United States Vitamin D Supplements Market Size, Share, and COVID-19 Impact Analysis, By Type (Vitamin D2, Vitamin D3), By Form (Liquid, Dry), and United States Vitamin D Supplements Market Insights Forecasts to 2033

Industry: HealthcareUnited States Vitamin D Supplements Market Insights Forecasts to 2033

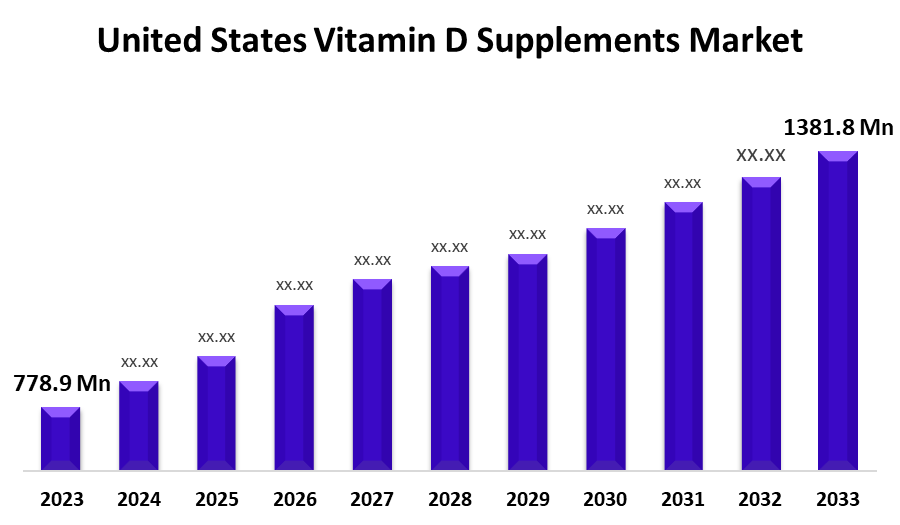

- The United States Vitamin D Supplements Market Size was valued at USD 778.9 Million in 2023.

- The Market Size is Growing at a CAGR of 5.9% from 2023 to 2033.

- The United States Vitamin D Supplements Market Size is Expected to Reach USD 1381.8 Million by 2033.

Get more details on this report -

The United States Vitamin D Supplements Market Size is Expected to Reach USD 1381.8 Million by 2033, at a CAGR of 5.9% during the forecast period 2023 to 2033.

Market Overview

Vitamin D deficiency is primarily responsible for rickets in children and osteoporosis in adults. It has also been linked to high blood pressure, common cancers, and viral infections. Vitamin D is also required for the development of skeletal structure and dental enamel in children. It can cause irritability, developmental failure, and an increased risk of respiratory infections later in life in newborns. Vitamin D, also known as "calciferol," is a fat-soluble vitamin that is found naturally in a few foods, can be added to others, and can be purchased as a dietary supplement. Vitamin D promotes calcium absorption in the gut and maintains serum calcium and phosphate levels, allowing normal bone mineralization and preventing hypocalcemic tetany. In foods and dietary supplements, vitamin D is found in two forms such as D2 (ergocalciferol) and D3 (cholecalciferol), which differ chemically only in their side-chain configurations. both types are efficiently absorbed in the small intestine.

Report Coverage

This research report categorizes the market for United States vitamin D supplements market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States vitamin D supplements market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States vitamin D supplements market.

