United States Vinyl Floor Covering Market Size, Share, and COVID-19 Impact Analysis, By Product (Vinyl Sheet, Vinyl Composite Tile, and Luxury Vinyl Tile), By Application (Residential and Commercial), and United States Vinyl Floor Covering Market Insights, Industry Trend, Forecasts to 2033

Industry: Advanced MaterialsUnited States Vinyl Floor Covering Market Size Insights Forecasts to 2033

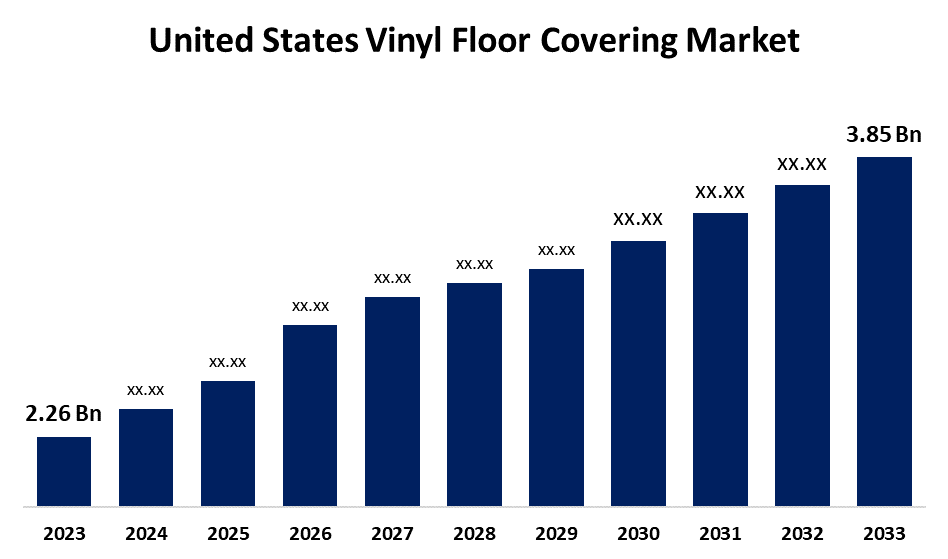

- The U.S. Vinyl Floor Covering Market Size was valued at USD 2.26 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.47% from 2023 to 2033

- The U.S. Vinyl Floor Covering Market Size is expected to reach USD 3.85 Billion by 2033

Get more details on this report -

The United States Vinyl Floor Covering Market is Anticipated to Exceed USD 3.85 Billion by 2033, growing at a CAGR of 5.47% from 2023 to 2033. The growing construction projects, renovations and remodeling, and development of commercial real estate as well as the rising popularity of sustainable building practices are driving the growth of the vinyl floor covering market in the US.

Market Overview

Vinyl floor covering is a kind of durable floor covering that is created by mixing natural and synthetic polymer components and arranging them into structural units that repeat. It is a water and stain-resistant synthetic flooring material. These coverings are durable, easy to maintain, and available in various designs and colors. Vinyl flooring is a finished flooring material that is mostly composed of composites of natural and synthetic polymer components, such as plasticizers and polyvinyl chloride, blended with material based on limestone. The construction industry in the US is responsible for the vinyl floor covering market as it is popular in residential and commercial construction projects. Further, the increasing construction projects, renovations, and remodeling as well as commercial real estate developments are majorly contributing to the market expansion. Furthermore, there is a growing popularity of sustainable building practices including the demand for recycled materials due to the growing environmental consciousness.

Report Coverage

This research report categorizes the market for the US vinyl floor covering market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States vinyl floor covering market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US vinyl floor covering market.

United States Vinyl Floor Covering Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.26 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.47% |

| 2033 Value Projection: | USD 3.85 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 192 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Product, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Armstrong Flooring, Shaw Industries Inc., CBC Flooring, Congoleum Corporation, Mohawk Industries Inc., Mannington Mills Inc., Lowe’s, Interface, Inc., Milliken & Company, Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The growing construction projects, renovations and remodeling, and development of commercial real estate are significantly driving the market. The creation of novel, creative floor covering options, as well as consumer trends in building materials and floor plans leads to driving up the market. Further, the improved office and workplace expansion along with rising consumer lifestyles and quick urbanization are responsible for propelling the market demand. Environment-friendly floor-covering solutions are getting increasingly popular as a result of consumers' growing awareness of environmental protection.

Restraining Factors

The production of flooring products releases volatile organic compounds (VOCs) which is a primary cause of indoor air pollution. The World Health Organization (WHO) estimates that breathing contaminated air causes approximately 7 million deaths annually. These factors are restraining the market for vinyl floor covering.

Market Segmentation

The United States Vinyl Floor Covering Market share is classified into product and application.

- The luxury vinyl tile segment dominates the market with the largest market share during the forecast period.

The United States vinyl floor covering market is segmented by product into vinyl sheet, vinyl composite tile, and luxury vinyl tile. Among these, the luxury vinyl tile segment dominates the market with the largest market share during the forecast period. Luxury vinyl tile (LVT) or wide plank vinyl flooring is water resistant, durable, and easy to install popularly used in residential as well as commercial sectors. The increasing use of LVT in place of industry staples like engineered wood flooring, solid wood flooring, and porcelain is predicted to propel the market in the LVT segment.

- The commercial segment dominated the US vinyl floor covering market with the largest market share in 2023.

Based on the application, the U.S. vinyl floor covering market is divided into residential replacement, commercial, and builder. Among these, the commercial segment dominated the US vinyl floor covering market with the largest market share in 2023. Vinyl flooring is becoming more and more common for usage in commercial settings including businesses, homes, and other hospitality sectors. The excellent aesthetics, cost-effectiveness, and expanding stature of architects and designers are anticipated to drive the market demand for vinyl floor covering in the commercial segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. vinyl floor covering market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Armstrong Flooring

- Shaw Industries Inc.

- CBC Flooring

- Congoleum Corporation

- Mohawk Industries Inc.

- Mannington Mills Inc.

- Lowe's

- Interface, Inc.

- Milliken & Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2023, Encina Development Group, a producer of circular chemicals from end-of-life plastics based in The Woodlands, Texas, formed a recycling partnership with Shaw Industries Group Inc., a global flooring manufacturer based in Dalton, Georgia. Under the agreement, Shaw will provide Encina with more than 2 million pounds of waste materials from its carpet manufacturing processes annually.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Vinyl Floor Covering Market based on the below-mentioned segments:

US Vinyl Floor Covering Market, By Product

- Vinyl Sheet

- Vinyl Composite Tile

- Luxury Vinyl Tile

US Vinyl Floor Covering Market, By Application

- Residential

- Commercial

Need help to buy this report?