United States Veterinary Medicine Market Size, Share, and COVID-19 Impact Analysis, By Product (Biologics, Pharmaceuticals, and Medicated Feed Additives), By Animal Type (Production Animals and Companion Animals), By Route of Administration (Oral, Injectable, Topical, and Other Routes), By Distribution Channel (Veterinary Hospitals & Clinics, E-Commerce, Offline Retail Stores, and Others), and United States Veterinary Medicine Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Veterinary Medicine Market Insights Forecasts to 2033

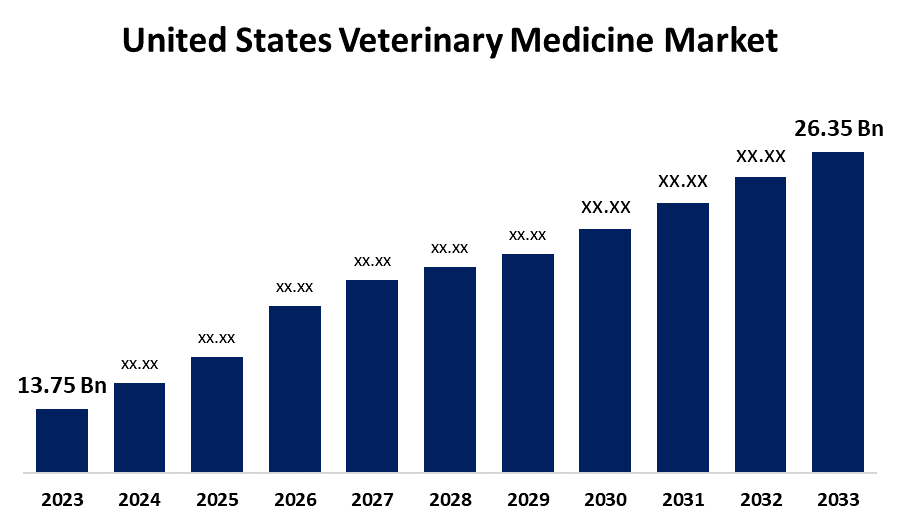

- The U.S. Veterinary Medicine Market Size was valued at USD 13.75 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.72% from 2023 to 2033

- The U.S. Veterinary Medicine Market Size is Expected to reach USD 26.35 Billion by 2033

Get more details on this report -

The United States Veterinary Medicine Market Size is anticipated to Exceed USD 26.35 Billion by 2033, Growing at a CAGR of 6.72% from 2023 to 2033. The growing prevalence of zoonotic diseases, growth in livestock population, pet ownership, and increasing emphasis on preventive care are driving the Growth of the veterinary medicine market in the US.

Market Overview

Veterinary medicine is a medical specialty, that emphasizes the prevention, management, diagnosis, and treatment of disease and injury in animals. It is affecting the health of domestic and wild animals. It also includes the prevention of the transmission of animal diseases to people. According to the Livestock and Poultry: World Markets and Trade report from the U.S. Foreign Agricultural Service, as of January 2024, the country has 87.8 million cattle and 74.97 million swine stock. Further, 86.9 million homes in the United States, or sixty-six percent of households, are pet owners, according to the American Pet Products (APPA) National Pet Owners Survey of 2023 and 2024. Veterinary medicine experienced a surge in demand due to the increased livestock population and pet ownership for managing veterinary healthcare. Treatment options are being revolutionized by 3D printing, genomics, and personalized medicine; less invasive surgery and robotic surgery are also boosting surgical outcomes. The increasing emphasis on the development and launching of novel medicine for safe and effective veterinary healthcare is creating market growth opportunities. The integration of digital and AI technologies in medical research aids in managing veterinary healthcare, thereby paving the way for advancements in the field of veterinary medicine for diagnostic purposes.

Report Coverage

This research report categorizes the market for the US veterinary medicine market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States veterinary medicine market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US veterinary medicine market.

United States Veterinary Medicine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 13.75 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.72% |

| 2033 Value Projection: | USD 26.35 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Animal Type, By Route of Administration, By Distribution Channel |

| Companies covered:: | Boehringer Ingelheim International GmbH, Merck & Co., Inc., Elanco, Vetbiologics, Ceva, Bimeda Corporate, IDEXX, Phibro Animal Health Corporation, Cargill, Incorporated, Neogen Corporation, Kindred Biosciences, Inc., and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

According to scientific estimates, animals can transmit about 60% of all known infectious diseases that affect humans, and animals are also the source of 3 out of every 4 newly discovered or developing infectious diseases in humans. In the US, gastrointestinal diseases associated with animals or their habitats are thought to be responsible for 450,000 illnesses, 5,000 hospital admissions, and 76 fatalities annually. Thus, the increasing number of cases of these diseases raises concerns about veterinary health, thereby driving the market demand for veterinary medicine. The increased livestock population in the country surges the growing need for veterinary health care which leads to driving the market demand. The increasing pet ownerships along with high spending on pets by owners are responsible for driving the market growth. Preventive care procedures including routine health checkups, immunizations, parasite management, and nutritional counseling are being promoted by veterinarians to enhance animals' quality of life. This move toward preventive treatment has helped to promote the veterinary medicine market growth.