United States Vitamin D Supplements Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 778.9 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.9% |

| 2033 Value Projection: | USD 1381.8 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Form |

| Companies covered:: | Amway, Pfizer Inc., Abbott Laboratories,, GNC Holdings Inc, Glanbia Plc, Nature’s Bounty Co., NOW Health Group, Inc., NutraMarks, Inc., Garden of Life LLC, Reckitt Benckiser Group plc, Jamieson Wellness Inc., NatureWise, Nutraceutical International Corporation, Swanson Health Products and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Customers in the United States make purchase decisions based on product labeling. Dietary supplement preferences are rapidly evolving as a result of the country's demographic trend of an aging population, rising lifestyle-related diseases, and rising healthcare costs. The Vitamin D market is being driven by a rise in public awareness of vitamin D deficiency. Sports nutrition sales are expected to grow significantly, with new product releases aided by expanding fitness patterns and sports activity. As a result, the United States vitamin D supplements market is expected to grow during the forecast period. Also, the rising prevalence of chronic diseases is fueling the growth of the Vitamin D supplements market in the United States. The rising prevalence of chronic diseases is the leading cause of death in United States. Chronic diseases are thought to account for more than 29.88% of all deaths. The diseases affect nearby 40.5% of the US population. As a result, the United States vitamin D supplements market is expected to grow during the forecast period.

Restraining Factors

Regulatory concerns about the use of U.S. vitamin D supplements, as well as increasingly stringent government policy, are expected to impede the growth of the United States vitamin D supplements market. Calcium or hypercalcemia is a side effect of vitamin D poisoning that causes nausea, vomiting, exhaustion, and frequent urination. This is expected to hamper market growth during the forecast period.

Market Segment

- In 2023, the vitamin D3 segment accounted for the largest revenue share over the forecast period.

Based on the type, the United States vitamin D supplements market is segmented into vitamin D2 and vitamin D3. Among these, the vitamin D3 segment has the largest revenue share over the forecast period. This is due to its widespread use in the animal feed industry. Calcifediol is the primary circulating source of vitamin D, and its blood levels represent the body's nutrient stores. It can be found in fatty animal-derived foods such as fish oil and egg yolk. When exposed to ultravoilet (UVB) rays from the sun, the body produces vitamin D3, which is then absorbed through the skin of animals like sheep and cows.

- In 2022, the dry segment accounted for the largest revenue share over the forecast period.

Based on the form, the United States airport ground and cargo handling services market is segmented into liquid & dry. Among these, the dry segment has the largest revenue share over the forecast period. This is due to rising demand in the food and beverage and pharmaceutical industries. The dry product is simple to handle and store, has good stability, and can be used in a variety of applications. As a result, it's a popular choice for manufacturers of food, beverages, feed, and pet food, as well as pharmaceutical companies. Furthermore, the development of vitamin D consumables such as pills and capsules are expected to increase vitamin D's penetration in doctor-prescribed medications. Some of the most common dry vitamin D applications are food fortification, dietary supplements, functional food and beverage, and medicinal food. The Dry Form segment is expected to be the fastest growing and to have the highest CAGR during the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States vitamin D supplements market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amway

- Pfizer Inc.

- Abbott Laboratories,

- GNC Holdings Inc

- Glanbia Plc

- Nature’s Bounty Co.

- NOW Health Group, Inc.

- NutraMarks, Inc.

- Garden of Life LLC

- Reckitt Benckiser Group plc

- Jamieson Wellness Inc.

- NatureWise

- Nutraceutical International Corporation

- Swanson Health Products

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In October 2022, Nurishable has reintroduced their All New Three-in-One Supplement. Instead of taking three separate vitamins, Nurishable Triple Play combines zinc 50 mg, vitamin D3 10,000 iu, and vitamin C 500 mg into a single capsule for maximum convenience and savings.

In September 2021, MegaFood, an Otsuka Holdings Co. Ltd brand, announced the addition of three new multivitamins to their line: a Multivitamin for Daily Energy, a Multivitamin for Daily Immune Support, and a Multivitamin for Daily Stress Relief. Vitamin D is present in all of these multivitamins.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States vitamin D supplements market based on the below-mentioned segments:

United States Vitamin D Supplements Market, By Type

- vitamin D2

- vitamin D3

United States Vitamin D Supplements Market, By Form

- Dry

- Liquid

Need help to buy this report?