United States Vodka Market Size, Share, and COVID-19 Impact Analysis, By Type (Flavored and Non-flavored), By Distribution Channel (On-trade and Off-trade), and U.S. Vodka Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsUnited States Vodka Market Insights Forecasts to 2033

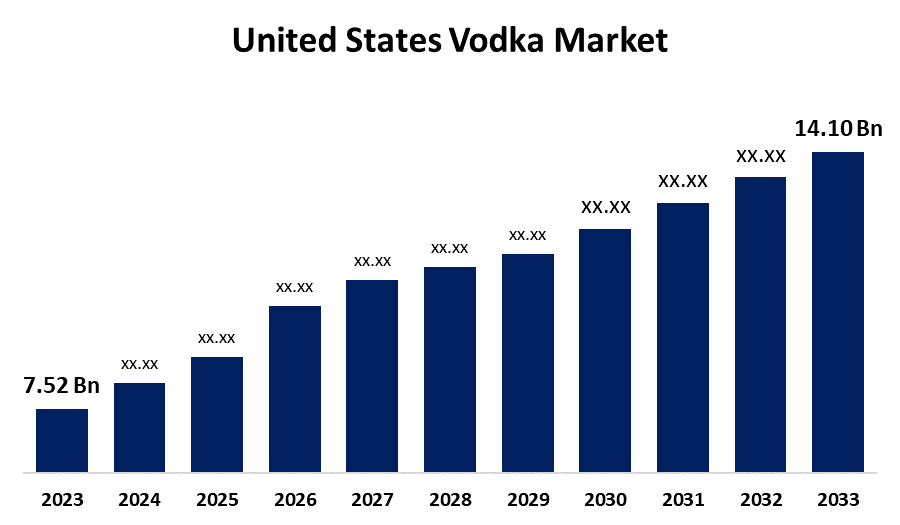

- The United States Vodka Market Size Was Estimated at USD 7.52 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.49% from 2023 to 2033

- The USA Vodka Market Size is Expected to Reach USD 14.10 Billion by 2033

Get more details on this report -

The United States Vodka Market Size is Expected to reach USD 14.10 billion by 2033, Growing at a CAGR of 6.49% from 2023 to 2033.

Market Overview

The industry and consumer behavior related to the manufacture, sale, and consumption of vodka in the United States, including both domestic and foreign brands, is referred to as the US vodka market. The rising demand for flavored and premium vodkas, which appeal to customers looking for exceptional and distinctive drinking experiences, is the cause of this growth. This demand is further fueled by the thriving cocktail culture in the United States, where vodka serves as a versatile base for a wide range of cocktails. Online purchases of vodka have become simpler for customers due to e-commerce. In addition to giving customers more options and convenience, this has improved sales of craft vodkas and other specialty goods in the US vodka market. Furthermore, the United States government aids in the market expansion. For instance, in January 2025, the Treasury Department’s Alcohol and Tobacco Tax and Trade Bureau released two proposed regulations to offer customers better information about the ingredients in alcoholic beverages. These rules address requirements for ingredients, processing, and labeling. In addition, the expansion of craft distilleries, which boost local economies and provide distinctive, small-batch vodka products, is encouraged by the US government.

Report Coverage

This research report categorizes the market for the U.S. vodka market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US vodka market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA vodka market.

United States Vodka Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 7.52 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.49% |

| 2033 Value Projection: | USD 14.10 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 166 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Distribution Channel |

| Companies covered:: | Pernod Ricard S.A, Sazerac Company, Inc., Bacardi Ltd., New Amsterdam Spirits Company, Diageo Plc., Belvedere Ltd., Brown-Forman Corp., Fifth Generation, Inc., Distell Group Holdings Ltd, American Liquor Co., and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The United States vodka market is expanding due to there are consumers who are looking for healthier vodka substitutes. The demand for vodkas with fewer calories and carbohydrates is rising as a result of this in the US vodka market. Furthermore, several vodka companies advertise that their goods are gluten-free or naturally sourced. Additionally, the United States has seen a sharp increase in the number of craftsman distilleries. These distilleries provide premium, limited-edition vodkas that appeal to customers seeking out unusual and interesting products. In addition, a robust distribution network that includes both on-trade and off-trade channels helps the U.S. market. The availability of vodka products to a broad range of consumers is greatly aided by supermarkets and hypermarkets.

Restraining Factors

The US Vodka market is significantly impacted by complex and time-consuming regulations, which discourage new entrants and increase costs for existing producers. In addition, the market for vodka is being strained by the development in non-alcoholic beverages including craft brews, hard seltzers, and cannabis-infused drinks because consumers are demanding healthier options.

Market Segmentation

The U.S. vodka market share is classified into type and distribution channel.

- The non-flavored segment accounted for the largest market share of 60.57% in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the type, the U.S. vodka market is divided into flavored and non-flavored. Among these, the non-flavored segment accounted for the largest market share of 60.57% in 2023 and is expected to grow at a significant CAGR during the forecast period. The market presence of non-flavored vodka is further supported by the rise of cocktail culture and the demand for utilizing non-flavored vodka as a base for customized drinks. Its neutral taste and versatility make it perfect for mixing with other beverages, making it a key growth driver.

- The on-trade segment accounted for the highest market share of 61.14% in 2023 and is expected to grow at a significant CAGR during the projected timeframe.

Based on the distribution channel, the U.S. vodka market is classified into on-trade and off-trade. Among these, the on-trade segment accounted for the highest market share of 61.14% in 2023 and is expected to grow at a significant CAGR during the projected timeframe. This segment is increasing due to the rise of cocktail culture and mixology has driven a surge in demand for diverse, unique flavors, particularly among millennials, who are eager to explore new taste experiences. In addition, flavored vodka's market expansion has been further fueled by the proliferation of both online and offline retail channels.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. vodka market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pernod Ricard S.A

- Sazerac Company, Inc.

- Bacardi Ltd.

- New Amsterdam Spirits Company

- Diageo Plc.

- Belvedere Ltd.

- Brown-Forman Corp.

- Fifth Generation, Inc.

- Distell Group Holdings Ltd

- American Liquor Co.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2025, the 77-calorie Crystal Light Vodka Refreshers were introduced by Kraft Heinz in response to market demand for alcoholic beverages with fewer calories. This action demonstrated Kraft Heinz's commitment to capitalizing on the growing hard seltzer market, which may have piqued investor interest. The company's full-year earnings report revealed a significant increase in net income despite a sales drop, reassuring investors about profitability. Simultaneously, the company introduced HEINZ Flavor Tour Condiments, reflecting a diversification strategy that positively influenced investor perception.

Market Segment

This study forecasts revenue at U.S., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the U.S. vodka market based on the below-mentioned segments:

U.S. Vodka Market, By Type

- Flavored

- Non-flavored

U.S. Vodka Market, By Distribution Channel

- On-trade

- Off-trade

Need help to buy this report?