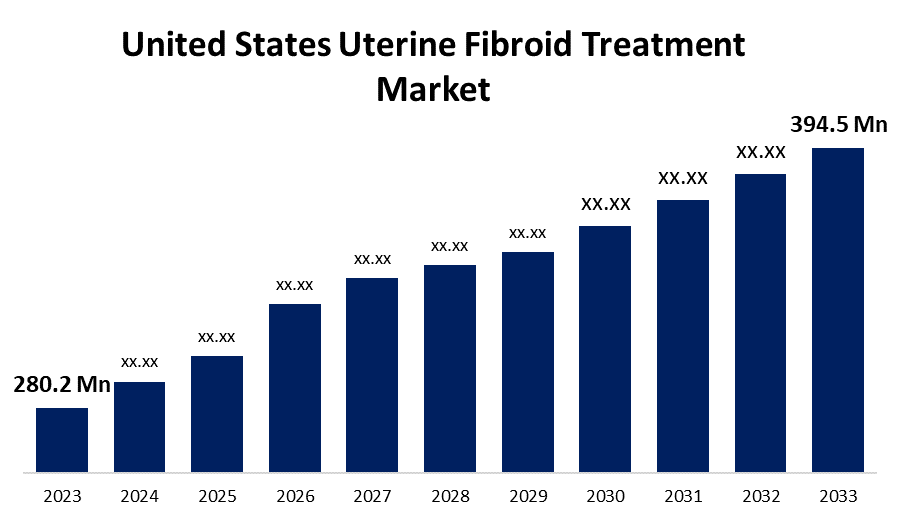

- The United States Uterine Fibroid Treatment Market Size was valued at USD 280.2 Million in 2023

- The Market Size is Growing at a CAGR of 3.48% from 2023 to 2033

- The U.S. Uterine Fibroid Treatment Market Size is expected to reach USD 394.5 Million by 2033

Get more details on this report -

The United States Uterine Fibroid Treatment Market is anticipated to exceed USD 394.5 Million by 2033, growing at a CAGR of 3.48% from 2023 to 2033. The growing incidence of uterine fibroids among women and the increasing number of hysterectomy are driving the growth of the uterine fibroid treatment market in the United States.

Market Overview

Uterine fibroid, also known as uterine leiomyomas, are the most common tumors affecting the female reproductive tract. These tumors disrupt the function of the uterus and cause anemia, excess bleeding, and pelvic discomfort. These are the most common tumors of the female reproductive tract. There are various treatment options for treating uterine fibroid such as drug therapy and surgical procedures such as hysteroscopy, laparoscopy, laparotomy, or robotic-assisted myomectomy. In 2021, the US Department of Health and Human Services Office of the Assistant Secretary for Health (OASH) estimates that about 20-80% of women develop fibroids by the time they reach age 50 and fibroids become more common as women age, particularly in the 30s and 40s through menopause. With the increasing need to treat heavy menstrual bleeding and the surging demand for novel hormonal medical therapy, the US uterine fibroids treatment market is expected to experience considerable expansion over the forecast period. The advancement of effective and advanced technologies, increased government interventions and increased public awareness are leveraging the market expansion.

Report Coverage

This research report categorizes the market for the US uterine fibroid treatment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the uterine fibroid treatment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the uterine fibroid treatment market.

United States Uterine Fibroid Treatment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 280.2 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.48% |

| 2033 Value Projection: | USD 394.5 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Procedure Type, By End User |

| Companies covered:: | Boston Scientific Corporation, Blue Endo, CooperSurgical, Inc., Karl Storz SE & Co. KG, Myovant Sciences GmbH (Sumitovant Biopharma Ltd.), LiNA Medical ApS, Halt Medical, Inc. (Hologic Inc.), Olympus Corporation, Merot Medical Systems, Richard Wolf GmbH, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

According to the Journal of Biomed Women’s Health article, it is estimated that the prevalence of UL (Uterine leiomyomata (fibroids)) to increase up to 80% by 2025. Thus, the growing incidence of uterine fibroids among women is expected to drive the market demand. The increasing number of hysterectomy along with the adoption of minimally invasive therapies and robotic procedures are driving up the market growth.

Restraining Factors

The various complications associated with the morcellators during surgical procedures are restraining the US uterine fibroid treatment market.

Market Segmentation

The United States Uterine Fibroid Treatment Market share is classified into procedure type and end user.

- The hysterectomy segment dominates the market with the largest market share during the forecast period.

The United States uterine fibroid treatment market is segmented by procedure type into endometrial ablation, MRI guided procedures, hysterectomy, myomectomy, uterine artery embolization, radiofrequency ablation, and others. Among these, the hysterectomy segment dominates the market with the largest market share during the forecast period. Women who have large fibroid size and have completed their fertility recommend hysterectomy. The American Congress of Obstetricians and Gynecologists reports that approximately 600,000 hysterectomy procedures are carried out annually.

- The hospitals segment dominates the United States uterine fibroid treatment market during the forecast period.

Based on the end user, the United States uterine fibroid treatment market is divided into hospitals and ambulatory surgical centers. Among these, the hospitals segment dominates the United States uterine fibroid treatment market during the forecast period. Hospitals are seeing an increase in hospitalizations for treatment as a result of the high prevalence of uterine fibroids. Large hospitals are increasingly focusing on teaching gynecologists and interventional radiologists to apply robotic minimally invasive procedures and radiofrequency ablation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US uterine fibroid treatment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Boston Scientific Corporation

- Blue Endo

- CooperSurgical, Inc.

- Karl Storz SE & Co. KG

- Myovant Sciences GmbH (Sumitovant Biopharma Ltd.)

- LiNA Medical ApS

- Halt Medical, Inc. (Hologic Inc.)

- Olympus Corporation

- Merot Medical Systems

- Richard Wolf GmbH

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2022, Olympus, a global technology leader in designing and delivering innovative solutions for medical and surgical procedures, announced the market launch of the moresolution Power Morcellator, which is manufactured by TROKAMED GmbH and is available in the U.S. through a distribution agreement with Olympus America, Inc. The moresolution Morcellator is designed for advanced gynecologic procedures with large, calcified tissue specimens.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Uterine Fibroid Treatment Market based on the below-mentioned segments:

United States Uterine Fibroid Treatment Market, By Procedure Type

- Endometrial Ablation

- MRI Guided Procedures

- Hysterectomy

- Myomectomy

- Uterine Artery Embolization

- Radiofrequency Ablation

- Others

United States Uterine Fibroid Treatment Market, By End User

- Hospitals

- Ambulatory Surgical Centers

Need help to buy this report?