United States Veterinary Point of Care Diagnostics Market Size, Share, and COVID-19 Impact Analysis, By Test Type (Clinical Biochemistry, Immunodiagnostics, Molecular Diagnostics, Haematology, Urinalysis, and Other Test Type), By Sample (Blood and Urine), By End-user (Veterinary Hospitals & Clinics, Diagnostic Labs, Home Care Settings, and Others), and United States Veterinary Point of Care Diagnostics Market Insights, Industry Trend, Forecasts to 2033.

Industry: HealthcareUnited States Veterinary Point of Care Diagnostics Market Insights Forecasts to 2033

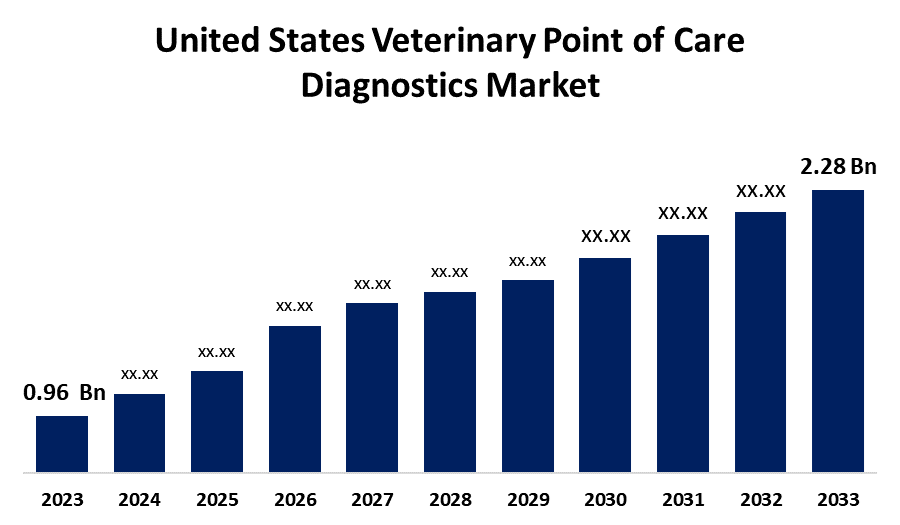

- The U.S. Veterinary Point of Care Diagnostics Market Size was Valued at USD 0.96 Billion in 2023

- The United States Veterinary Point of Care Diagnostics Market Size is Growing at a CAGR of 9.04% from 2023 to 2033

- The USA Veterinary Point of Care Diagnostics Market Size is Expected to Reach USD 2.28 Billion by 2033

Get more details on this report -

The USA Veterinary Point of Care Diagnostics market size is anticipated to exceed USD 2.28 Billion by 2033, growing at a CAGR of 9.04% from 2023 to 2033. The U.S. veterinary point of care diagnostics market is growing based on increasing pet ownership, progress in rapid testing, and expanding demand for disease detection at early stages. Clinical biochemistry takes the lead among test types for veterinary hospitals.

Market Overview

United States veterinary point-of-care (POC) diagnostics market is the market for diagnostic devices and tests that offer quick, on-site results for veterinarians to diagnose and treat animals immediately. These diagnostics are generally applied in veterinary clinics, animal hospitals, research facilities, farms, and even mobile veterinary units. Moreover, the U.S. veterinary point-of-care diagnostics market is poised for considarabel growth driven by AI-based diagnostic technologies, real-time biosensors, and individualized pet health monitoring drivers that are frequently underestimated. Telemedicine-integrated POC testing, growth in wearable veterinary diagnostics, and heightened emphasis on one-health surveillance for zoonotic disease further distinguish its path. Pet insurance expansion and demand for infectious disease screening with rapid turnaround times also present untapped opportunities in this dynamic market. For instance, VolitionRx Limited (Volition) has declared that it has entered into an exclusive worldwide supply and license agreement with Heska Corporation (Heska) to distribute Volitions Nu.Q Vet Cancer Screening test. The move is anticipated to boost their long-term relationship as well as access to unpenetrated economies.

Report Coverage

This research report categorizes the market for the US veterinary point of care diagnostics market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. veterinary point of care diagnostics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA veterinary point of care diagnostics market.

