United States Veterinary Oncology Diagnostics Market Size, Share, and COVID-19 Impact Analysis, By Animal Type (Canine, Feline, and Others), By Test Type (Blood Tests, Biopsy, Urinalysis, Endoscopy, Genome testing, and Imaging), By End-use (Veterinary hospitals and clinics and Reference Laboratories), and U.S. Veterinary Oncology Diagnostics Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Veterinary Oncology Diagnostics Market Insights Forecasts to 2033

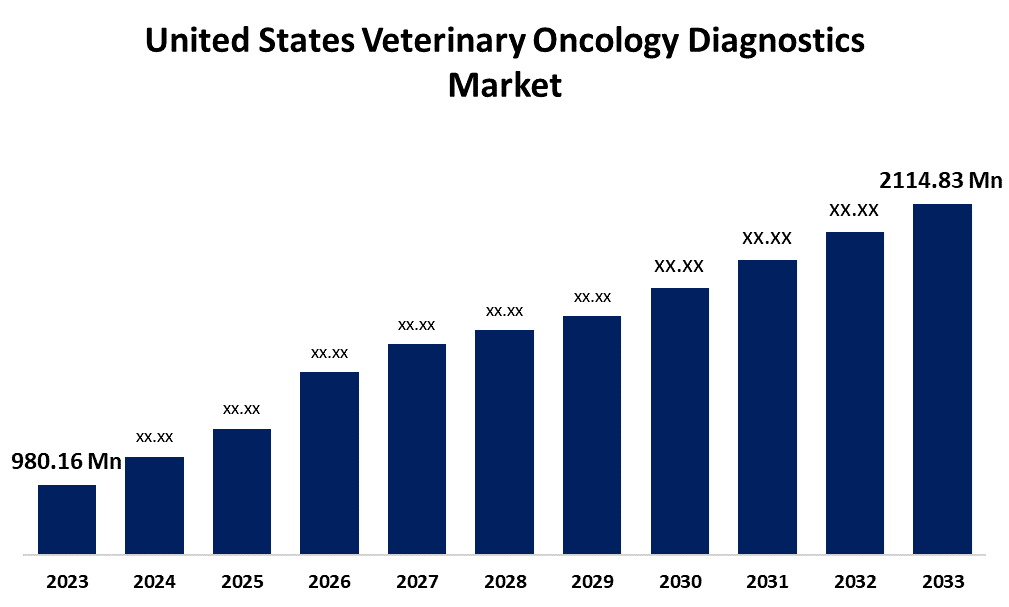

- The United States Veterinary Oncology Diagnostics Market Size Was Estimated at USD 980.16 Million in 2023.

- The Market Size is Growing at a CAGR of 7.99% from 2023 to 2033

- The USA Veterinary Oncology Diagnostics Market Size is Expected to Reach USD 2114.83 Million by 2033

Get more details on this report -

The United States Veterinary Oncology Diagnostics Market Size is Expected to reach USD 2114.83 Million by 2033, Growing at a CAGR of 7.99% from 2023 to 2033.

Market Overview

The market for veterinary oncology diagnostics in the United States includes the diagnostics sector that focuses on detecting and describing cancer in animals. The market is anticipated to be driven by rising awareness of animal health and welfare as well as changes in demographics and lifestyles that result in higher expenditure on pet healthcare. Additionally, the growing demand for veterinary oncology services and treatments is anticipated to be driven by the rising pet adoption rate and the rising incidence of cancer in pet animals. In addition, the market will expand as a result of improved pet cancer examinations brought about by the growing veterinary oncology research and development. This expansion is also a result of investments in companion animal cancer diagnosis and treatment. For instance, in May 2024, the AKC Canine Health Foundation (CHF) commemorated Canine Cancer Awareness Month by providing $3.6 million to ongoing cancer research. In addition, CHF supports molecular-level cancer studies and advancements in veterinary oncology, including pilot studies on canine melanoma and osteosarcoma, enhancing diagnostic tests and treatments for human cancer research.

Report Coverage

This research report categorizes the market for the U.S. veterinary oncology diagnostics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US veterinary oncology diagnostics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA veterinary oncology diagnostics market.

