United States Vital Signs Measurable Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Blood Pressure Monitors, Pulse Oximeters, Temperature Monitoring Devices, and Others), By End-use (Hospitals, Physician’s Office, Home Healthcare, Ambulatory Centers, Emergency Care Centers, and Others), and United States Vital Signs Measurable Devices Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareUnited States Vital Signs Measurable Devices Market Insights Forecasts to 2033

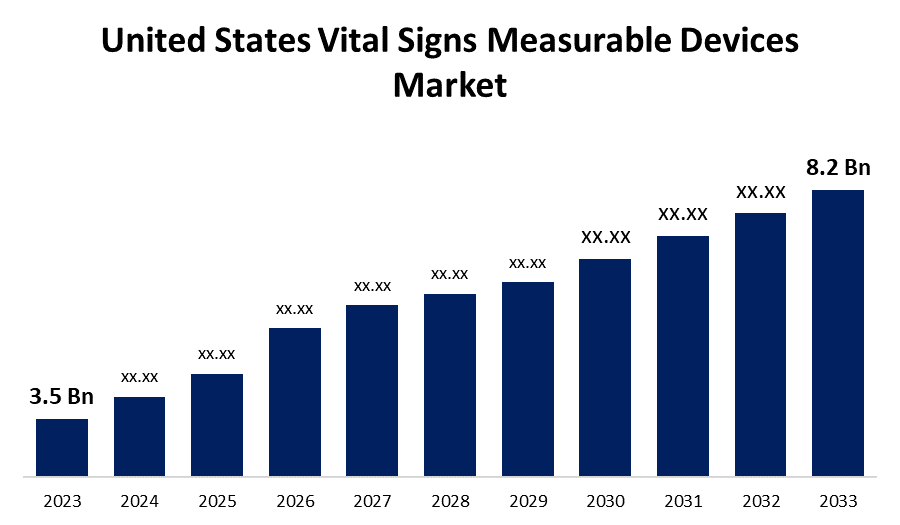

- The United States Vital Signs Measurable Devices Market Size was valued at USD 3.5 Billion in 2023.

- The Market Size is Growing at a CAGR of 8.89% from 2023 to 2033

- The U.S. Vital Signs Measurable Devices Market Size is Expected to Reach USD 8.2 Billion by 2033

Get more details on this report -

The United States Vital Signs Measurable Devices Market is anticipated to exceed USD 8.2 billion by 2033, growing at a CAGR of 8.89% from 2023 to 2033. The growing prevalence of chronic diseases, the development of innovative devices, and demand for homecare healthcare settings are driving the growth of the vital signs measurable devices market in the United States.

Market Overview

Vital signs measurable devices are the monitoring services used in hospitals, clinics, ambulatory surgical centers, and home care settings for measuring the vital signs of the human body, such as body temperature, heart rate or pulse rate, respiratory rate, and blood pressure. Vital signs offer critical information about a patient’s health that is essential for determining the presence of acute medical issues, identify chronic disease state, and body’s response to physiological stress. Vital signs measurable devices are used for ongoing chronic disease treatment as well as for monitoring patients' vital signs in emergency rooms. The increasing popularity of wireless patient monitoring devices as well as the development of new technologies and features surges the homecare healthcare settings which are offering market opportunities. Major industries are placing a high priority on innovation and technological breakthroughs due to benefits over traditional ones that help to strengthen their position in the market. For instance, VitalTraqTM, a multivital remote patient monitoring platform introduced by Blue Spark Technologies is a cutting-edge gadget that can be controlled remotely by having sensors with AI integration. Further, the product expansion strategic acquisition includes enhancing capabilities, expanding product offerings, and reinforcing competencies led by the key companies.

Report Coverage

This research report categorizes the market for the US vital signs measurable devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the vital signs measurable devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the vital signs measurable devices market.

United States Vital Signs Measurable Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 3.5 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 8.89% |

| 023 – 2033 Value Projection: | USD 8.2 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By End-use |

| Companies covered:: | General Electric, Masimo, Suntech Medical, Inc., Nonin Medical Inc., American Diagnostic Corporation, Smiths Medical, Compass Health Brands, Aed.Us, A Coro Medical Company, Telatemp Corporation, Honeywell, Nanowear, Valencell, and Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The development of innovative multipurpose devices for effective monitoring of vital signs in healthcare settings is driving the market growth. The increasing population and elderly population and the rise in a number of hospitals in the region are contributing to drive the market growth. Further, the emerging trend of medical tourism in emerging countries and the increased coverage of medical insurance, and are also driving the market. Approximately 45% of Americans suffer from at least one chronic illness, and the percentage is steadily rising, according to an NIH article. The rising chronic conditions may lead to an increase in the cardiovascular and diabetes patients in the region which is significantly responsible for driving the market.

Restraining Factors

The increased cost of purchase and maintenance of vital sign measurable devices can limit the access or affordability for patients in developing countries hampering the market growth.

Market Segmentation

The United States Vital Signs Measurable Devices Market share is classified into product and end-use.

- The blood pressure monitors segment dominates the market with the largest market share in 2023.

The US vital signs measurable devices market is segmented by product into blood pressure monitors, pulse oximeters, temperature monitoring devices, and others. Among these, the blood pressure monitors segment dominates the market with the largest market share in 2023. Heart disease and stroke are further consequences of hypertension. According to the statistics of CDC, in U.S., hypertension is the leading cause of death. Thus, there is an increasing demand for innovation of blood pressure monitors which is likely to drive the market growth.

- The hospitals segment accounted for the largest share of the US vital signs measurable devices market in 2023.

Based on the end-use, the United States vital signs measurable devices market is divided into hospitals, physician’s office, home healthcare, ambulatory centers, emergency care centers, and others. Among these, the hospitals segment accounted for the largest share of the United States vital signs measurable devices market in 2023. In order to consult with patients, hospitals in their ICU, nurse stations, OPDs, operating rooms, and outpatient wards necessitate the use of these gadgets. Hospitals typically favor technologically advanced monitoring devices to improve patient and physician comfort, which in turn drives up market demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US vital signs measurable devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- General Electric

- Masimo

- Suntech Medical, Inc.

- Nonin Medical Inc.

- American Diagnostic Corporation

- Smiths Medical

- Compass Health Brands

- Aed.Us, A Coro Medical Company

- Telatemp Corporation

- Honeywell

- Nanowear

- Valencell

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, Nanowear, a leader in healthcare-at-home remote diagnostics, announced that its nanotechnology-enabled wearable and software platform, SimpleSenseTM, has received FDA 510(k) clearance for a novel AI-enabled Software-as-a-Medical Device (SaMD).

- In April 2023, Honeywell announced that it has developed a real-time health monitoring system, which captures and records patients' vital signs both within the hospital setting and remotely. Honeywell's solution uses advanced sensing technology to monitor vital signs via a skin patch, which connects the data instantaneously to healthcare providers on mobile devices and an online dashboard.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Vital Signs Measurable Devices Market based on the below-mentioned segments:

United States Vital Signs Measurable Devices Market, By Product

- Blood Pressure Monitors

- Pulse Oximeters

- Temperature Monitoring Devices

- Others

United States Vital Signs Measurable Devices Market, By End-use

- Hospitals

- Physician’s Office

- Home Healthcare

- Ambulatory Centers

- Emergency Care Centers

- Others

Need help to buy this report?