Restraining Factors

The lack of veterinarians and veterinary professionals due to various factors including high cost of entry, long hours, and stress dealing with animal owners are hampering the market. Further, the stringent regulatory guidelines pertaining to veterinary vaccine approval are restraining the market growth.

Market Segmentation

The United States Veterinary Medicine Market share is classified into product, animal type, route of administration, and distribution channel.

- The pharmaceuticals segment dominates the US veterinary medicine market with the largest share in 2023.

The United States veterinary medicine market is segmented by product into biologics, pharmaceuticals, and medicated feed additives. Among these, the pharmaceuticals segment dominates the US veterinary medicine market with the largest share in 2023. Veterinary pharmaceuticals are significantly used for animal disease diagnosis, treatment, prevention, and control. The increasing pet ownership and awareness of veterinary preventive healthcare are driving the market growth.

- The production animals segment accounted for the largest revenue share of the US veterinary medicine market in 2023.

The United States veterinary medicine market is segmented by animal type into production animals and companion animals. Among these, the production animals segment accounted for the largest revenue share of the US veterinary medicine market in 2023. Veterinary medicine is important in the production of animal, concerning nutrition, genetics, economics, and food safety in order to support public well-being and enhance the food supply chain. The growing demand for animal protein, disease prevention, and globalization of livestock production are driving the market demand.

- The injectable segment dominates the US veterinary medicine market during the forecast period.

Based on the route of administration, the U.S. veterinary medicine market is divided into oral, injectable, topical, and other routes. Among these, the injectable segment dominates the US veterinary medicine market during the forecast period. The injectable route is becoming more and more common since it provides a faster start of effect, more precise dosage management, and improved drug absorption. The advantages of veterinary injection for being used for providing immunity and protecting animals from fatal diseases are driving the market.

- The veterinary hospitals & clinics segment dominates the market with a significant market share during the forecast period.

The United States veterinary medicine market is segmented by distribution channel into veterinary hospitals & clinics, e-commerce, offline retail stores, and others. Among these, the veterinary hospitals & clinics segment dominates the market with a significant market share during the forecast period. For veterinary clinics and hospitals to function lawfully and guarantee the efficacy and safety of the drugs they distribute, compliance with the rules established by the FDA is important. Personalized care provided by veterinarians in hospitals & clinics surges the demand for veterinary medicine in the veterinary hospitals & clinics segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. veterinary medicine market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Boehringer Ingelheim International GmbH

- Merck & Co., Inc.

- Elanco

- Vetbiologics

- Ceva

- Bimeda Corporate

- IDEXX

- Phibro Animal Health Corporation

- Cargill, Incorporated

- Neogen Corporation

- Kindred Biosciences, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Merck Animal Health, known as MSD Animal Health outside of the United States and Canada, a division of Merck & Co., Inc., Rahway, N.J., USA, announced the completion of its acquisition of the aqua business of Elanco Animal Health Incorporated.

- In February 2024, Elanco Animal Health Incorporated announced it has agreed to sell its aqua business to Merck Animal Health for approximately $1.3 billion in cash, which represents approximately 7.4x the estimated 2023 revenue of the Elanco aqua business.

- In January 2024, Bimeda, Inc. launched BOVitalize in the US. BOVitalize is an oral vitamin and mineral supplement for beef and dairy cows, bulls, and ruminating calves.

- In October 2023, Kemin Industries, a global ingredient manufacturer would launch the MEFLUVAC H5 PLUS 8 vaccine in partnership with ilender in Latin America to assist in building immunity against the highly pathogenic Avian Influenza.

- In August 2023, Boehringer Ingelheim announced that SENVELGO (velagliflozin oral solution), a revolutionary new treatment for cats with diabetes, has been approved by the U.S. Food and Drug Administration (FDA).

- In July 2023, Bimeda Inc. announced the availability of FDA-approved SpectoGard (spectinomycin sulfate) Sterile Solution for veterinarians and cattle producers in the United States.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Veterinary Medicine Market based on the below-mentioned segments:

US Veterinary M

- Biologics

- Pharmaceuticals

- Medicated Feed Additives

US Veterinary Medicine Market, By Animal Type

- Production Animals

- Companion Animals

US Veterinary Medicine Market, By Route of Administration

- Oral

- Injectable

- Topical

- Other Routes

US Veterinary Medicine Market, By Distribution Channel

- Veterinary Hospitals & Clinics

- E-Commerce

- Offline Retail Stores

- Others

Need help to buy this report?