United States Veterinary Oncology Diagnostics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 980.16 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.99% |

| 2033 Value Projection: | USD 2114.83 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 199 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Animal Type, By Test Type, By End-use |

| Companies covered:: | Zoetis, Antech Diagnostics, Inc. (Mars Inc.), IDEXX Laboratories, Inc., Neogen Corporation, CANCAN DIAGNOSTICS, Oncotect, PetDx, Gold Standard Diagnostics (Eurofins Technologies), Embark Veterinary, Inc, VolitionRx Limited, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The US veterinary oncology diagnostics market is mostly driven by factors such as expanding animal ownership and population rates, rising animal spending, a shift in emphasis toward preventative animal healthcare, improvements in veterinary cancer diagnostic testing, and increased R&D investment in animal health diagnostics to introduce novel products. Additionally, the market for veterinary oncology diagnostics has experienced significant growth because of the development of sophisticated veterinary cancer examinations, such as Oncotect's first and only at-home cancer screening test. Furthermore, the market for veterinary oncology diagnostics is expanding due largely to the rising incidence of cancer in pets.

Restraining Factors

There are several obstacles facing the US veterinary oncology diagnostics market, including the high cost of diagnostic equipment, restricted accessibility in remote areas, and an absence of established procedures for animal cancer diagnosis are some of the obstacles facing the US veterinary oncology diagnostics market. Furthermore, the market's expansion is constrained by economic volatility and pet owners' lack of awareness of sophisticated diagnostics.

Market Segmentation

The U.S. veterinary oncology diagnostics market share is classified into animal type, test type, and end-use.

- The canine segment accounted for the largest market share of 67.34% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the animal type, the U.S. veterinary oncology diagnostics market is divided into canine, feline, and others. Among these, the canine segment accounted for the largest market share of 67.34% in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is growing due to the increased incidence of cancer, rising awareness of early canine cancer detection, and the advancement of sophisticated canine cancer diagnostics technologies are the drivers of this growth.

- The biopsy segment accounted for the highest market share in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the test type, the U.S. veterinary oncology diagnostics market is classified into blood tests, biopsy, urinalysis, endoscopy, genome testing, and imaging. Among these, the biopsy segment accounted for the highest market share in 2023 and is expected to grow at a significant CAGR during the projected timeframe. The expansion of this segment is aided by the major companies' increased development and introduction of liquid biopsy tests, which allow for earlier and non-invasive cancer detection.

- The veterinary hospitals and clinics segment accounted for the largest market share of 54.40% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the end-use, the U.S. veterinary oncology diagnostics market is divided into veterinary hospitals and clinics and reference laboratories. Among these, the veterinary hospitals and clinics segment accounted for the largest market share of 54.40% in 2023 and is expected to grow at a significant CAGR during the forecast period. This segment is growing because of the large number of patients, availability of cutting-edge diagnostic equipment, and presence of specialist veterinary oncologists. In addition, the market domination of this category is attributed to the growing use of pet insurance and the growing awareness of early cancer detection among pet owners.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. veterinary oncology diagnostics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Zoetis

- Antech Diagnostics, Inc. (Mars Inc.)

- IDEXX Laboratories, Inc.

- Neogen Corporation

- CANCAN DIAGNOSTICS

- Oncotect

- PetDx

- Gold Standard Diagnostics (Eurofins Technologies)

- Embark Veterinary, Inc

- VolitionRx Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2025, IDEXX Laboratories introduced the IDEXX Cancer Dx™ Panel, a blood test designed for the early detection of canine lymphoma, making it easier for veterinarians to incorporate into routine wellness check-ups.

- In November 2022, Antech's veterinary diagnostic labs distribute the Nu.Q® Vet Cancer Screening Test, which was introduced by VolitionRx and provides rapid and affordable cancer screening for dogs.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. veterinary oncology diagnostics market based on the below-mentioned segments:

U.S. Veterinary Oncology Diagnostics Market, By Animal Type

- Canine

- Feline

- Others

U.S. Veterinary Oncology Diagnostics Market, By Test Type

- Blood Tests

- Biopsy

- Urinalysis

- Endoscopy

- Genome testing

- Imaging

U.S. Veterinary Oncology Diagnostics Market, By End-use

- Veterinary hospitals and clinics

- Reference Laboratories

Need help to buy this report?