United States Veterinary Point of Care Diagnostics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 0.96 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 107 |

| Segments covered: | By Test type , By Sample, By End-user |

| Companies covered:: | IDEXX, Zoetis Inc., Thermo Fisher Scientific Inc., Heska Corp, NEOGEN Corporation, Phibro Animal Health Corporation, VCA, Inc., Marshfield Labs, NeuroLogica Corp, Blair Milling and Elevator Co., Inc., Texas A&M Veterinary Medical Diagnostic Laboratory, ProtaTek International, Inc., University of Minnesota, Others, |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The U.S. veterinary point-of-care diagnostics market is driven by precision-based microfluidics, next-generation biosensors, and AI-enabled diagnostic platforms, uniquely positioning it for growth. High demand for transportable lab-on-chip, real-time detection of pathogens, and blockchain-stored pet medical records drives new developments. Improved preventive veterinary practice, gene-oriented pet diagnostics, and increased mobile veterinary services create new areas for growth, reframing the mode of delivering diagnostics in clinics as well as out in the field.

Restraining Factors

High price of advanced diagnostic equipment, restrictive reimbursement programs, and concern regarding accuracy with rapid testing prevent market growth. Furthermore, dearth of specialized professionals and compliance issues delay uptake in small animal veterinary practices.

Market Segmentation

The United States veterinary point of care diagnostics market share is classified into test type, sample, and end user.

- The clinical biochemistry segment accounted for the largest share of the US veterinary point of care diagnostics market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of test type, the United States veterinary point of care diagnostics market is divided into clinical biochemistry, immunodiagnostics, molecular diagnostics, haematology, urinalysis, and other test type. Among these, the clinical biochemistry segment accounted for the largest share of the United States veterinary point of care diagnostics market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Its use is propelled by its extensive application in the measurement of organ function, metabolic disturbances, and disease development in animals. The increased incidence of chronic diseases such as diabetes and renal diseases in pets and livestock and improvements in handheld analyzers further drive demand for clinical biochemistry tests.

- The blood segment accounted for a substantial share of the U.S. veterinary point of care diagnostics market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of sample, the U.S. veterinary point of care diagnostics market is divided into blood and urine. Among these, the blood segment accounted for a substantial share of the U.S. veterinary point of care diagnostics market in 2023 and is anticipated to grow at a rapid pace during the projected period. Blood-based diagnostics find extensive application in clinical biochemistry, hematology, immunodiagnostics, and molecular testing and offer quick insights into infections, organ function, and chronic disease. The widespread adoption of portable blood analysers and need for early detection of diseases also contribute to the dominance of this segment.

- The veterinary hospitals & clinics segment accounted for the largest share of the US veterinary point of care diagnostics market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of end user, the United States veterinary point of care diagnostics market is divided into veterinary hospitals & clinics, diagnostic labs, home care settings and others. Among these, the veterinary hospitals & clinics segment accounted for the largest share of the United States veterinary point of care diagnostics market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Their dominance is driven by high patient flow, sophisticated diagnostic capabilities, and fast disease detection requirements. Growing pet ownership, preventive care demand, and incorporation of innovative POC technologies further solidify their market position, positioning them as the main hub for veterinary diagnostics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the USA veterinary point of care diagnostics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- IDEXX

- Zoetis Inc.

- Thermo Fisher Scientific Inc.

- Heska Corp

- NEOGEN Corporation

- Phibro Animal Health Corporation

- VCA, Inc.

- Marshfield Labs

- NeuroLogica Corp

- Blair Milling and Elevator Co., Inc.

- Texas A&M Veterinary Medical Diagnostic Laboratory

- ProtaTek International, Inc.

- University of Minnesota

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2023, Zomedica Corp. released a partnership in the acquisition of Qorvo Biotechnologies LLC (QBT). From this acquisition, the firm would have total access to the TRUFORMA platform, i.e., instrument, software, and multiple critical veterinary diagnostic assays created by QBT.

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the US veterinary point of care diagnostics market based on the below-mentioned segments:

United States Veterinary Point of Care Diagnostics Market, By Test Type

- Clinical Biochemistry

- Immunodiagnostics

- Molecular Diagnostics

- Haematology

- Urinalysis

- Other Test Type

United States Veterinary Point of Care Diagnostics Market, By Sample

- Blood

- Urine

United States Veterinary Point of Care Diagnostics Market, By End-user

- Veterinary Hospitals & Clinics

- Diagnostic Labs

- Home Care Settings

- Others

Need help to buy this report?